Many fund managers are betting that nuclear energy, a traditionally unpopular sector among eco-friendly investors, will make a comeback.

According to the Intelligent Finance and Economics App, as global energy transition accelerates low-carbonization and artificial intelligence demand for electricity continues to soar, the huge potential of nuclear energy has once again caught the attention of fund managers. At the same time, the latest news suggests that Russia may restrict the export of uranium and other commodities, which seems to have put nuclear energy stocks back in the spotlight.

Nuclear energy makes a comeback.

Multiple fund managers are betting that nuclear energy, a traditionally unpopular sector among eco-friendly investors, will make a comeback.

Multiple fund managers are betting that nuclear energy, a traditionally unpopular sector among eco-friendly investors, will make a comeback.

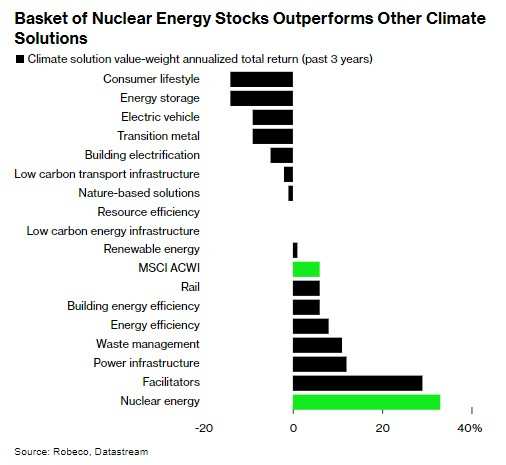

Companies like Robeco Institutional Asset Management, J O Hambro Capital Management, and Janus Henderson Investors believe that stocks related to nuclear energy play a role in their investment portfolios.

"In the past, we tended to be very cautious and exclusionary," said Chris Berkouwer, Chief Manager of Robeco's Net Zero 2050 Climate Equities Fund, "but now it is clear that nuclear energy is an 'indispensable part' in eliminating greenhouse gas emissions."

Including nuclear energy in an investment portfolio with an eco-friendly focus is sure to provoke debate. Skeptics point out a range of concerns, from nuclear waste to uranium supply and geopolitical impact. The recent global anxiety caused by the Russia-Ukraine conflict after the Zaporizhzhia Nuclear Power Plant came under Russian control has added to the worries.

Supporters, on the other hand, argue that running nuclear reactors is emission-free. Nuclear power plants require only a small amount of fuel to generate a large amount of electricity, making it more efficient than other energy sources. This is also one of the reasons why nuclear energy is the largest clean energy source in the USA, France, and South Korea.

In the European Union, strong lobbying from France helped nuclear energy to be included in the EU's classification of green energy by 2022.

At BlackRock Investment Institute, a subsidiary of BlackRock, nuclear energy is seen as part of the energy mix required for the construction of large data centers in the technology sector.

Alastair Bishop, Global Head of Sustainable Core Investments and Portfolio Manager at BlackRock Investment Institute, said in a media briefing in July: 'With the increasing adoption of artificial intelligence, electricity demand could double, or even quadruple, by the end of this decade. This will have profound implications for the electricity market.'

Robert Lancastle, Portfolio Manager at J O Hambro, stated in an interview that without nuclear energy, the world is unlikely to have enough energy to support the sustainable development of artificial intelligence.

He expressed in an interview that finding enough energy to power the AI revolution 'is a significant problem yet to be solved. We believe that nuclear energy - perhaps along with small modular reactors located near data centers - will be an interesting field, but it has not received sufficient attention.'

Since the first quarter of 2022, Lancastle has held a stake in Cameco (CCJ.US), the world's third-largest uranium producer. The stock has risen by around 80% since the beginning of the year.

He said in the past, the investment tasks in the environment, society, and governance were too narrow, which led to stocks like Cameco being "unpopular".

Other nuclear-themed companies include Constellation Energy Corp. (CEG.US, with a year-to-date increase of more than 50%), BWX Technologies (BWXT.US, with an increase of more than 20%), and NuScale Power (SMR.US, with an increase of more than 150%). In terms of fixed income, investors can obtain exposure to the nuclear power theme through companies like Orano SA, Urenco Ltd., and Electricite de France SA.

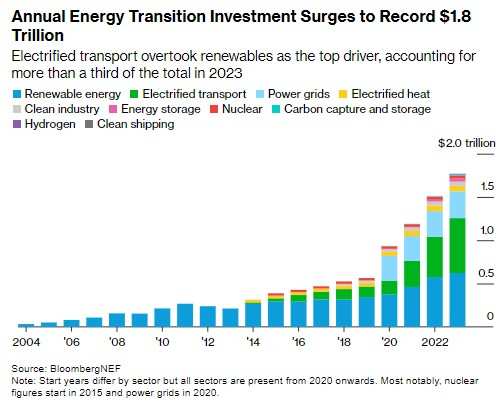

The International Energy Agency (IEA) estimated as early as 2022 that global nuclear power capacity needs to double from the 2020 level by the middle of this century to help the world achieve its net-zero emissions commitment. At the same time, the way governments around the world handle nuclear energy has significant geopolitical implications. As is well known, in the decade following the 2011 Fukushima nuclear power plant leakage incident in Japan, Germany gradually abandoned its nuclear energy projects. This decision later drew criticism as Germany found itself heavily reliant on high-emission fossil fuels supplied by Russia.

At the same time, the European Union's decision to include nuclear energy in its classification of green energy in 2022 has attracted criticism from environmental organizations. Concerns include how to handle the radioactive waste generated by nuclear power plants, which may take thousands of years to decompose. Another concern is that if nuclear technology falls into the wrong hands, it could be used to manufacture nuclear weapons.

Berkouwer of Robeco stated that the company takes a balanced approach in selecting nuclear assets, and if Robeco is exposed to high-risk countries on nuclear safety issues, investments cannot proceed. In addition, he stated that any nuclear energy stocks related to the defense industry will eventually be included in Robeco's exclusion list.

Berkouwer stated that he sees potential investment opportunities in uranium miners, equipment suppliers, companies that build so-called small modular reactors, and power companies in which nuclear energy is an important part of the energy infrastructure. He also listed software providers because many nuclear power plants require advanced software to operate properly.

But cost remains an issue, as nuclear power plants typically require billions of dollars in investment and construction time is usually longer than renewable energy facilities. Tal Lomnitzer, Senior Investment Manager of the Janus Henderson Investors Global Sustainable Equity Team, said this has brought "a bad reputation" to nuclear energy.

Even so, Lomnitzer expressed that the cost "can be addressed by small modular reactors. With the guarantee of the government and other aspects, public perception is expected to improve".

Russia restricts the export of csi commodity equity index

At a time when nuclear energy is favored by many fund managers, Russian President Putin said on Wednesday that the government may restrict the export of commodities such as nickel, titanium, and uranium in retaliation against Western sanctions. This move may affect the supply of raw materials in other parts of the world.

"Russia is in a leading position in terms of strategic raw material reserves such as uranium, titanium, and nickel," Putin said at a government meeting, suggesting that due to Western sanctions restricting the export of Russian goods such as diamonds, "perhaps we should also consider restrictions".

"I'm not saying we have to do it tomorrow, but we can consider certain restrictions on the supply to foreign markets, not only for the goods I mentioned, but also for some other goods," Putin said.

In the wake of these statements, US nuclear energy sectors, including Cameco, collectively surged on Wednesday. At the close, Cameco rose by over 6%, Constellation Energy rose by nearly 4%, and NuScale Power rose by nearly 6%.

It is understood that Russia is the world's fourth-largest uranium producer, with approximately 44% of the world's uranium enrichment capacity. US nuclear power plants rely on Russia, Kazakhstan, and Uzbekistan to supply about half of their uranium, with Russian uranium accounting for around 27% in 2023. Although Biden signed a law in May this year prohibiting the import of Russian uranium, he also left exemptions allowing the maintenance of current import levels until 2027 because the US does not have sufficient alternative production capacity.

多位基金经理押注,核能这个传统上不受环保投资者欢迎的领域,将卷土重来。

多位基金经理押注,核能这个传统上不受环保投资者欢迎的领域,将卷土重来。