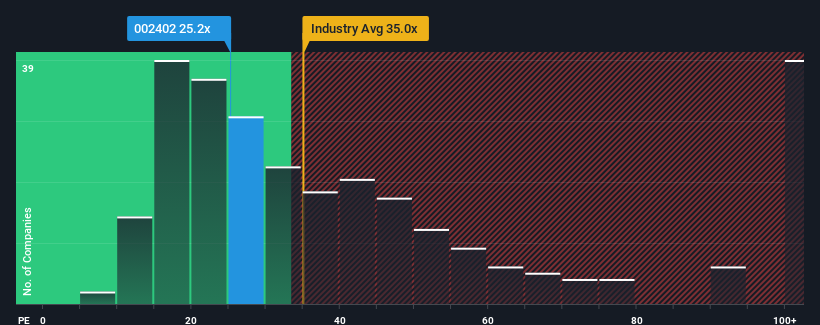

With a median price-to-earnings (or "P/E") ratio of close to 27x in China, you could be forgiven for feeling indifferent about Shenzhen H&T Intelligent Control Co.Ltd's (SZSE:002402) P/E ratio of 25.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Shenzhen H&T Intelligent ControlLtd has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shenzhen H&T Intelligent ControlLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 35% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 35% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 43% per year as estimated by the five analysts watching the company. With the market only predicted to deliver 20% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Shenzhen H&T Intelligent ControlLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Shenzhen H&T Intelligent ControlLtd's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen H&T Intelligent ControlLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shenzhen H&T Intelligent ControlLtd that you should be aware of.

If you're unsure about the strength of Shenzhen H&T Intelligent ControlLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.