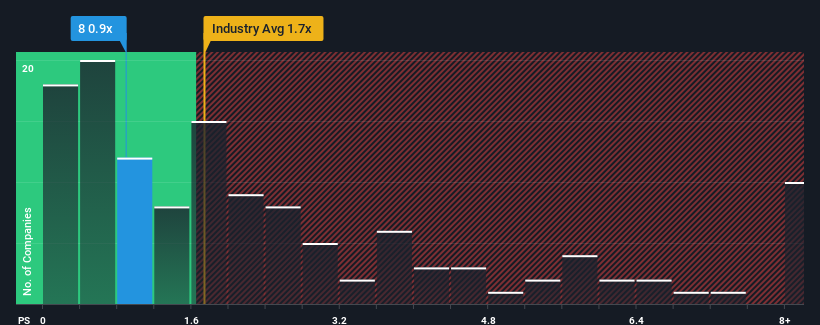

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Telecom industry in Hong Kong, you could be forgiven for feeling indifferent about PCCW Limited's (HKG:8) P/S ratio of 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does PCCW's P/S Mean For Shareholders?

PCCW's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think PCCW's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like PCCW's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.8% over the next year. With the industry predicted to deliver 5.0% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that PCCW's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that PCCW's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with PCCW (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.