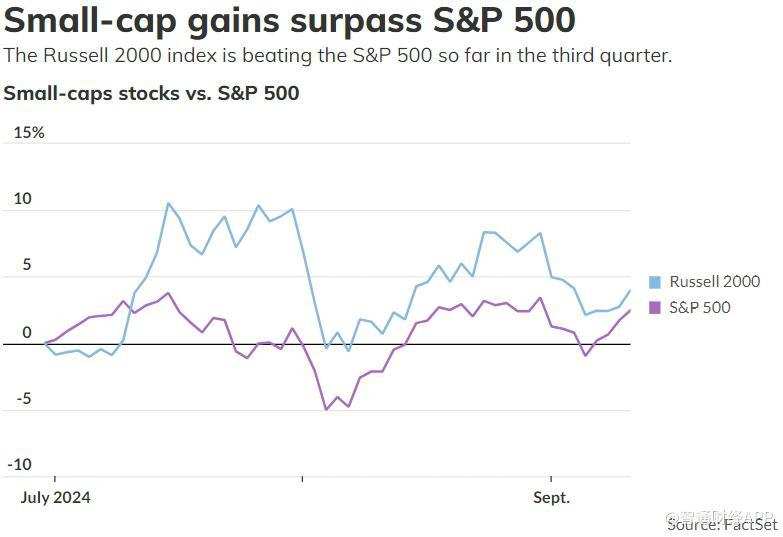

Even though the impact in September was more severe than that of large-cap stocks, the performance of US small-cap stocks in the third quarter was still better than the S&P 500 index

The Zhitong Finance App learned that even though the impact in September was more severe than that of large-cap stocks, the performance of US small-cap stocks in the third quarter was still superior to the S&P 500 index.

Liz Ann Sonders, chief investment strategist at SCHW.US, said in a telephone interview on Thursday: “Overall, the Federal Reserve made it clear at the Jackson Hole Economic Symposium at the end of August that it would adopt a more relaxed policy, which boosted small-cap stocks.” She explained, “Small-cap stocks generally perform well in interest rate cutting cycles, especially when the Federal Reserve cuts interest rates in response to a recession, and investors want to prepare for economic recovery.”

But Sonders also stated, “We are not currently in a recession.” Despite the economic slowdown, she added, “The economic performance has been good.”

According to FactSet, the Russell 2000 Index, the benchmark for US small-cap stocks, rose 4% this quarter, although it had fallen 4% this month as of Thursday. In contrast, the S&P 500 index rose only 2.5% in the third quarter, but since this year, the S&P 500 index has outperformed small-cap stocks by a large margin.

Investors expect the Federal Reserve will announce after Wednesday's policy meeting that it will begin to cut its benchmark interest rate, which has remained high since July 2023. The Federal Reserve had previously raised interest rates in response to a sharp rise in US inflation. After peaking in 2022, inflation has dropped significantly to a target close to 2%.

According to data from the CME FedWatch tool, as of Thursday, traders in the federal funds futures market expect a 69% chance that the Federal Reserve will cut the policy interest rate by 25 basis points to the target range of 5% to 5.25% at this meeting.

For investors who want the Federal Reserve to cut interest rates more drastically, Sonders cautioned: “Be careful what you expect.” She explained that larger interest rate cuts usually occur during economic recessions or financial crises.

The recent rebound in small-cap stocks “stalled” to a certain extent because traders adjusted their expectations for interest rate cuts back from 50 basis points to 25 basis points. Saunders said this “may trigger a profit settlement for small-cap stocks, because overall, small-cap stocks usually benefit more from interest rate cuts than large companies.”

However, Sonders also cautioned that the small-cap market is huge and not “homogenized.” Within the Russell 2000 Index, there is a huge difference in stock performance. Generally, the performance of low-quality stocks and high-quality stocks is not the same.

“The economy is slowing down and is not accelerating,” said Sonders. Therefore, if investors want to find opportunities in small-cap stocks, they should “focus on high-quality companies.”

The S&P Small-Cap 600 Index generally includes higher-quality stocks than the Russell 2000 Index because it uses a “profit filter,” which Sonders said investors can use as a benchmark when screening investment opportunities.

Small-cap stocks surpassed the S&P 500 index on Thursday. The Russell 2000 Index rose 1.2%, and the S&P Small Cap 600 also rose 1.2%, both outperforming the 0.7% increase of the S&P 500 Index.

The US stock market generally rose on Thursday. The blue chip indicator Dow Jones Industrial Average rose nearly 0.6%, while the Nasdaq Composite Index, which is dominated by technology stocks, rose 1%. As of 2024, the S&P 500 index has accumulated a cumulative increase of 17.3%, far exceeding the Russell 2000 index's year-to-date increase of just over 5%, despite poor performance in September. According to FactSet, the S&P 500 index fell 0.9% this month as of Thursday, while the Russell 2000 index fell 4% in September.