"We have just entered 1996," according to the latest report from Bank of America. The bank states that the AI boom is still in its very early stages.

According to the Wall Street banking giant Bank of America, the global AI boom is still in its nascent stage, similar to the development path of the internet in the 1990s. It can be compared to the "1996 moment" of the internet boom, signifying that the AI boom is still in its very early stages. The bank states that the impact of AI will be perceived faster than previous technological advancements. Regarding the stock price trend of NVIDIA (NVDA.US), which is known as the "most important stock in the world" and the "global AI leader", Bank of America believes that the relatively low levels after the selling wave are good opportunities to "buy on dips", and it continues to list NVIDIA as its preferred stock in the semiconductor sector.

Recently, there has been a growing skepticism in the market about the AI boom, with doubts about the significant profit prospects and the cooling down of the AI hype. However, the analyst team at Bank of America emphasizes that the AI boom is still in its very early stages and it follows a similar development trajectory as the internet technology in the 1990s.

As the skepticism towards AI grows, there is a growing number of people who are eager to see companies achieve the promised efficiency, productivity, and most importantly, significant profit increases through this technology.

The latest report from Bank of America states: "Doubters claim that the revenue potential of generative AI does not prove the rationality of the massive investment in AI infrastructure currently. But please remember, what is much more important than the initial consumer use cases of the internet are the thousands of breakthrough use cases and internet companies that have emerged due to internet technology."

The bank states that this report, released on Thursday, draws on consultation and survey data from over 3,000 stock analysts and some professional institutions' macro strategy analysts.

These analysts and strategy analysts generally agree that AI is the third major technology cycle in the past 50 years, starting with the debut of ChatGPT in November 2022. The development trajectory of AI follows the personal computing boom that began in 1981 and the internet innovation wave that started in 1994. The internet development gained explosive expansion momentum in 1996.

According to the report from Bank of America, unlike the technological boom cycles that take 15-30 years to become mainstream, the impact of artificial intelligence (AI) may manifest at a much faster pace. The report states, 'Generative AI may catalyze a new technological revolution, disrupting all industries and changing the global economy in the next 5 to 10 years.'

However, the report claims that investors may underestimate the long-term impact of this technology while overestimating its short-term potential, but this is also a typical characteristic of technological booms. 'Capital expenditure related to AI is expected to exceed $1 trillion in the coming years, but compared to the internet age, AI development is still in its early stage,' Bank of America added.

Enterprises worldwide are rushing to layout the AI field, which is an unstoppable trend.

Bank of America's analyst team states that the current level of investment in top AI companies such as OpenAI, Anthropic, and Inflection AI is just a prerequisite for creating breakthrough generative AI applications, which are still largely in the testing phase and require more time to develop iterative large models and some core technological aspects.

Some strategists predict that AI will drive accelerated profit expansion for most industry groups, with the semiconductor and software industries expected to benefit the most. The profit margins are anticipated to expand by approximately 4.8% and 5.2% respectively over the next five years.

At the time of the report's release, doubts about AI technology have been growing stronger as some investors argue that they have not seen any meaningful return on investment in this technology from major tech giants, leading to the recent sharp drop in Nvidia's stock price and a negative catalyst causing its market value to evaporate by about $400 billion in the past week.

However, from Bank of America's latest report, as well as the latest report from IDC, we can see that the current development of AI technology is still at a very early stage. The construction of AI infrastructure dominated by AI GPU demand is just getting started. Therefore, companies like Nvidia, which specialize in AI chips, are the earliest beneficiaries of the AI boom. The outlook for future profitability in AI software and other application areas remains optimistic in the long run. This is also one of the core reasons why Bank of America continues to be bullish on Nvidia's stock price.

According to the latest forecast in the well-known research institution IDC's "Global AI and Generative AI Spending Guide," the institution predicts that by 2028, global AI-related spending (with a focus on AI-supported applications, AI chips, AI infrastructure, and related IT and business services) will at least double from the current level, reaching approximately $632 billion. AI, especially generative AI (GenAI), is rapidly integrating into various terminal devices and products. IDC forecasts a compound annual growth rate (CAGR) of 29.0% in AI spending for the period 2024-2028.

IDC pointed out that software or applications will be the largest category of AI technology expenditure, accounting for more than half of the entire AI market in most forecasts. IDC predicts that the five-year compound annual growth rate of AI software will reach 33.9% during the period from 2024 to 2028. IDC forecasts that spending on AI-related hardware, including servers, storage devices, and infrastructure-as-a-service, will become the second largest category of technology expenditure.

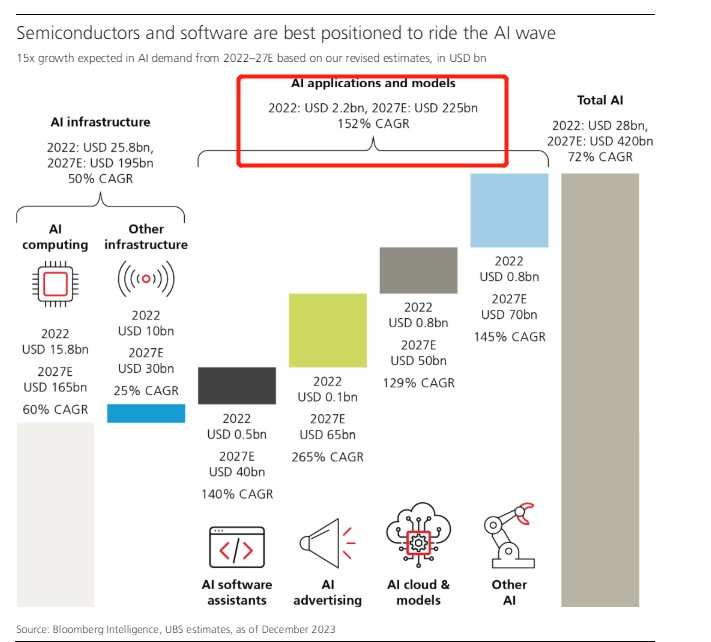

A research report released by the global bank UBS shows that the global technology industry is just starting a large-scale performance growth cycle. UBS expects that by 2027, AI technology will achieve extremely broad application scales in various sectors of the world's major economies, driving AI big models and AI software applications to become a submarket worth as much as $225 billion, compared to the scale of only $2.2 billion in 2022, it's an epic leap. The compounded annual growth rate during this period is expected to be as high as 152%. UBS also predicts that the total revenue of the AI industry will increase 15-fold, surging from about $28 billion in 2022 to $420 billion in 2027.

The AI frenzy, in the long run, may be the core catalyst of the bull market in the stock market.

On Wall Street, the sentiment of 'buying on dips' is exceptionally strong. The bulls of U.S. stocks on Wall Street firmly believe that this round of correction has squeezed out the majority of the 'AI bubble', and those technology companies that can continuously profit from the AI wave are expected to enter a new round of 'primary uptrend' and soar, such as Nvidia, AMD, Taiwan Semiconductor, Advantest, and other popular chip stocks. Chips are an indispensable core infrastructure for popular generative AI tools such as ChatGPT, and these popular chip stocks can be called the biggest winners of the AI boom, especially the combination of 'CUDA ecosystem + high-performance AI GPU', which makes Nvidia's moat exceptionally strong.

Global fund managers and market strategists from the world's largest asset management institutions, such as the largest-scale asset management giant BlackRock Inc. and BNP Paribas Asset Management in Europe, have expressed that the global stock market's unprecedented investment craze around artificial intelligence is far from over. Leaders in AI such as Nvidia, whose stock prices have repeatedly hit new highs, are expected to continue to drive a 'long bull trend' in the global stock market, continuously breaking historical highs.

Economists from Capital Economics even predict that the optimistic sentiment driven by the development of AI technology will push the extra multiple expansion expectations, driving the benchmark S&P 500 index to reach the historical peak of 7000 points in 2025.

Evercore ISI, which has been bearish on the US stocks in the long term, recently completely reversed its position and turned to a strong bullish outlook on the US stocks. Julian Emanuel, the Chief Stock and Quantitative Strategist at the firm, significantly raised the organization's year-end forecast for the S&P 500 index to 6000 points.

Evercore ISI emphasized that the fading inflation and the artificial intelligence craze led by tech giants will further drive up US stocks. "Today, the potential of artificial intelligence is changing every job and every industry. Inflation easing, the Federal Reserve's intention to cut interest rates within the year, and the economic resilience backdrop support the 'Golden-Haired Girl' economy."

Goldman Sachs, Bank of America, Morgan Stanley, and other Wall Street analysts are very optimistic about the trend of Nvidia's stock price. They generally believe that global enterprises still have strong demand for Nvidia's H100/H200 AI GPUs, and the next generation of AI GPUs based on the Blackwell architecture are expected to bring a larger scale of revenue contribution. The "CUDA software and hardware collaborative platform + high-performance AI GPUs" together form Nvidia's incredibly strong moat, leading these major banks to enthusiastically declare that it is a great opportunity to 'buy on the dip.'

Among them, Bank of America's analysis team recently reiterated a 'buy' rating for Nvidia, considering it the 'best industry choice.' They mentioned that the decline in Nvidia's stock price provides a good entry point and raised Nvidia's target stock price from $150 to $165, compared to Nvidia's Thursday close at $119.140. The BofA analyst emphasized that market doubts about the potential of artificial intelligence are unnecessary at least until 2026.