Given the latest US core inflation exceeding expectations, the possibility of a 50 basis point rate cut next week has significantly decreased; Timilau stressed that in addition to focusing on the rate cut next week, attention should also be paid to Fed Chairman Powell's views on the health of the economy; The latest expectations show that the probability of a 25 or 50 basis point rate cut by the Fed in November is close, and the probability of a total rate cut of at least 100 basis points this year exceeds 80%.

According to CaiLian News on September 12th (Editor: Shi Zhengcheng), with Wednesday's US CPI data exceeding expectations, speculation about the magnitude of the Fed's rate cut next week is nearing its end.

At a time when Federal Reserve officials remained silent, well-known macroeconomist Nick Timiraos, hailed as the 'Fed spokesman', wrote on Wednesday that the trend of persistent inflation weakness paved the way for the Fed to gradually lower interest rates starting next week, but the unexpected rise in housing inflation made it difficult for officials to push for a larger rate cut.

(Source: X)

(Source: X)

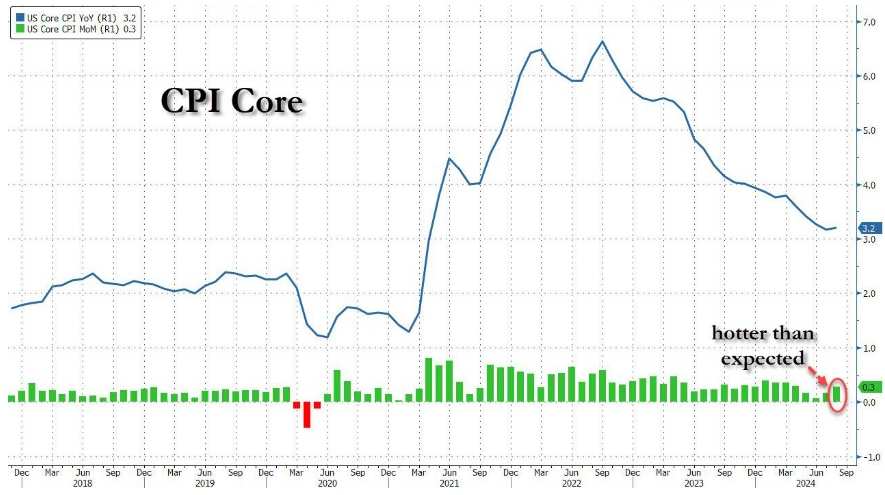

To summarize the situation of US CPI in August: Nominal CPI rose 0.2% month-on-month and 2.5% year-on-year; the biggest problem is the core CPI, which increased by 0.3% month-on-month (actually 0.281%) driven by housing costs, higher than the market's general expectation of 0.2%; core CPI annual rate is 3.2%, in line with expectations.

Unlike nominal CPI, which dropped to its lowest level since February 2021, the decline in core CPI is significantly slower. Among them, core CPI has been rising for 51 consecutive months on a month-on-month basis, which is also a new record in US history.

The most worrying thing is that the annual rate of housing inflation has risen for the first time since the beginning of 2023!

"Setting the tone" reduces interest rates by 25 basis points

Timilaus said that stronger housing inflation has led to a higher-than-expected increase in core inflation in August, which may make it more difficult for officials to push for a larger 50 basis point rate cut at next week's meeting.

Of course, investors don't have to worry too much about the Fed reversing its stance on interest rate cuts. Timilaus also said that Wednesday's CPI data will not change the position of the majority of central bank officials who are ready to cut rates. The only remaining point of contention is with "some officials", and the possibility of a larger rate cut has not been completely ruled out.

In addition to inflation data, investors are also increasingly concerned about the health of the US economy. While inflation is easing, the US labor market is also visibly cooling - new job additions and wage growth are slowing down, and the time it takes for unemployed people to find new jobs has also increased. E-commerce giant Amazon also reported that consumers are buying more discounted goods and low-priced necessities.

Timilaus believes that for the Fed meeting next week, in addition to paying attention to the magnitude of the rate cut, attention should also be paid to Federal Reserve Chairman Powell's view on the health of the economy.

So...what are the expectations for the remaining two meetings during the year?

As the Federal Reserve is expected to cut interest rates by 25 basis points next week, the investment market is also starting to look ahead to the two interest rate meetings later this year.

Due to the impact of this year's US election, the Federal Open Market Committee's November decision will be postponed until November 7th, which is a relatively rare 'Friday morning decision' moment. The last meeting of the year will announce its decision on December 18th.

According to the latest changes in the CME's 'FedWatch', against the backdrop of a 25 basis point interest rate cut in September, the market is still oscillating between a further 25 basis point or 50 basis point rate cut in November, with probabilities ranging from 40-50%.

(Fed rate cut expectations in November, source: CME)

The December meeting, which is further away, is more complex in terms of expectations. The most mainstream expectation at present is that the Federal Reserve will cut interest rates by a total of 100 basis points this year, which means that at least one of the three meetings in the future will see a 50 basis point rate cut. In contrast to the cautious stance of the Federal Reserve, the probability of only three 25 basis point rate cuts this year is only 17.2%.

(Fed rate cut expectations in December, source: CME)

The Federal Reserve will also release its latest economic forecast for this issue next week, including the latest 'dot plot'. In June of this year, due to an unexpected rebound in inflation in the first half of the year, more than half of the officials expected 'at most one interest rate cut' for the year. However, that expectation is already outdated as the situation has evolved.

(来源:X)

(来源:X)