Chengdu Xinzhu Road&Bridge Machinery Co.,LTD (SZSE:002480) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

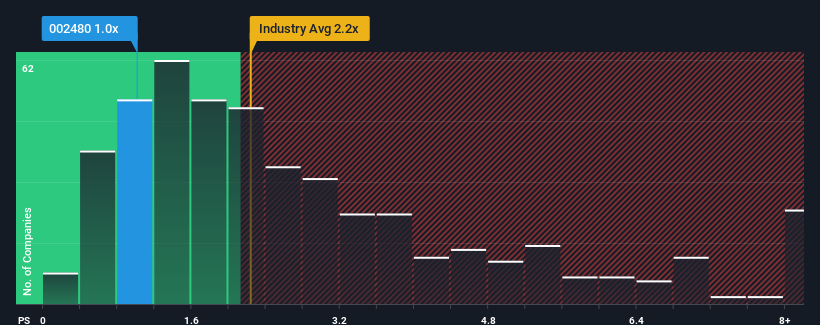

Although its price has surged higher, given about half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") above 2.2x, you may still consider Chengdu Xinzhu Road&Bridge MachineryLTD as an attractive investment with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Chengdu Xinzhu Road&Bridge MachineryLTD's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Chengdu Xinzhu Road&Bridge MachineryLTD has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Chengdu Xinzhu Road&Bridge MachineryLTD will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chengdu Xinzhu Road&Bridge MachineryLTD will help you shine a light on its historical performance.How Is Chengdu Xinzhu Road&Bridge MachineryLTD's Revenue Growth Trending?

Chengdu Xinzhu Road&Bridge MachineryLTD's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Chengdu Xinzhu Road&Bridge MachineryLTD's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 71% last year. The latest three year period has also seen an excellent 168% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 23%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Chengdu Xinzhu Road&Bridge MachineryLTD's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Chengdu Xinzhu Road&Bridge MachineryLTD's P/S?

Despite Chengdu Xinzhu Road&Bridge MachineryLTD's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Chengdu Xinzhu Road&Bridge MachineryLTD revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You always need to take note of risks, for example - Chengdu Xinzhu Road&Bridge MachineryLTD has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Chengdu Xinzhu Road&Bridge MachineryLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.