$RHBBANK (1066.MY)$ Technical Analysis:

Support: RM6.280

Resistance: RM5.660

The current buy-sell ratio is -51.59%, indicating that selling pressure dominates the market, possibly due to profit-taking by investors. Given that most shareholders' cost basis is around RM5.6 and the current price is RM6.24, the majority of shareholders are in a profitable position and may choose to sell to lock in gains, thereby increasing selling pressure.

However, with the current price of RM6.240 above the support level of RM5.660, a Sharp decline in the short term is unlikely. If the price breaks through the resistance level of RM6.280, it is expected to rise further.

However, with the current price of RM6.240 above the support level of RM5.660, a Sharp decline in the short term is unlikely. If the price breaks through the resistance level of RM6.280, it is expected to rise further.

Market News:

1H FY2024 Financial Overview:

On August 27, RHB Bank released its half-year financial report for the period ending June 30, 2024 ("1H FY2024"), showing a total revenue increase of over 10% to RM4.2 billion. The group attributed this significant growth to strong contributions from both net interest income and non-interest income.

The group achieved a net profit of RM1.45 billion, slightly lower than the RM1.57 billion recorded in the first half of last year, with the return on equity ("ROE") rising to 9.6%. Additionally, RHB’s cost-to-income ratio improved to 46.3%, reflecting effective cost management.

Collaborative Progress:

On September 4, RHB Banking Group, in collaboration with BNP Paribas Malaysia Berhad, launched Malaysia’s first sustainable use-of-proceeds (UOP) cross-currency repurchase (repo) transaction. This cross-currency repo involving Australian dollars and Malaysian ringgit bonds aims to support SMEs transitioning to sustainability.

The banking group plans to achieve a RM50 billion sustainable finance goal by 2026. To date, RM31 billion has been mobilized, accounting for 62% of the 2026 target, demonstrating significant progress and reinforcing its commitment to supporting businesses in transitioning to low-carbon practices. RHB positions itself as a catalyst for sustainable business and a leader in advancing a low-carbon future.

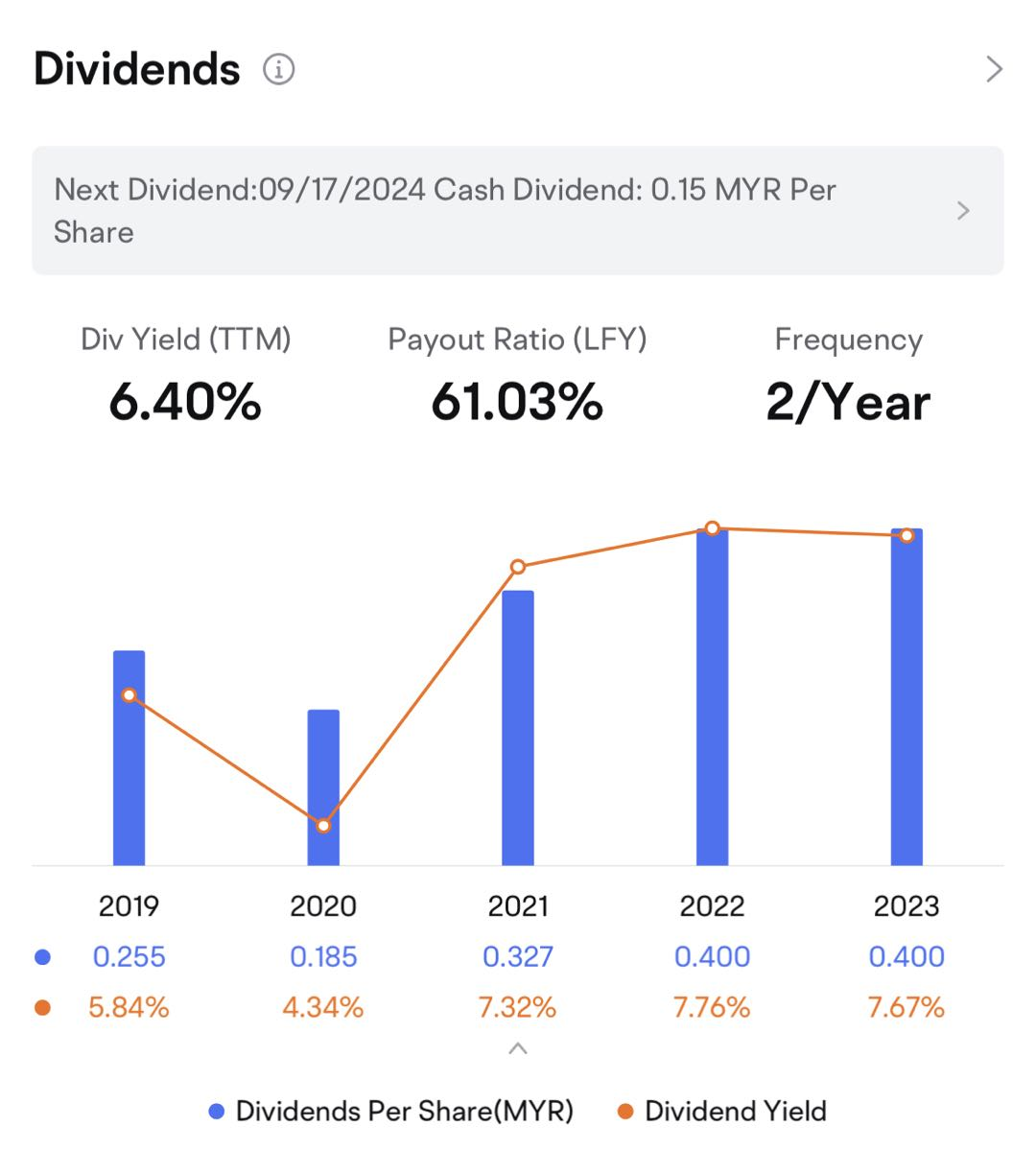

Dividend Payout:

RHBBANK is also favored for its high dividend yield of approximately 6.4%, providing stable returns amid capital market pressures. The next payout will be on September 17, 2024, with a dividend of RM0.15 per share.

Combined Analysis:

The current stock price is above the support level, indicating strong market support. Despite some selling pressure, if the stock price can break through the resistance level, it will offer further upside potential for investors.

RHB Banking Group’s proactive engagement in sustainable finance, in collaboration with BNP Paribas, lays a solid foundation for its long-term growth. The upcoming dividend payout will further enhance its appeal to value investors.

In summary, RHB Banking Group’s stock shows positive signals both technically and fundamentally. While short-term market fluctuations may occur, its strategic positioning in sustainable finance and robust dividend policy make it a noteworthy investment prospect in the long term.