Unpacking the Latest Options Trading Trends in Royal Caribbean Gr

Unpacking the Latest Options Trading Trends in Royal Caribbean Gr

Financial giants have made a conspicuous bearish move on Royal Caribbean Gr. Our analysis of options history for Royal Caribbean Gr (NYSE:RCL) revealed 9 unusual trades.

金融巨头对皇家加勒比集团采取了明显的看跌举动。我们对皇家加勒比集团(纽约证券交易所代码:RCL)期权历史的分析显示了9笔不寻常的交易。

Delving into the details, we found 11% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $240,230, and 2 were calls, valued at $194,468.

深入研究细节,我们发现11%的交易者看涨,而44%的交易者表现出看跌倾向。在我们发现的所有交易中,有7笔是看跌期权,价值为240,230美元,2笔是看涨期权,价值194,468美元。

Expected Price Movements

预期的价格走势

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $160.0 for Royal Caribbean Gr, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在皇家加勒比集团过去三个月的135.0美元至160.0美元之间的价格区间上。

Volume & Open Interest Development

交易量和未平仓合约的发展

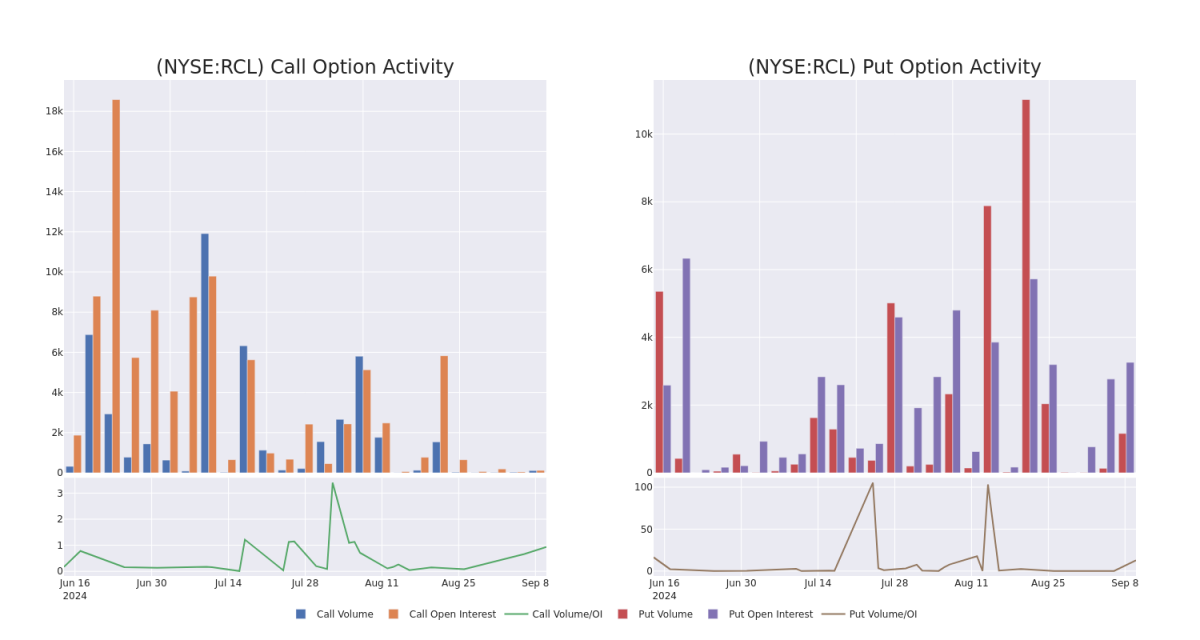

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Royal Caribbean Gr's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Royal Caribbean Gr's significant trades, within a strike price range of $135.0 to $160.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量皇家加勒比集团在特定行使价下期权的流动性和利息水平的关键。下面,我们概述了皇家加勒比集团过去一个月在135.0美元至160.0美元行使价区间内的重要交易的看涨期权和未平仓合约的交易量和未平仓合约的趋势。

Royal Caribbean Gr Option Activity Analysis: Last 30 Days

皇家加勒比Gr期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCL | CALL | SWEEP | NEUTRAL | 03/21/25 | $28.15 | $27.15 | $27.62 | $140.00 | $111.1K | 120 | 41 |

| RCL | CALL | TRADE | NEUTRAL | 03/21/25 | $28.05 | $27.4 | $27.76 | $140.00 | $83.2K | 120 | 71 |

| RCL | PUT | SWEEP | BEARISH | 09/13/24 | $1.23 | $0.97 | $1.04 | $152.50 | $54.6K | 73 | 542 |

| RCL | PUT | SWEEP | NEUTRAL | 09/20/24 | $7.85 | $7.55 | $7.5 | $160.00 | $37.5K | 481 | 53 |

| RCL | PUT | TRADE | BEARISH | 09/20/24 | $2.7 | $2.55 | $2.7 | $152.50 | $34.0K | 70 | 236 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCL | 打电话 | 扫 | 中立 | 03/21/25 | 28.15 美元 | 27.15 美元 | 27.62 美元 | 140.00 美元 | 111.1 万美元 | 120 | 41 |

| RCL | 打电话 | 贸易 | 中立 | 03/21/25 | 28.05 美元 | 27.4 美元 | 27.76 美元 | 140.00 美元 | 83.2 万美元 | 120 | 71 |

| RCL | 放 | 扫 | 粗鲁的 | 09/13/24 | 1.23 美元 | 0.97 美元 | 1.04 | 152.50 美元 | 54.6 万美元 | 73 | 542 |

| RCL | 放 | 扫 | 中立 | 09/20/24 | 7.85 美元 | 7.55 美元 | 7.5 美元 | 160.00 美元 | 37.5 万美元 | 481 | 53 |

| RCL | 放 | 贸易 | 粗鲁的 | 09/20/24 | 2.7 美元 | 2.55 美元 | 2.7 美元 | 152.50 美元 | 34.0 万美元 | 70 | 236 |

About Royal Caribbean Gr

关于皇家加勒比集团

Royal Caribbean is the world's second-largest cruise company, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021.

皇家加勒比是全球第二大邮轮公司,在邮轮度假行业的五个全球和合作伙伴品牌中运营68艘邮轮。该公司经营的品牌包括皇家加勒比国际、Celebrity Cruises和Silversea。该公司还对一家运营TUI Cruises和Hapag-Lloyd Cruises的合资企业进行了50%的投资。产品组合中的品牌选择使Royal能够在创新、船舶和服务质量、行程多样性、目的地选择和价格的基础上进行竞争。该公司于2021年完成了对Azamara品牌的剥离。

After a thorough review of the options trading surrounding Royal Caribbean Gr, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对皇家加勒比集团的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Current Position of Royal Caribbean Gr

皇家加勒比集团目前的职位

- With a volume of 475,266, the price of RCL is down -2.4% at $156.42.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 44 days.

- RCL的交易量为475,266美元,下跌了-2.4%,至156.42美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在44天后公布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Royal Caribbean Gr with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解皇家加勒比集团的最新期权交易,以获取实时提醒。