Highbroad Advanced Material (Hefei) Co., Ltd. (SZSE:301321) Shares Fly 26% But Investors Aren't Buying For Growth

Highbroad Advanced Material (Hefei) Co., Ltd. (SZSE:301321) Shares Fly 26% But Investors Aren't Buying For Growth

Highbroad Advanced Material (Hefei) Co., Ltd. (SZSE:301321) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

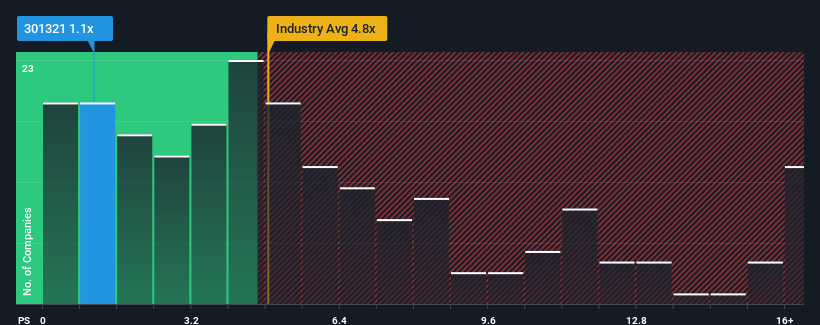

Although its price has surged higher, Highbroad Advanced Material (Hefei) may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 4.8x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Highbroad Advanced Material (Hefei)'s P/S Mean For Shareholders?

Highbroad Advanced Material (Hefei) has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Highbroad Advanced Material (Hefei) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Highbroad Advanced Material (Hefei) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Highbroad Advanced Material (Hefei)?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Highbroad Advanced Material (Hefei)'s to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Highbroad Advanced Material (Hefei)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 20% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Highbroad Advanced Material (Hefei)'s P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Highbroad Advanced Material (Hefei)'s P/S Mean For Investors?

Shares in Highbroad Advanced Material (Hefei) have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Highbroad Advanced Material (Hefei) confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Highbroad Advanced Material (Hefei) (2 don't sit too well with us!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.