Nvidia, the number one in US stock turnover, closed 1.92% higher on Thursday, continuing Wednesday's sharp rise and trading at $43.099 billion. Nvidia CEO Hwang In-hoon reiterated at the Goldman Sachs Technology conference on Wednesday local time that Blackwell chips are already in full production and will begin shipping in the fourth quarter. Huang Renxun said earlier that demand for Blackwell chips is strong, and supplier production is catching up.

Goldman Sachs reaffirmed Nvidia's “buy” rating and continued to be included in the convinced purchases list, with a target price of $135.

The second-place Tesla closed up 0.74% and traded $16.43 billion. Tesla CEO Musk hinted in response to netizens on X that the company may develop a new Cybertruck for the international market to meet global demand for electric pickups.

Cybertruck was first launched in the US in 2023, and Tesla delivered this model to the first customers in November last year. However, despite Cybertruck's various tours in Asia and Europe, Tesla did not announce specific plans to introduce the model to other markets.

Cybertruck was first launched in the US in 2023, and Tesla delivered this model to the first customers in November last year. However, despite Cybertruck's various tours in Asia and Europe, Tesla did not announce specific plans to introduce the model to other markets.

Apple, which ranked 3rd, closed 0.05% higher and traded $8.292 billion. There were reports on Thursday that the US Food and Drug Administration (FDA) has approved hearing aid software for Apple's AirPods Pro.

Fourth place Broadcom closed up 3.97% and traded $7.113 billion. US technology stocks generally rose on Thursday. Earlier, there were rumors that the US might allow chip companies to export advanced chips to Saudi Arabia.

No. 6 Meta Platforms closed 2.69% higher at $6.073 billion. The media reported on Thursday that the company added new features and procedures to its WhatsApp Business app in India to help Indian businesses use WhatsApp to communicate with customers.

Meta said in a press release on Thursday (Sept. 12) that at its first WhatsApp Business Summit in India, the company unveiled news about the messaging and calling app.

Sandhya Devanathan, vice president of Meta India, said in a press release: “These features and programs we are announcing today demonstrate our commitment to helping businesses maximize their commercial value while providing a superior customer experience on WhatsApp.”

The 8th Google Class A stock (GOOGL) closed 2.34% higher and traded $4.429 billion. OpenAI CEO Sam Altman and Nvidia CEO Hwang In-hoon visited the White House to meet with senior Biden administration officials and other industry leaders to discuss how to meet the huge infrastructure needs of artificial intelligence projects.

According to people familiar with the matter, participants from the tech community also included Anthropic CEO Dario Amodei, Google President Ruth Porat, and Microsoft President Brad Smith. A White House official said discussions revolved around strengthening public-private partnerships in developing artificial intelligence data centers in the US. People familiar with the matter said the topics discussed included facility licensing, labor, electricity demand and its economic impact.

The 12th Micron closed down 3.79% and traded $2.666 billion. Micron has had its target price and rating downgraded by analysts.

Brokerage firm Raymond James lowered the target price of the stock from $160 to $125; BNP Paribas downgraded Micron Technology's rating from “outperforming the market” to “outperforming the market” and the target share price from $140 to $67.

The reduction in Micron's target price reflects a recent slowdown in sales growth in the non-high-bandwidth memory DRAM and NAND markets. However, Raymond James believes this is only a temporary slowdown and expects the DRAM upward cycle to continue until the second half of 2025.

BNP Paribas analyst Karl Ackerman said he expects Micron's sluggish performance to continue. Micron hit an annual high of $153 in mid-June, but has been declining for most of the time since then.

The 13th place Oracle closed 2.67% higher and traded $2.478 billion. Oracle executives expect revenue of at least $66 billion for fiscal year 2026; revenue of at least $104 billion for fiscal year 2029, and earnings per share are expected to increase 20% at that time.

Citi raised Oracle's price target from $140 to $157, maintaining a “neutral” rating.

The 16th Wells Fargo closed down 4.02% and traded $2.212 billion. The US Monetary Authority (OCC), the top banking regulator in the US, announced on Thursday that it discovered that Wells Fargo had flaws in financial crime risk management operations and internal anti-money laundering (AML) controls, so it took enforcement action against the bank and requested that the bank take remedial measures.

According to the requirements of the agreement relating to enforcement actions, Wells Fargo must first obtain permission from the OCC if it wants to conduct new business in medium- to high-risk areas related to money laundering or US sanctions in the future.

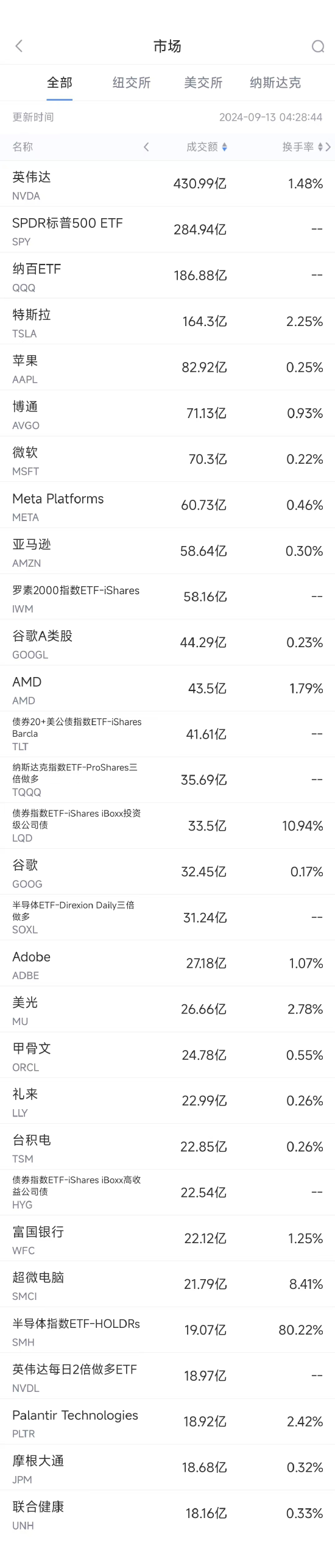

(Screenshot from the Sina Finance App Market - US Stocks - Market section, swipe left for more data) Download the Sina Finance App

Cybertruck于2023年首次在美国上市,特斯拉在去年11月向首批客户交付了这款车型。然而,尽管Cybertruck在亚洲和欧洲进行了各种巡展,但特斯拉并未宣布将该车型引入其他市场的具体计划。

Cybertruck于2023年首次在美国上市,特斯拉在去年11月向首批客户交付了这款车型。然而,尽管Cybertruck在亚洲和欧洲进行了各种巡展,但特斯拉并未宣布将该车型引入其他市场的具体计划。