On Tuesday, Nvidia, which ranked first in trading volume in U.S. stocks, rose 1.53% with a turnover of $28.108 billion. Nvidia CEO Huang Renxun will speak at the Goldman Sachs conference in San Francisco on Wednesday, with Blackwell's issues expected to be the focus of attention. He plans to talk to Goldman Sachs CEO David Solomon at 7:20 a.m. local time.

Nvidia investors are eagerly awaiting the latest developments on the company's Blackwell chip development, hoping for a catalyst to stop the stock's decline. The next-generation processor was announced six months ago, but its release was delayed due to engineering issues.

Although CEO Jensen Huang tried to reassure the market last month by stating that revenue from the chip will arrive soon, some investors still want more details. This, combined with concerns about the overall macroeconomic environment, has caused the stock to drop 13% since the earnings report.

Tesla, which ranked second, rose 4.58% with a turnover of $17.426 billion. The European Union is reportedly planning to lower the proposed tariff rate on electric cars imported from China.

Tesla, which ranked second, rose 4.58% with a turnover of $17.426 billion. The European Union is reportedly planning to lower the proposed tariff rate on electric cars imported from China.

In addition, according to reports, Deutsche Bank analyst Edison Yu has given a "buy" rating on Tesla stock for the first time on Tuesday, with a target price of $295, and advises investors not to be concerned about the "temporary" weakness in vehicle deliveries and profit margins.

He believes that Tesla is not just an automobile company, so he has a different perspective on the valuation of Tesla's stock. He said, "Fundamentally, we do not see Tesla as an auto manufacturer, but as a technology platform that is trying to reshape multiple industries, deserving a unique valuation framework."

Apple, which ranked third, fell 0.36% with a turnover of $11.285 billion. The European Court ruled on the 10th that Apple must pay a tax of 13 billion euros (approximately $14.4 billion) to Ireland. At the same time, it upheld the 2.4 billion euro fine imposed on Google for abusing its monopoly power and suppressing competitors. The European Court's statement confirms the European Commission's 2016 decision that Apple must repay 13 billion euros in tax benefits to Ireland.

The European Court also rejected Google's appeal on the same day and upheld the European Commission's 2017 ruling that Google abused its dominant position and favored its own shopping service "Google Shopping", imposing a fine of 2.4 billion euros.

Microsoft rose by 2.09% to $8.055 billion in turnover. Microsoft will hold a summit on Tuesday local time to discuss measures to improve the cybersecurity system. In July, CrowdStrike's software update failed, leading to IT system crashes in multiple locations worldwide.

This meeting marks an important first step for Microsoft in addressing the issues that affected nearly 8.5 million Windows devices on July 19, disrupting operations in industries ranging from major airlines to banks and medical care.

Delta Air Lines said that after the outage caused a large number of flight cancellations and resulted in a loss of at least $0.5 billion to the airline, the company is making legal claims against CrowdStrike and Microsoft.

Oracle rose by 11.44% to $6.449 billion in turnover. The company's first-quarter revenue, profit, and highly anticipated cloud infrastructure revenue all exceeded expectations, calling the multi-cloud agreement signed with Amazon AWS a "milestone" event. Q1 revenue increased by 7% year-on-year to $13.3 billion, with analysts expecting $13.23 billion; among them, cloud infrastructure revenue, which is highly anticipated, increased by 45% year-on-year to $2.2 billion, with analysts expecting $2.18 billion. Non-GAAP net income increased by 18% year-on-year to $4 billion, while GAAP net income was $2.9 billion.

The company has signed a multi-cloud agreement with Amazon AWS. The latest version of Oracle's Exadata hardware and database software, version 23ai, will be embedded in AWS cloud datacenters. When it goes live in December of this year, AWS customers will have easy access to Oracle databases.

JPMorgan fell by 5.19%, marking its largest single-day decline in four years, with a turnover of $5.774 billion. Daniel Pinto, the company's President and Chief Operating Officer, stated at an industry conference that external analysts' forecasts for the bank's spending and net interest income for next year are overly optimistic.

Pinto mentioned that the external figure for JPMorgan's net interest income (NII) is $89.5 billion, which is "unreasonable" given the rate expectations, and the actual number will be lower. Pinto's comments have heightened analysts' pessimistic expectations for large US banks. David Solomon, the CEO of Goldman Sachs, said on Monday that trading revenue for the third quarter is expected to fall by 10%.

Broadcom rose by 5.25% to $5.268 billion in turnover. Recently, Broadcom held an FY2024Q3 earnings conference. The company's CEO stated that in FY24 Q3, the company's consolidated net revenue was $13.1 billion, a 47% year-on-year increase, while operating profit increased by 44% year-on-year. The revenue of the semiconductor solutions segment was $7.3 billion, accounting for 56% of this quarter's total revenue and a 5% year-on-year increase. The gross margin of the semiconductor solutions segment was approximately 68%, a decrease of 270 basis points year-on-year, mainly due to the impact of more customized AI accelerator combinations. R&D expenses increased, with operating expenses growing by 11% to reach $0.881 billion, and the semiconductor operating profit margin was 56%.

Broadcom stated that various signs clearly indicate that the semiconductor has passed the trough. In the non-AI field, non-AI semiconductor demand in Q3 increased by 20%, and continued recovery is expected in Q4. Company executives stated that the demand for AI remains strong, and AI revenue in Q4 is expected to increase by 10% month-on-month, exceeding $3.5 billion. This will bring the AI revenue for FY24 to over $12 billion, higher than the previous expectation of over $11 billion.

Broadcom's senior management stated that semiconductor revenue in Q4 is expected to be approximately $8 billion, an increase of 9% year-on-year, and infrastructure software revenue is expected to be approximately $6 billion. Therefore, the company expects comprehensive revenue in Q4 to be approximately $14 billion, a 51% year-on-year increase. The company stated that this will drive the adjusted EBITDA in Q4 to about 64% of the revenue, indicating an increase in the revenue forecast for FY24 to $51.5 billion and an increase in the adjusted EBITDA as a percentage of annual revenue to 61.5%.

Google's Class A shares (GOOGL) fell by 0.03%, with a turnover of 4.314 billion USD. Google, embroiled in antitrust lawsuits, ultimately lost in the European Union's ruling. Today, the EU court announced that it upheld the original judgment and fined 2.4 billion euros to punish Google for displaying its own shopping services prominently in the search engine, while suppressing the rankings of competitors, and abusing its monopoly power to suppress competition.

Google failed to overturn the European Union's ruling to fine it 2.4 billion euros for antitrust behavior.

On the morning of September 10, local time in Europe, the European Court of Justice announced that it upheld the lower court's ruling and fined Google 2.4 billion euros ($2.6 billion) to punish its abuse of monopoly power to suppress competitors. This final ruling means that Google can no longer appeal.

Exxon Mobil, ranked 14th, fell by 3.64%, with a turnover of 2.328 billion USD. On Tuesday, international crude oil prices fell sharply, putting pressure on the crude oil sector.

In addition, according to reports, Exxon Mobil closed the Hoover oil platform in the Gulf of Mexico due to the impact of the storm. The intensity of the tropical storm 'Francine' moving northward in the Gulf of Mexico has increased, prompting oil drilling companies to evacuate workers and suspend some offshore oil production. At the same time, the U.S. Coast Guard has warned shipping companies of the imminent high winds.

According to US government forecasters in a statement at 13:00 Houston time on September 9th, Hurricane Frances is expected to hit parts of the Gulf Coast with strong winds and heavy rain, and is expected to become a full-fledged hurricane by Wednesday. Chevron, Exxon Mobil, and Shell have taken measures such as evacuating workers from affected facilities, suspending drilling activities, and shutting down some oil wells.

Eli Lilly and Co. fell 0.77% to $1.741 billion in trading. Eli Lilly announced the appointment of its senior financial expert Lucas Montarce as the new CFO, effective immediately. The personnel change comes at a critical time, as Eli Lilly is investing billions of dollars to expand production to meet the surging demand for its diabetes and weight loss drugs, such as Mounjaro and Zepbound. Despite FDA approval, Eli Lilly drugs still face supply shortages.

Goldman Sachs fell 4.39% to $1.643 billion in trading. CEO David Solomon warned on Monday that trading revenue for the third quarter is likely to decline by 10%.

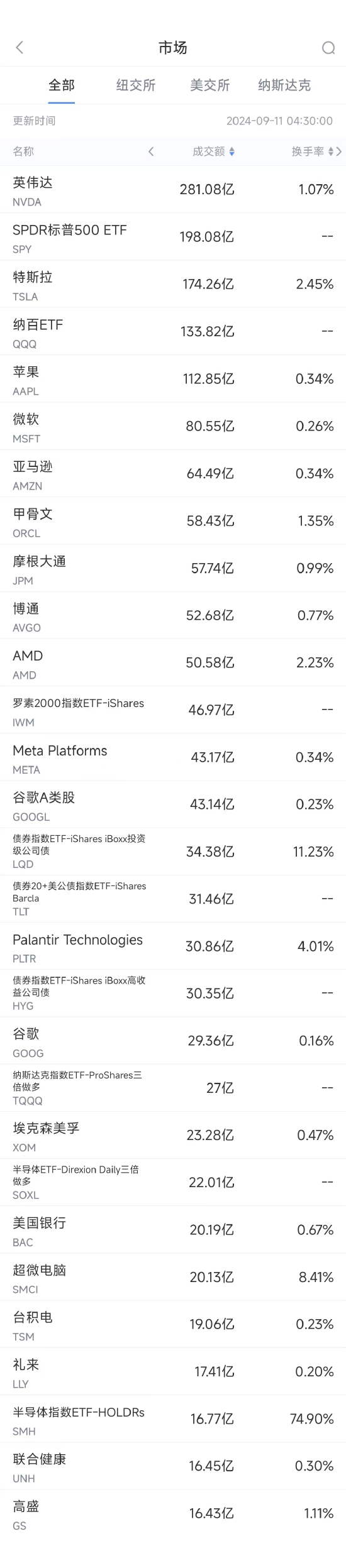

(Screenshot from the Financial APP market sector of the US stock market - swipe left for more data) Download the Financial APP

第2名特斯拉收高4.58%,成交174.26亿美元。欧盟据悉将降低对自中国进口电动汽车拟议的进口税税率。

第2名特斯拉收高4.58%,成交174.26亿美元。欧盟据悉将降低对自中国进口电动汽车拟议的进口税税率。