What the Options Market Tells Us About Eaton Corp

What the Options Market Tells Us About Eaton Corp

Whales with a lot of money to spend have taken a noticeably bullish stance on Eaton Corp.

有很多钱可以花的鲸鱼对伊顿公司采取了明显的看涨立场

Looking at options history for Eaton Corp (NYSE:ETN) we detected 8 trades.

查看伊顿公司(纽约证券交易所代码:ETN)的期权历史记录,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看涨的预期开启交易,37%的投资者持看跌预期。

From the overall spotted trades, 3 are puts, for a total amount of $126,690 and 5, calls, for a total amount of $349,579.

在已发现的全部交易中,有3笔是看跌期权,总额为126,690美元,5笔是看涨期权,总额为349,579美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $260.0 to $300.0 for Eaton Corp over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将伊顿公司的价格区间从260.0美元扩大到300.0美元。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

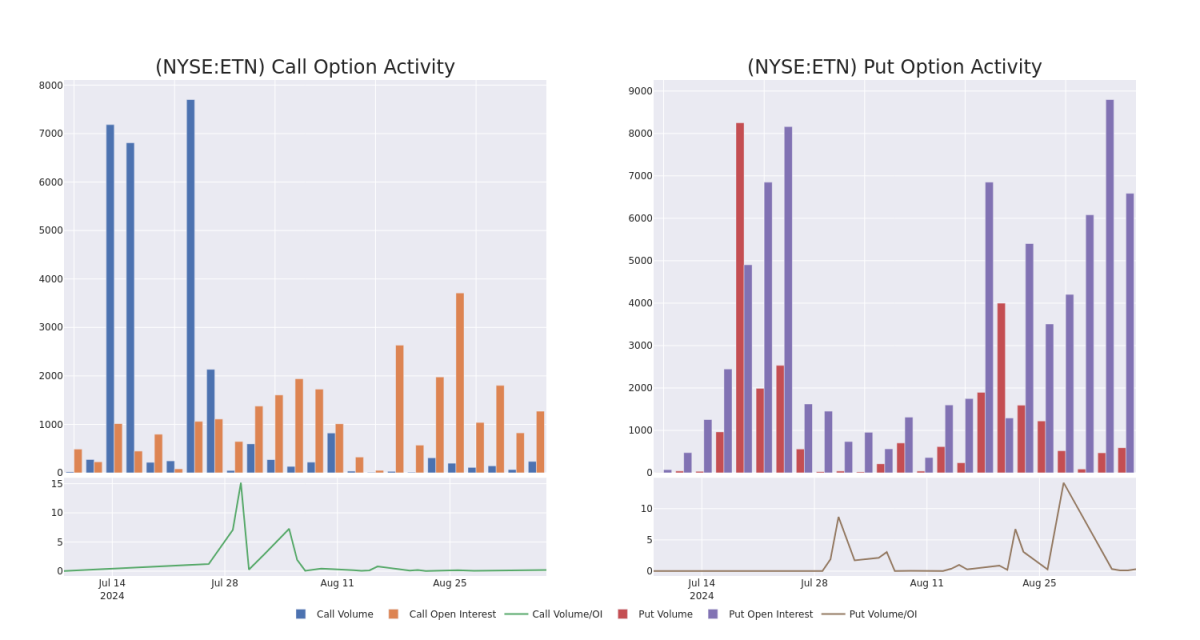

In terms of liquidity and interest, the mean open interest for Eaton Corp options trades today is 931.33 with a total volume of 1,452.00.

就流动性和利息而言,今天伊顿公司期权交易的平均未平仓合约为931.33,总交易量为1,452.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eaton Corp's big money trades within a strike price range of $260.0 to $300.0 over the last 30 days.

在下图中,我们可以跟踪过去30天伊顿公司在260.0美元至300.0美元行使价区间内的大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Eaton Corp Option Volume And Open Interest Over Last 30 Days

伊顿公司过去 30 天的期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | TRADE | BEARISH | 01/17/25 | $28.5 | $28.1 | $28.1 | $290.00 | $129.2K | 294 | 53 |

| ETN | CALL | TRADE | NEUTRAL | 10/18/24 | $16.0 | $15.7 | $15.87 | $290.00 | $79.3K | 461 | 197 |

| ETN | PUT | TRADE | BULLISH | 09/20/24 | $7.2 | $6.7 | $6.9 | $290.00 | $69.0K | 2.1K | 106 |

| ETN | CALL | SWEEP | BULLISH | 09/20/24 | $3.4 | $3.0 | $3.4 | $300.00 | $64.9K | 2.3K | 557 |

| ETN | CALL | SWEEP | BULLISH | 09/20/24 | $3.0 | $2.8 | $3.0 | $300.00 | $45.0K | 2.3K | 365 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 28.5 美元 | 28.1 美元 | 28.1 美元 | 290.00 美元 | 129.2 万美元 | 294 | 53 |

| ETN | 打电话 | 贸易 | 中立 | 10/18/24 | 16.0 美元 | 15.7 美元 | 15.87 美元 | 290.00 美元 | 79.3 万美元 | 461 | 197 |

| ETN | 放 | 贸易 | 看涨 | 09/20/24 | 7.2 美元 | 6.7 美元 | 6.9 美元 | 290.00 美元 | 69.0 万美元 | 2.1K | 106 |

| ETN | 打电话 | 扫 | 看涨 | 09/20/24 | 3.4 美元 | 3.0 美元 | 3.4 美元 | 300.00 美元 | 64.9 万美元 | 2.3K | 557 |

| ETN | 打电话 | 扫 | 看涨 | 09/20/24 | 3.0 美元 | 2.8 美元 | 3.0 美元 | 300.00 美元 | 45.0 万美元 | 2.3K | 365 |

About Eaton Corp

伊顿公司简介

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton's portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

这家同名公司由约瑟夫·伊顿于1911年创立,最初在新泽西州销售卡车车轴。此后,伊顿成为工业强国,主要是通过对各个终端市场的收购。伊顿的投资组合大致可分为两部分:其电气和工业业务。其电气产品组合(约占公司收入的70%)销售数据中心、公用事业以及商业和住宅建筑中的组件,而其工业业务(占收入的30%)则销售商用和客用车辆及飞机的组件。作为爱尔兰的住所,伊顿获得了优惠的税收待遇,但其收入的一半以上来自美国。

Following our analysis of the options activities associated with Eaton Corp, we pivot to a closer look at the company's own performance.

在分析了与伊顿公司相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Present Market Standing of Eaton Corp

伊顿公司目前的市场地位

- Trading volume stands at 1,383,116, with ETN's price up by 3.03%, positioned at $297.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

- 交易量为1,383,116美元,其中ETN的价格上涨了3.03%,为297.04美元。

- RSI指标显示该股可能接近超买。

- 预计将在48天后公布财报。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eaton Corp options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解伊顿公司最新的期权交易。