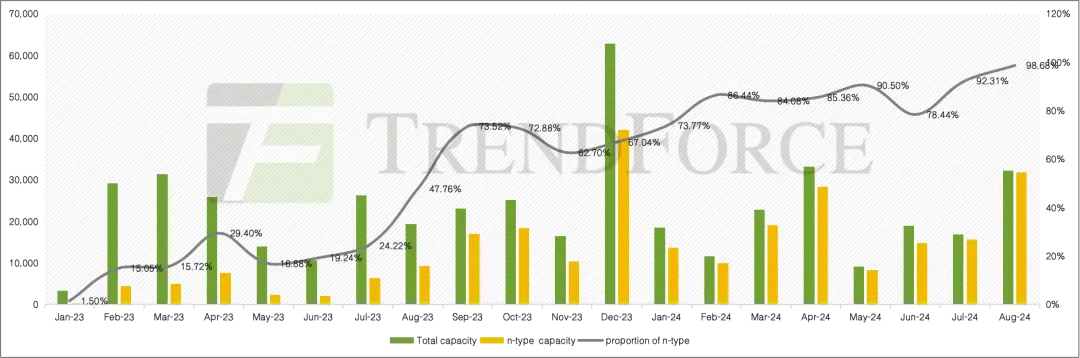

According to TrendForce Jibang Consulting's China PV Industry Bidding Database, the domestic PV module tender volume from January to August 2024 was about 163.2 GW, +1.92% compared with the same period. Of these, the N-type module tenders were about 142 GW, accounting for 87%.

The Zhitong Finance App learned that according to the TrendForce Jibang Consulting China PV Industry Bidding Database, the domestic PV module tender volume from January to August 2024 was about 163.2 GW, +1.92% over the same period. Of these, N-type modules were tendered for about 142 GW, accounting for 87%.

Looking at a single month, in August 2024, China announced a total of about 32.3GW of PV module tenders, +91% month-on-month. Mainly, Huadian Group and Huaneng Group plan to collect PV modules on a large scale for the year-end quick installation project. Among them, it is clear that the tender volume for N-type modules reached 31.8 GW, accounting for 99%, and the demand for P-type modules was less than 1%. It is worth noting that BC components have begun to be included in the procurement scope on a large scale, and the terminal market's attention and recognition of BC components has increased, and it is expected that the collection of BC components will increase in the future.

Figure: Domestic component monthly bidding capacity (MW) from 2023 to 2024 August

Figure: Domestic component monthly bidding capacity (MW) from 2023 to 2024 August

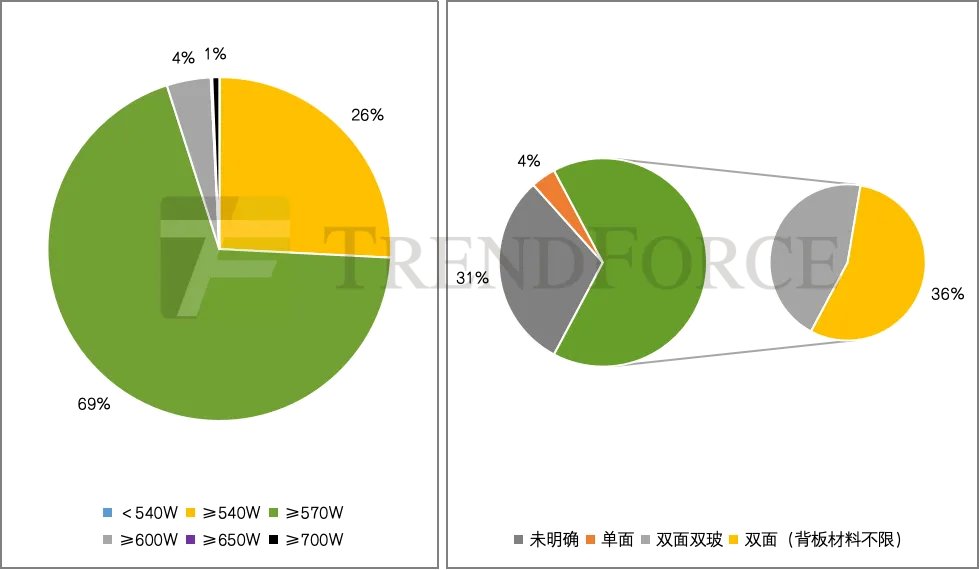

Demand for 600W+ power has increased, and demand for double-sided components continues to rise

In terms of power, from January to August 2024, a total of about 163.2 GW modules were tendered domestically, and the tender scale for 570 W and above modules was about 121 GW (74%). Of these, the tender scale for modules of 600 W or more was 8 GW (5%), and demand continued to rise. Of these, about 1.1 GW clearly proposed to bid for 700W and above components, and demand for high power components did not decrease.

Furthermore, in the 163.2GW module tender, it is clear that the bid scale for double-sided modules reached 107 GW, accounting for about 65.53%, of which the double-sided double glass tenders accounted for about 29% (48 GW).

Figure: Tender scale for each power segment of domestic components and single and double sided bidding scale, unit:%

In August, the average price of N-type Topcon modules opened steady, breaking through 0.7 yuan/W at low prices

In August, a total of about 2.4 GW N-type Topcon modules were collected and tendered. The bid price was between 0.69-0.813 yuan/W, and the average bid price was 0.759 yuan/W. Mainly, Guangzhou Development opened a tender for the 2024-2025 2.4 GW centralized procurement project for photovoltaic modules. Specifically, the tender was divided into three segments, each with a capacity of 800 MW.

Fourteen companies participated in bid section 1 (N-type double glass). The bid unit price was between 0.69-0.79 yuan/W, with an average of 0.753 yuan/W. Note that the unit price of 0.69 yuan/W hit a new low N-type bid price. This also shows that some companies still want to seize orders through low prices, and market competition is still fierce; 21 companies participated in bid segment 2 (n-type double sided) and section 3 (n-type double sided), respectively., the average bid price was 0.76 yuan/W, and 0.763 yuan/W

Figure: Domestic N-type Topcon module bid price trend from June to August 2024, unit: yuan/W

From January to August 2024, it was announced that the winning bid scale reached 181.6 GW, and the TOP10 companies accounted for 53% of the bid scale

Judging from the component bid results (including finalists), from January to August 2024, the winning bid results and the number of successful candidates reached 181.6 GW, including the bid size of 115.4 GW, and the scale of the first successful candidate was 66.2 GW; in the component bid results (including the bid approval and the first candidate winning the bid), Jingke (688223.SH), Longji (601012.SH), Tianhe (688599.SH), and Jingao (002459.SZ) won the bid scale of 73.1 GW, accounting for 40.3%; Top 10 Group Companies (Jingke, Longji, Tianhe, Jingao, Tongwei, Yiyi New Energy, Artes, Dongfang Risheng, GCL Integrated, and Zhengtai New Energy) won the bid scale of 96.3GW, accounting for 53%. Tongwei, Longji, and Jingao have set bids on a large scale, which are 6.2 GW, 5.7 GW, and 5.7 GW respectively; Longji, Tianhe, and Jingke won most of the bids.

Figure: Scale of domestic PV module tenders and procurement from January to August 2024, unit: MW