Smart Money Is Betting Big In Mastercard Options

Smart Money Is Betting Big In Mastercard Options

Investors with a lot of money to spend have taken a bullish stance on Mastercard (NYSE:MA).

有大量资金可以花的投资者对万事达卡(纽约证券交易所代码:MA)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MA, it often means somebody knows something is about to happen.

这些是机构还是仅仅是富人,我们都不知道。但是,当MA发生如此大的事情时,这通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Mastercard.

今天,Benzinga的期权扫描仪发现了11笔不常见的万事达卡期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 36% bullish and 27%, bearish.

这些大资金交易者的整体情绪在36%的看涨和27%的看跌之间。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $291,339, and 5 are calls, for a total amount of $427,272.

在我们发现的所有特殊期权中,有6个是看跌期权,总额为291,339美元,5个是看涨期权,总额为427,272美元。

Predicted Price Range

预测的价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $440.0 to $550.0 for Mastercard during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注万事达卡在过去一个季度的价格范围从440.0美元到550.0美元不等。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

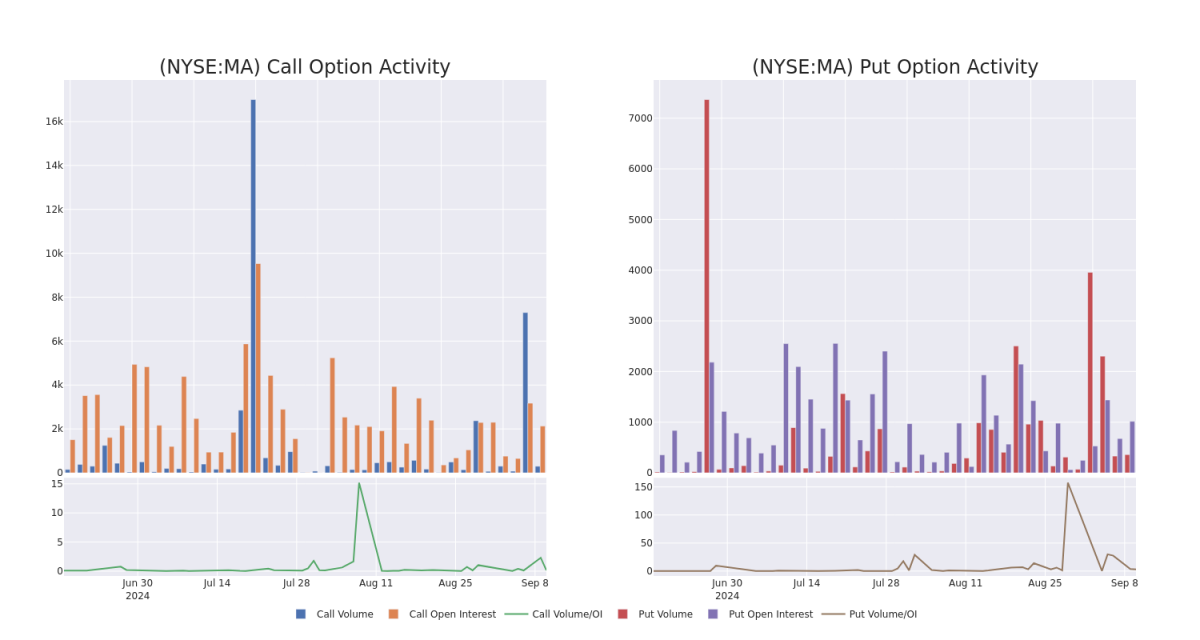

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Mastercard's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下万事达卡期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Mastercard's whale activity within a strike price range from $440.0 to $550.0 in the last 30 days.

下面,我们可以观察到过去30天内,万事达卡所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的分别变化,其行使价在440.0美元至550.0美元之间。

Mastercard Call and Put Volume: 30-Day Overview

万事达卡看涨和看跌量:30 天概览

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MA | CALL | SWEEP | BULLISH | 11/15/24 | $23.65 | $23.15 | $23.64 | $480.00 | $182.1K | 415 | 77 |

| MA | CALL | TRADE | BEARISH | 01/17/25 | $15.0 | $14.5 | $14.69 | $510.00 | $107.2K | 295 | 73 |

| MA | CALL | TRADE | NEUTRAL | 04/17/25 | $12.0 | $11.3 | $11.67 | $550.00 | $58.3K | 3 | 50 |

| MA | PUT | SWEEP | NEUTRAL | 11/15/24 | $26.0 | $23.65 | $24.72 | $500.00 | $52.0K | 105 | 62 |

| MA | PUT | SWEEP | NEUTRAL | 11/15/24 | $26.1 | $25.35 | $25.67 | $500.00 | $51.7K | 105 | 123 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MA | 打电话 | 扫 | 看涨 | 11/15/24 | 23.65 美元 | 23.15 美元 | 23.64 美元 | 480.00 美元 | 182.1 万美元 | 415 | 77 |

| MA | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 15.0 美元 | 14.5 美元 | 14.69 美元 | 510.00 美元 | 107.2 万美元 | 295 | 73 |

| MA | 打电话 | 贸易 | 中立 | 04/17/25 | 12.0 美元 | 11.3 美元 | 11.67 美元 | 550.00 美元 | 58.3 万美元 | 3 | 50 |

| MA | 放 | 扫 | 中立 | 11/15/24 | 26.0 美元 | 23.65 美元 | 24.72 美元 | 500.00 美元 | 52.0 万美元 | 105 | 62 |

| MA | 放 | 扫 | 中立 | 11/15/24 | 26.1 美元 | 25.35 美元 | 25.67 美元 | 500.00 美元 | 51.7 万美元 | 105 | 123 |

About Mastercard

关于万事达卡

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

万事达卡是全球第二大支付处理商,2023年处理的交易量超过9万亿美元。万事达卡在 200 多个国家开展业务,处理超过 150 种货币的交易。

In light of the recent options history for Mastercard, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于万事达卡最近的期权历史,现在应该专注于公司本身。我们的目标是探索其目前的表现。

Present Market Standing of Mastercard

万事达卡目前的市场地位

- Currently trading with a volume of 601,961, the MA's price is down by -0.43%, now at $485.01.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 44 days.

- 目前的交易量为601,961美元,均线的价格下跌了-0.43%,目前为485.01美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计财报将在44天后发布。

Professional Analyst Ratings for Mastercard

万事达卡的专业分析师评级

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $538.3333333333334.

在过去的30天中,共有3位专业分析师对该股发表了看法,将平均目标股价设定为538.33333333334美元。

- An analyst from JP Morgan has decided to maintain their Overweight rating on Mastercard, which currently sits at a price target of $570.

- In a cautious move, an analyst from Compass Point downgraded its rating to Neutral, setting a price target of $525.

- An analyst from BMO Capital has decided to maintain their Outperform rating on Mastercard, which currently sits at a price target of $520.

- 摩根大通的一位分析师已决定维持对万事达卡的增持评级,目前的目标股价为570美元。

- Compass Point的一位分析师谨慎地将其评级下调至中性,将目标股价定为525美元。

- BMO Capital的一位分析师已决定维持对万事达卡的跑赢大盘评级,目前的目标股价为520美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Mastercard with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解万事达卡的最新期权交易,以获取实时提醒。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MA, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MA, it often means somebody knows something is about to happen.