①成交额环比昨日增长前十的ETF中有6只为港股相关ETF,其中恒生科技指数ETF(513180)成交额环比增长106%。②此前的市场人气龙头深圳华强连续2日跌停,这2个交易日该股龙虎榜买入前五席位均为东方财富拉萨地区各营业部。

沪深股通今日合计成交907.16亿,其中贵州茅台和美的集团分居沪股通和深股通成交额个股首位。板块主力资金方面,计算机板块净流入居首。ETF成交方面,沪深300ETF(510300)成交额位居首位。期指持仓方面,IH、IF合约空头减仓数量大于多头。龙虎榜方面,保变电气获机构买入超6000万,同时遭机构卖出超5000万,遭国盛证券宁波桑田路营业部卖出超7000万;大富科技遭机构卖出近2000万;翠微股份遭机构卖出超2000万;日久光电获一家一线游资席位买入超4000万;银宝山新遭一家量化席位卖出超2000万。

一、沪深股通前十大成交

今日沪股通总成交金额为464.07亿,深股通总成交金额为443.09亿。

今日沪股通总成交金额为464.07亿,深股通总成交金额为443.09亿。

从沪股通前十大成交个股来看,贵州茅台位居首位,招商银行、长江电力成交额分居二、三位。

从沪股通前十大成交个股来看,贵州茅台位居首位,招商银行、长江电力成交额分居二、三位。从深股通前十大成交个股来看,美的集团位居首位,宁德时代、中际旭创分居二、三位,新易盛和天孚通信也位居前十行列。

二、板块个股主力大单资金

从板块表现来看,华为昇腾、电商、鸿蒙概念、CPO等板块涨幅居前,旅游、医药商业、保险、中药等板块跌幅居前。

从主力板块资金监控数据来看,计算机板块主力资金净流入居首。

从主力板块资金监控数据来看,计算机板块主力资金净流入居首。板块资金流出方面,医药板块主力资金净流出居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股华为和CPO概念股较多,常山北明净流入居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股华为和CPO概念股较多,常山北明净流入居首。主力资金流出前十的个股中高位股较多,天风证券净流出居首。

三、ETF成交

从成交额前十的ETF来看,沪深300ETF(510300)成交额位居首位,创业板ETF(159915)成交额位居次席,三只恒生指数相关ETF位居前十行列。

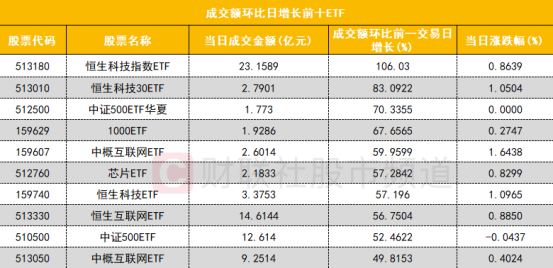

从成交额前十的ETF来看,沪深300ETF(510300)成交额位居首位,创业板ETF(159915)成交额位居次席,三只恒生指数相关ETF位居前十行列。 从成交额环比增长前十的ETF来看,有6只港股相关ETF,其中恒生科技指数ETF(513180)成交额环比增长106%位居首位。

从成交额环比增长前十的ETF来看,有6只港股相关ETF,其中恒生科技指数ETF(513180)成交额环比增长106%位居首位。四、期指持仓

四大期指主力合约中,IH、IF合约多空双方均减仓,空头减仓数量较多;IC、IM合约多空双方均加仓,多头加仓数量均较多。

四大期指主力合约中,IH、IF合约多空双方均减仓,空头减仓数量较多;IC、IM合约多空双方均加仓,多头加仓数量均较多。五、龙虎榜

1、机构

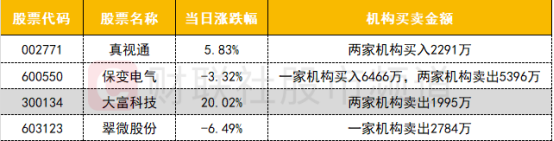

龙虎榜机构活跃度一般,买入方面,国企改革概念股保变电气获机构买入超6000万,同时遭机构卖出超5000万。

龙虎榜机构活跃度一般,买入方面,国企改革概念股保变电气获机构买入超6000万,同时遭机构卖出超5000万。卖出方面,折叠屏概念股大富科技遭机构卖出近2000万;移动支付概念股翠微股份遭机构卖出超2000万。

2、游资

一线游资活跃度一般,折叠屏概念股日久光电获一家一线游资席位买入超4000万;保变电气遭国盛证券宁波桑田路营业部卖出超7000万。此前的市场人气龙头深圳华强连续2日跌停,这2个交易日该股龙虎榜买入席位前五均为东方财富拉萨地区各营业部。

一线游资活跃度一般,折叠屏概念股日久光电获一家一线游资席位买入超4000万;保变电气遭国盛证券宁波桑田路营业部卖出超7000万。此前的市场人气龙头深圳华强连续2日跌停,这2个交易日该股龙虎榜买入席位前五均为东方财富拉萨地区各营业部。量化资金活跃度一般,银宝山新遭一家量化席位卖出超2000万。