Those holding Kuke Music Holding Limited (NYSE:KUKE) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 110% following the latest surge, making investors sit up and take notice.

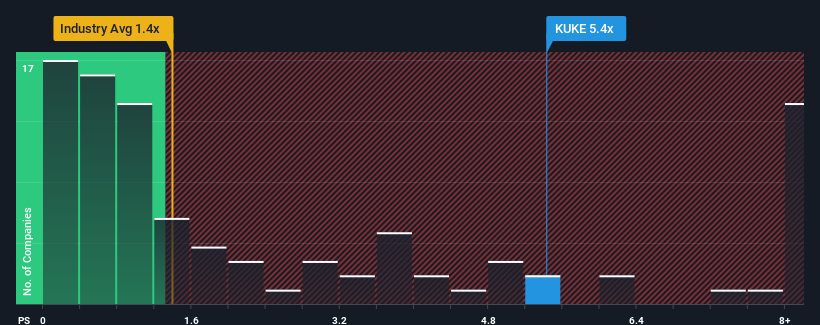

After such a large jump in price, given around half the companies in the United States' Entertainment industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Kuke Music Holding as a stock to avoid entirely with its 5.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Kuke Music Holding Has Been Performing

For instance, Kuke Music Holding's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Kuke Music Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Kuke Music Holding's Revenue Growth Trending?

In order to justify its P/S ratio, Kuke Music Holding would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 7.1% decrease to the company's top line. As a result, revenue from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this in mind, we find it worrying that Kuke Music Holding's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Kuke Music Holding's P/S

The strong share price surge has lead to Kuke Music Holding's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kuke Music Holding currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It is also worth noting that we have found 4 warning signs for Kuke Music Holding (3 are potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.