① Despite the sell-off of Nvidia shares, Goldman Sachs chief analyst Toshiya Hari maintained a buy rating on the chip giant. ② Goldman Sachs analysts believe that in the field of commercial chips, Nvidia is the first choice.

Financial Services Association, September 10 (Editor Bian Chun) Recently, shares of Nvidia, the world's “AI chip hegemon,” have been violently sold off, but Goldman Sachs has not been deterred by this trend.

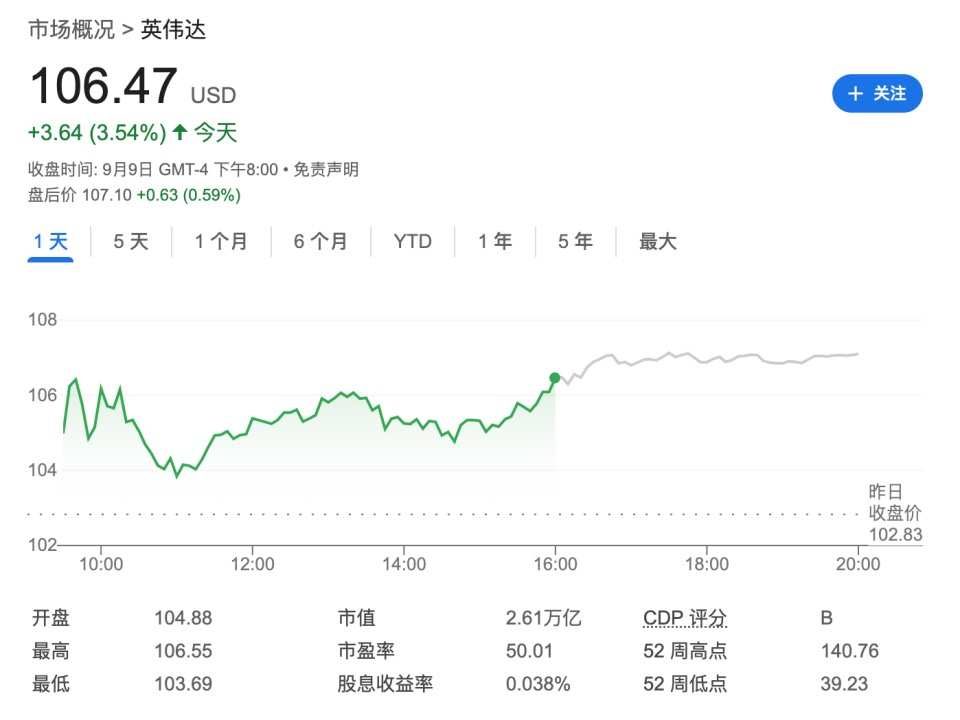

On Tuesday, Nvidia's stock price plummeted 9.53%, and its market value evaporated by about 279 billion dollars in a single day, setting a new record for US stocks. Nvidia's market capitalization evaporated a total of about 400 billion dollars last week.

According to data from Bespoke Investment Group, Nvidia was one of the biggest drivers for the S&P 500 index to start in September, the worst since 1953, but the index recovered some of its losses on Monday.

According to data from Bespoke Investment Group, Nvidia was one of the biggest drivers for the S&P 500 index to start in September, the worst since 1953, but the index recovered some of its losses on Monday.

Despite the sell-off of Nvidia shares, Goldman Sachs chief analyst Toshiya Hari maintained a buy rating on the chip giant.

On Monday, at Goldman Sachs's 2024 Communications and Technology Conference, when asked if the Goldman Sachs team thought Nvidia shares had been oversold, Hari answered, “Yes, we think so.”

“(Nvidia)'s recent performance hasn't been good, but we're still optimistic about the stock,” Hari said. “First, demand for accelerated computing is still very strong. We tend to spend a lot of time with hyperscale enterprises (Amazon, Google, Microsoft, etc.), but you'll see that demand is expanding to a wider range of businesses, even sovereign countries.”

The Nvidia sell-off crisis began with the quarterly report for the second fiscal quarter of fiscal year 2025, which was announced on August 28. Although the earnings report performed better than expected, it was still not good enough for Wall Street. Although Nvidia's revenue was 4.1% higher than Wall Street's expectations, the company's profit margin was the lowest since the fourth quarter of fiscal year 2023.

One of the major market debates surrounding Nvidia is whether its profit momentum is sustainable.

The Goldman Sachs stock research team pointed out in a recent report that since the beginning of 2023, investors' sentiment about artificial intelligence “has changed nearly 180 degrees.” Investors' patience is running out, and they want to see — rather than be told — AI-driven revenue streams and profit margins improvements.

However, Goldman Sachs also emphasized that with regard to profound technological changes such as artificial intelligence, judgments cannot be made based only on short-term costs and returns. The bank predicts that by the second half of 2025, generative artificial intelligence will make a substantial contribution to the growth of the industry.

“I think their competitive position is still very strong,” Hari said of Nvidia. “We do think Nvidia is the first choice in the field of commercial chips, and even compared to custom chips, they have an advantage in terms of speed of innovation.”

In addition to the performance falling short of Wall Street's highest expectations, delivery issues with the much-anticipated Blackwell chip, recent rumors of antitrust scrutiny, investors' cautious investment in AI, and increased overall market volatility are all driving factors behind the sharp drop in Nvidia's stock price in this round.

Bank of America also said a few days ago that the sharp drop in Nvidia's stock price in the past week provided an attractive buying opportunity.

After a sharp drop of 14% last week, Nvidia's stock price rebounded sharply by 3.5% on Monday, boosting the performance of the NASDAQ, which is dominated by technology stocks. Since this year, the cumulative increase in Nvidia's stock price is still as high as 121%.

Bespoke Investment Group的数据显示,英伟达是标普500指数创下1953年以来最糟糕9月开局的最大推动因素之一,不过该指数周一收复了部分失地。

Bespoke Investment Group的数据显示,英伟达是标普500指数创下1953年以来最糟糕9月开局的最大推动因素之一,不过该指数周一收复了部分失地。