Check Out What Whales Are Doing With HON

Check Out What Whales Are Doing With HON

Whales with a lot of money to spend have taken a noticeably bullish stance on Honeywell Intl.

有大量资金可以花的鲸鱼对霍尼韦尔国际采取了明显的看涨立场。

Looking at options history for Honeywell Intl (NASDAQ:HON) we detected 13 trades.

查看霍尼韦尔国际(纳斯达克股票代码:HON)的期权历史记录,我们发现了13笔交易。

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 38% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,61%的投资者以看涨的预期开盘,38%的投资者持看跌预期。

From the overall spotted trades, 9 are puts, for a total amount of $901,501 and 4, calls, for a total amount of $130,046.

在所有已发现的交易中,有9笔是看跌期权,总额为901,501美元,4笔是看涨期权,总额为130,046美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $175.0 to $230.0 for Honeywell Intl over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将霍尼韦尔国际的价格定在175.0美元至230.0美元之间。

Volume & Open Interest Development

交易量和未平仓合约的发展

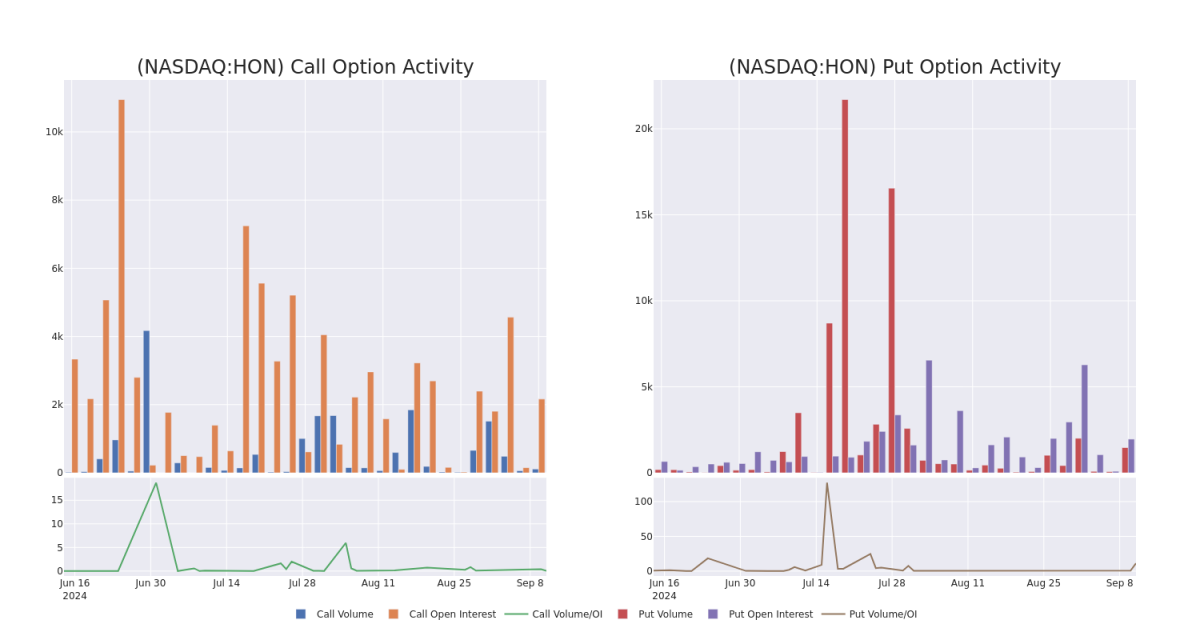

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Honeywell Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Honeywell Intl's substantial trades, within a strike price spectrum from $175.0 to $230.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了霍尼韦尔国际期权在指定行使价下的流动性和投资者对他们的兴趣。即将发布的数据可视化了与霍尼韦尔国际大量交易相关的看涨期权和看跌期权交易量和未平仓合约的波动,在过去30天内,行使价范围从175.0美元到230.0美元不等。

Honeywell Intl Option Activity Analysis: Last 30 Days

霍尼韦尔国际期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HON | PUT | SWEEP | BULLISH | 10/18/24 | $3.2 | $2.95 | $3.2 | $195.00 | $312.7K | 316 | 1 |

| HON | PUT | SWEEP | BULLISH | 12/20/24 | $6.9 | $6.8 | $6.8 | $195.00 | $126.4K | 602 | 562 |

| HON | PUT | SWEEP | BULLISH | 12/20/24 | $5.2 | $5.1 | $5.2 | $190.00 | $82.1K | 621 | 173 |

| HON | PUT | TRADE | BULLISH | 01/16/26 | $34.5 | $32.3 | $32.8 | $230.00 | $78.7K | 3 | 25 |

| HON | PUT | SWEEP | BEARISH | 12/20/24 | $12.8 | $12.1 | $12.45 | $210.00 | $69.8K | 417 | 135 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 亲爱的 | 放 | 扫 | 看涨 | 10/18/24 | 3.2 美元 | 2.95 美元 | 3.2 美元 | 195.00 美元 | 312.7 万美元 | 316 | 1 |

| 亲爱的 | 放 | 扫 | 看涨 | 12/20/24 | 6.9 美元 | 6.8 美元 | 6.8 美元 | 195.00 美元 | 126.4 万美元 | 602 | 562 |

| 亲爱的 | 放 | 扫 | 看涨 | 12/20/24 | 5.2 美元 | 5.1 美元 | 5.2 美元 | 190.00 美元 | 82.1 万美元 | 621 | 173 |

| 亲爱的 | 放 | 贸易 | 看涨 | 01/16/26 | 34.5 美元 | 32.3 美元 | 32.8 美元 | 230.00 美元 | 78.7 万美元 | 3 | 25 |

| 亲爱的 | 放 | 扫 | 粗鲁的 | 12/20/24 | 12.8 美元 | 12.1 美元 | 12.45 美元 | 210.00 美元 | 69.8 万美元 | 417 | 135 |

About Honeywell Intl

关于霍尼韦尔国际

Honeywell traces its roots to 1885 with Albert Butz's firm, Butz Thermo-Electric Regulator, which produced a predecessor to the modern thermostat. Other inventions by Honeywell include biodegradable detergent and autopilot. Today, Honeywell is a global multi-industry behemoth with one of the largest installed bases of equipment. It operates through four business segments: aerospace technologies (37% of 2023 company revenue), industrial automation (29%), energy and sustainability solutions (17%), and building automation (17%). Recently, Honeywell has made several portfolio changes to focus on fewer end markets and align with a set of secular growth trends. The firm is working diligently to expand its installed base, deriving 30% of its revenue from recurring aftermarket services.

霍尼韦尔的历史可以追溯到1885年,当时是阿尔伯特·布茨的Butz热电调节器公司,该公司生产了现代恒温器的前身。霍尼韦尔的其他发明包括可生物降解的洗涤剂和自动驾驶仪。如今,霍尼韦尔是一家全球多行业巨头,拥有最大的设备安装基础之一。它通过四个业务领域运营:航空航天技术(占2023年公司收入的37%)、工业自动化(29%)、能源和可持续发展解决方案(17%)和楼宇自动化(17%)。最近,霍尼韦尔对投资组合进行了几项调整,将重点放在较少的终端市场上,并与一系列长期增长趋势保持一致。该公司正在努力扩大其安装量,其收入的30%来自定期售后服务。

After a thorough review of the options trading surrounding Honeywell Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对霍尼韦尔国际的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Present Market Standing of Honeywell Intl

霍尼韦尔国际目前的市场地位

- Currently trading with a volume of 633,074, the HON's price is down by -0.27%, now at $200.41.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 43 days.

- HON目前的交易量为633,074美元,价格下跌了-0.27%,目前为200.41美元。

- RSI读数表明,该股目前可能接近超买。

- 预计将在43天后发布财报。

What Analysts Are Saying About Honeywell Intl

分析师对霍尼韦尔国际的看法

In the last month, 1 experts released ratings on this stock with an average target price of $210.0.

上个月,1位专家发布了该股的评级,平均目标价为210.0美元。

- An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $210.

- 摩根士丹利的一位分析师将其股票评级下调至同等权重,目标股价为210美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。