A Closer Look at Delta Air Lines's Options Market Dynamics

A Closer Look at Delta Air Lines's Options Market Dynamics

High-rolling investors have positioned themselves bearish on Delta Air Lines (NYSE:DAL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DAL often signals that someone has privileged information.

大額投資者看淡達美航空 (紐交所:DAL),這對零售交易者非常重要。 我們今天通過Benzinga追蹤到公開可獲得的期權數據才發現了這種活動。雖然這些投資者的身份還不確定,但DAL股票的如此重大變動往往意味着有人掌握了內幕信息。

Today, Benzinga's options scanner spotted 11 options trades for Delta Air Lines. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現了11次達美航空的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 27% bullish and 63% bearish. Among all the options we identified, there was one put, amounting to $77,000, and 10 calls, totaling $664,685.

這些主要交易者的情緒有些分散,有27%的人看好而63%的人持看淡態度。在我們所發現的所有期權中,有一項看跌期權金額爲$77,000,而10項看漲期權總計$664,685。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $45.0 for Delta Air Lines during the past quarter.

分析這些合約的成交量和持倉量,似乎大型交易者在過去一個季度一直關注着達美航空股票在$30.0到$45.0之間的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

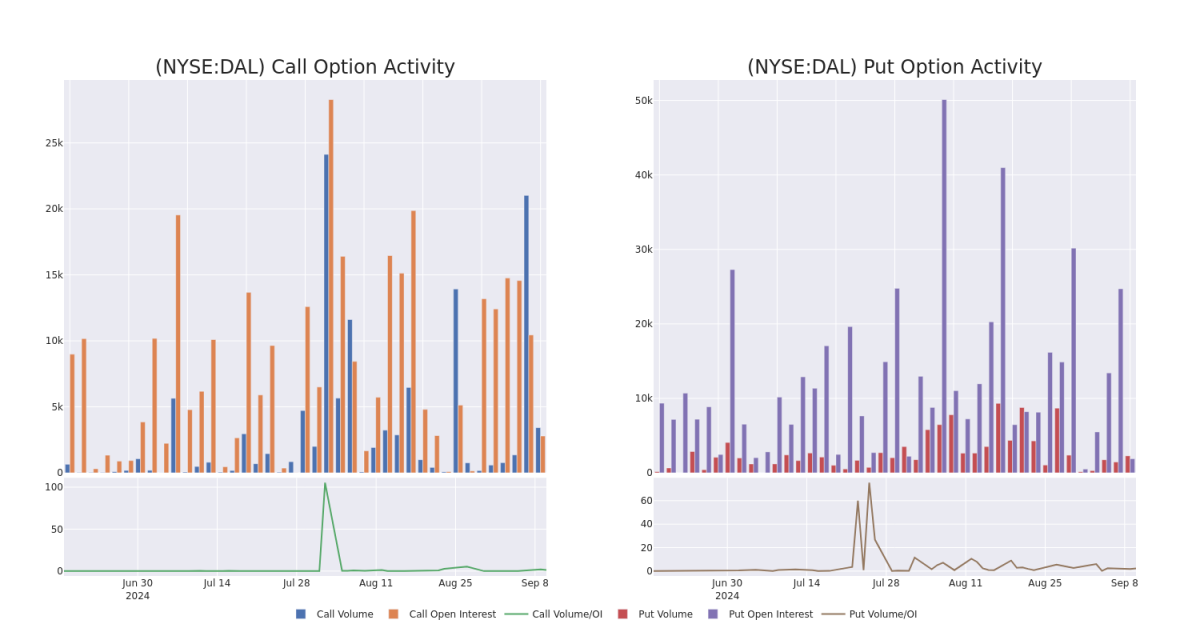

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Delta Air Lines's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Delta Air Lines's significant trades, within a strike price range of $30.0 to $45.0, over the past month.

檢視成交量和持倉量對股票研究至關重要。這些信息對於衡量在特定行權價上達美航空期權的流動性和興趣水平至關重要。以下是過去一個月內,在$30.0到$45.0之間行權價範圍內涉及達美航空的重大交易的成交量和持倉量趨勢快照。

Delta Air Lines Option Volume And Open Interest Over Last 30 Days

過去30天內的達美航空期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | CALL | TRADE | BEARISH | 09/13/24 | $3.2 | $2.0 | $2.41 | $44.00 | $120.5K | 4.2K | 0 |

| DAL | CALL | TRADE | NEUTRAL | 09/13/24 | $2.35 | $1.65 | $2.0 | $44.50 | $100.0K | 1.9K | 0 |

| DAL | PUT | TRADE | BEARISH | 12/18/26 | $7.7 | $7.2 | $7.7 | $45.00 | $77.0K | 674 | 0 |

| DAL | CALL | SWEEP | BEARISH | 09/13/24 | $0.85 | $0.67 | $0.7 | $45.00 | $70.0K | 5.3K | 1.2K |

| DAL | CALL | SWEEP | BULLISH | 09/20/24 | $3.55 | $2.85 | $3.1 | $42.50 | $64.1K | 1.1K | 208 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看漲 | 交易 | 看淡 | 09/13/24 | $3.2 | $2.0 | $2.41 | $44.00 | 120,500美元 | 4.2千 | 0 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看漲 | 交易 | 中立 | 09/13/24 | $2.35 | $1.65 | $2.0 | $44.50 | $100.0K | 1.9K | 0 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看跌 | 交易 | 看淡 | 12/18/26 | $7.7 | $7.2 | $7.7 | $45.00 | $77.0K | 674 | 0 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看漲 | SWEEP | 看淡 | 09/13/24 | $0.85 | $0.67 | 0.7美元 | $45.00 | $70.0K | 5.3K | 1.2K |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看漲 | SWEEP | 看好 | 09/20/24 | $3.55 | $2.85 | $3.1 | $42.50 | $64.1K | 1.1千 | 208 |

About Delta Air Lines

關於達美航空

Atlanta-based Delta Air Lines is one of the world's largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned the greatest portion of its international revenue and profits from flying passengers over the Atlantic Ocean.

總部位於亞特蘭大的達美航空是全球最大的航空公司之一,擁有覆蓋50多個國家的300多個目的地網絡。達美通過其在亞特蘭大、紐約、鹽湖城、底特律、西雅圖和明尼阿波利斯 - 聖保羅等最大樞紐上收集和分發全球乘客。達美的歷史收入和利潤的最大部分來自於飛越大西洋運送乘客。

Having examined the options trading patterns of Delta Air Lines, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在調查了達美航空的期權交易模式之後,我們現在將直接關注該公司。這個轉變使我們能夠深入了解它目前的市場地位和表現。

Where Is Delta Air Lines Standing Right Now?

達美航空現狀如何?

- With a volume of 2,862,325, the price of DAL is up 0.38% at $44.45.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 28 days.

- 成交量爲2,862,325,DAL價格上漲了0.38%,達到了$44.45。

- RSI因子暗示底層股票可能被超買。

- 下一個季度收益預計在28天內公佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $45.0 for Delta Air Lines during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $45.0 for Delta Air Lines during the past quarter.