According to the latest survey by the New York Federal Reserve, people's expectations for the labor market are mixed and generally stable. Inflation expectations for the next 1 and 5 years are stable, but inflation expectations have risen for 3 years, and uncertainty about inflation has increased. Zerohedge said that the Federal Reserve is concerned about employment responsibilities and will begin an easing cycle. While prices are still high, the risk of being caught off guard is increasing in the future.

On Monday, according to the New York Federal Reserve Consumer Expectations Survey, the August 1-year inflation forecast rose slightly to 3% from 2.97% in the previous month. The median inflation forecast for the next three years rebounded slightly from the July low, rising from 2.3% to 2.5%. The five-year inflation forecast remained stable at 2.8%.

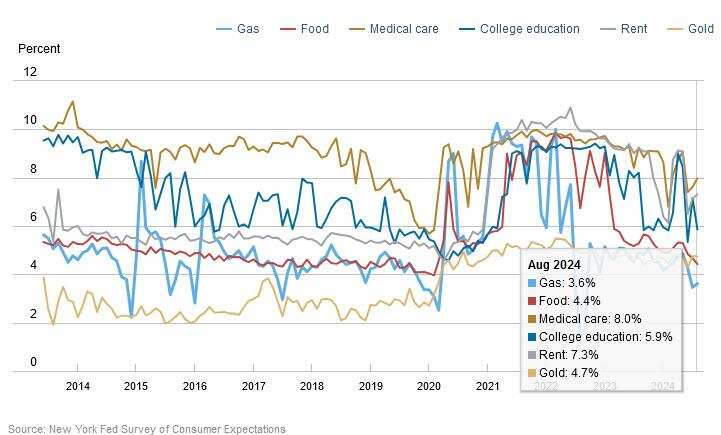

Looking at specific categories, consumers expect the next year to:

- Gasoline prices are expected to rise by 3.62%, an increase of 0.1 percentage points over the previous month.

- Food prices are expected to rise 4.42%, down 0.3 percentage points from the previous month.

- Medical expenses are expected to rise 7.97%, an increase of 0.4 percentage points over the previous month.

- The cost of college education is expected to rise 5.86%, down 1.3 percentage points from the previous month.

- Rental prices are expected to rise 7.31%, an increase of 0.2 percentage points over the previous month.

- The median increase in housing prices is expected to rise from 3% in July to 3.1% in August, the highest since May.

Consumer uncertainty about inflation expectations is growing. Views on future inflation also vary widely: looking ahead to the next five years, a quarter of consumers expect the inflation rate to drop to zero or less, while another portion of respondents think the inflation rate will double to 6% or more.

Consumer uncertainty about inflation expectations is growing. Views on future inflation also vary widely: looking ahead to the next five years, a quarter of consumers expect the inflation rate to drop to zero or less, while another portion of respondents think the inflation rate will double to 6% or more.

Financial blogger ZeroEdge commented that the Federal Reserve is concerned about its employment responsibilities and will begin an easing cycle. With US stocks, US housing prices, rents, and food prices all at historically high levels, there is a growing risk of being caught off guard in the future. The New York Federal Reserve's latest investigation report indicates the emergence of this possibility.

Consumer household income expectations improved slightly, rising 0.1 percentage points to 3.1%. Over the past year, the expected increase in household income has been in a narrow range of 3.0%-3.1%.

The median increase in household spending is expected to rise 0.1 percentage points to 5.0%. Since November 2023, the growth forecast for household spending has been fluctuating in a narrow range of 4.9%-5.2%, far higher than the 3.1% in February 2020.

The New York Federal Reserve's survey report also shows that the proportion of consumers who are unable to pay the minimum repayment amount is expected to rise 0.3 percentage points to 13.6% in the future, the highest level since April 2020.

On the labor market side, which has received much attention, the New York Federal Reserve's latest survey report shows that people's expectations for the labor market are mixed and generally stable:

The median income growth forecast for the next year rose from 2.7% to 2.9%, slightly higher than the average of 2.8% over the past 12 months. The increase was most significant for respondents earning less than $0.05 million a year.

The average unemployment forecast, that is, the average probability that the US unemployment rate will be higher than the current one year from now, rose from 36.6% in July to 37.7% in August.

The average perceived probability of unemployment over the next 12 months fell 1 percentage point to 13.3%, lower than the average of the past 12 months of 13.7%.

The average probability of voluntary separation over the next 12 months fell from 20.7% to 19.1%, slightly lower than the average of 19.4% over the past 12 months.

If unemployed, people think the average probability of finding a job fell 0.2 percentage points to 52.3%, lower than the average of the past 12 months of 53.9%, and even lower than 55.7% in the same period last year.

消费者们对通胀预期的不确定性正在增加。人们对未来通胀走势的看法也差异巨大:展望未来五年,有四分之一的消费者预计通胀率将降至零或更低,而另一部分受访者则认为通胀率将翻倍至6%或更高。

消费者们对通胀预期的不确定性正在增加。人们对未来通胀走势的看法也差异巨大:展望未来五年,有四分之一的消费者预计通胀率将降至零或更低,而另一部分受访者则认为通胀率将翻倍至6%或更高。