Investors with a lot of money to spend have taken a bearish stance on Crown Castle (NYSE:CCI).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCI, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCI, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Crown Castle.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 55%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $85,248, and 8, calls, for a total amount of $402,750.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $125.0 for Crown Castle during the past quarter.

Volume & Open Interest Development

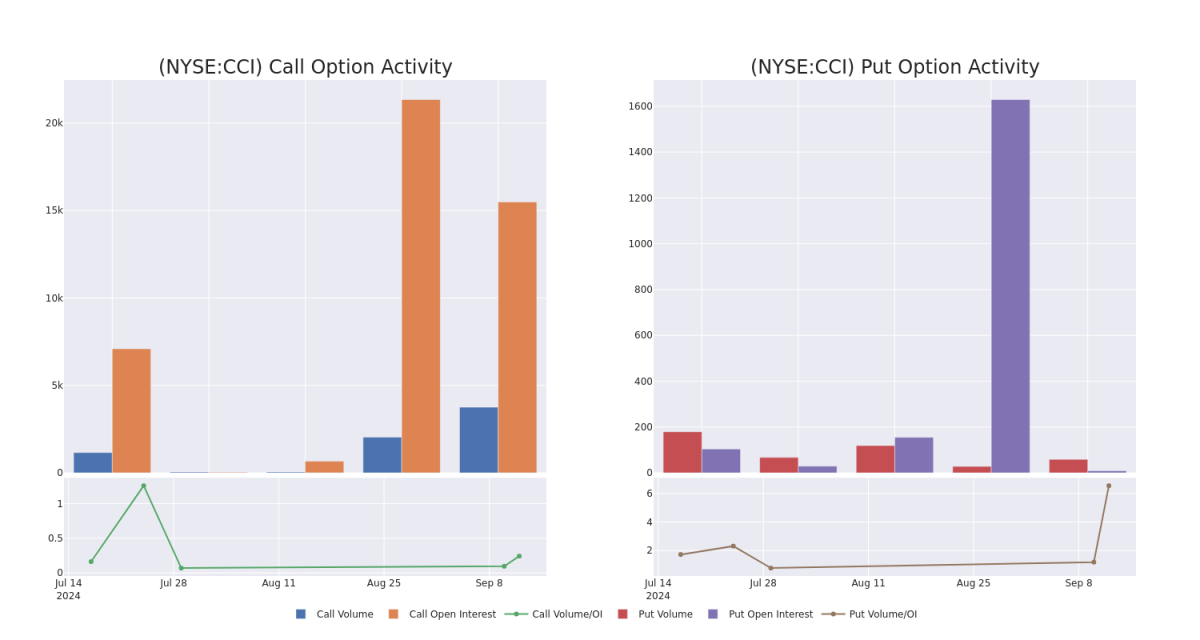

In today's trading context, the average open interest for options of Crown Castle stands at 2213.86, with a total volume reaching 3,812.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Crown Castle, situated within the strike price corridor from $60.0 to $125.0, throughout the last 30 days.

Crown Castle Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCI | PUT | SWEEP | BEARISH | 06/20/25 | $14.7 | $14.4 | $14.69 | $125.00 | $85.2K | 9 | 59 |

| CCI | CALL | TRADE | NEUTRAL | 10/18/24 | $18.9 | $18.5 | $18.7 | $100.00 | $65.4K | 585 | 60 |

| CCI | CALL | TRADE | BEARISH | 10/18/24 | $2.65 | $2.6 | $2.6 | $120.00 | $65.0K | 8.5K | 410 |

| CCI | CALL | TRADE | BEARISH | 01/17/25 | $59.8 | $59.0 | $59.1 | $60.00 | $59.1K | 10 | 52 |

| CCI | CALL | TRADE | BEARISH | 04/17/25 | $16.5 | $16.1 | $16.26 | $105.00 | $56.9K | 84 | 35 |

About Crown Castle

Crown Castle International owns and leases roughly 40,000 cell towers in the United States. It also owns more than 90,000 route miles of fiber. It leases space on its towers to wireless service providers, which install equipment on the towers to support their wireless networks. The company's fiber is primarily leased by wireless service providers to set up small-cell network infrastructure and by enterprises for their internal connection needs. Crown Castle's towers and fiber are predominantly located in the largest us cities. The company has a very concentrated customer base, with about 75% of its revenue coming from the big three us mobile carriers. Crown Castle operates as a real estate investment trust.

Following our analysis of the options activities associated with Crown Castle, we pivot to a closer look at the company's own performance.

Current Position of Crown Castle

- Trading volume stands at 2,182,446, with CCI's price down by -0.89%, positioned at $119.07.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 34 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.