According to a survey of economists, the Federal Reserve is likely to cut interest rates by 25 basis points at the next meeting and the following two meetings.

According to a survey of economists, the Federal Reserve is likely to cut interest rates by 25 basis points at its next meeting and the following two meetings. Although the market generally expects the Fed to cut rates at the meeting on September 17-18, most of the 46 economists surveyed believe that policymakers will adopt a more gradual rate cut strategy, rather than the one percentage point rate cut expected by traders before the end of the year.

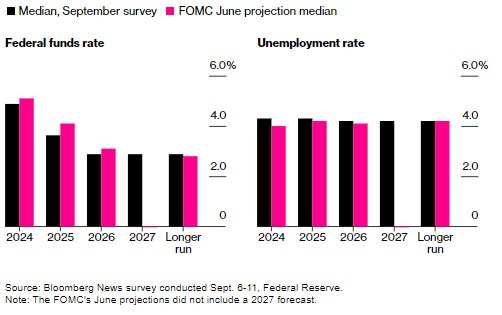

The latest economic survey data shows that only a few economists expect the Fed to further cut rates by 50 basis points at the November or December meeting. However, respondents generally believe that compared to the forecast in June, the Fed will adopt a more aggressive rate-cutting path in the coming years. According to economists' expectations, the median forecast of the Fed's upcoming dot plot may show that by the end of next year, rates could be between 3.5% and 3.75%, and by the end of 2026, rates could be between 2.75% and 3%.

Scott Anderson, Chief U.S. Economist at BMO Capital Markets, said he expects the Fed to cut rates and may hint at a series of further rate cuts at the upcoming meeting to reduce the tightening effects of monetary policy.

Scott Anderson, Chief U.S. Economist at BMO Capital Markets, said he expects the Fed to cut rates and may hint at a series of further rate cuts at the upcoming meeting to reduce the tightening effects of monetary policy.

Overall, the latest non-farm payrolls data and CPI and PPI data have failed to resolve the huge debate in the market about the magnitude of the Fed's rate cut in September. After the release of a series of economic data including non-farm payrolls, both the camp that advocates a normalized pace of 25 basis points rate cuts and the camp that advocates a 50 basis points rate cut to boost the U.S. economy have expanded. Looking at a comprehensive pricing of interest rate futures and bond markets, the camp of traders who agree with a 25 basis points rate cut in September is more powerful. The comprehensive information implied by these latest economic data suggests that the mystery of how much the Fed will cut rates in September may not be revealed until the last moment, namely the Federal Open Market Committee (FOMC) monetary policy meeting on September 17-18, Eastern Time.

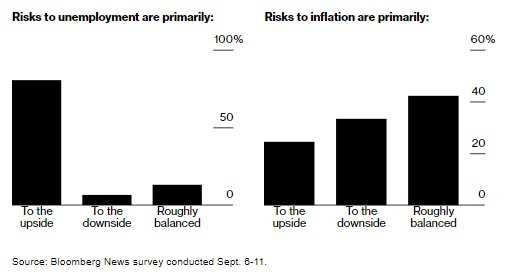

With growing concerns about a rise in the unemployment rate and a slowdown in hiring, the pace of rate cuts is also accelerating. This strengthens the argument for normalization of policy to start now, as inflation has not yet fully dropped to the Fed's 2% target. Economists generally expect that the median forecast for the unemployment rate by Fed policymakers this year will rise from 4% in June to 4.3%, and 80% of economists believe that the risk of unemployment is mainly upward.

With concerns intensifying about the slowdown in hiring and the rise in the unemployment rate, the pace of rate cuts is also accelerating. This strengthens the argument for normalizing policy now, as inflation has not yet fully reached the Fed's 2% target. Economists generally expect that the median forecast for the unemployment rate by Fed policymakers for this year will rise from 4% in June to 4.3%, and 80% of economists believe that the risk of unemployment is mainly upward.

Despite growing concerns about the labor market, more than three-quarters of respondents believe that the US economy may continue to grow in the next 12 months. Economists expect the latest quarterly forecasts from Federal Reserve officials to maintain expectations of economic growth, but inflation and core inflation expectations may slightly decline. Respondents have different views on inflation risks, with some believing that the risks are biased upward and others believing they are biased downward.

Federal Reserve Chairman Jerome Powell recently hinted at a conference in Jackson Hole, Wyoming that he and his colleagues may cut interest rates at the September meeting. He emphasized that further weakness in the labor market is "unwelcome".

However, some policymakers are concerned that once rate cuts begin, inflation may reignite, thus advocating for a more gradual approach to policy normalization. In recent years, inflation in the real estate market has been a key factor driving up overall prices, although there are currently no significant signs of cooling. This has raised concerns among some people who believe that lowering interest rates may further stimulate economic activity and even lead to further price increases.

The pace of rate cuts by the Federal Reserve sparks debates: Gradual or aggressive?

In the formulation of monetary policy, the term "gradual" has been used by some decision-makers to describe their expectations for the pace of rate cuts, but this concept is interpreted differently by different individuals. In a recent survey, more than half of economists believed that gradual rate cuts mean a 25 basis point reduction at each policy meeting, while 27% of respondents believed that rate cuts would continue at each meeting. Based on the median forecasts of these economists, the central bank may reduce interest rates to 3% during the current rate-cutting cycle.

Although most economists expect next week's policy decision to be unanimous, there is still a 16% chance of dissenting voices in favor of larger rate cuts. Dissent has been rare during Jerome Powell's tenure as Federal Reserve Chairman, and if regional Federal Reserve Bank presidents dissent, it will be the first time since 2022, when the Fed began quick rate hikes to curb demand. Even rarer, if a member of the Board of Governors or the Chairman opposes rate cuts, it will be the first time since 2005.

Economists have different views on how the Federal Reserve will communicate its policy action next week. While most expect the Fed to take a more dovish stance in the post-meeting statement, focusing more on employment issues, there is disagreement on how policymakers will signal future actions.

About 44% of respondents expect that Federal Reserve officials will adjust their statement to acknowledge potential policy adjustments in the future; 31% believe they will explicitly state their intention to continue reducing interest rates and may provide guidance on the pace of rate cuts. Meanwhile, one-fifth of economists believe that the Federal Reserve will not change its guidance on future policy adjustments.

Gus Faucher, chief economist at PNC Financial Services Group, said, 'The statement is expected to acknowledge the slowdown in job growth and rise in the unemployment rate, but also note that the labor market overall remains at full employment.' He added, 'The statement will also emphasize that the Federal Reserve does not want to see further weakness in the labor market.'

Will the Federal Reserve cut interest rates as expected by the market in this meeting? What impact will it have on the stock market? Welcome mooer to make an appointment to watch the September FOMC interest rate meeting~

Editor/ping

BMO资本市场的首席美国经济学家斯科特·安德森表示,他预计美联储将降息,并可能在即将召开的会议上暗示一系列进一步的降息措施,以减少货币政策的紧缩效应。

BMO资本市场的首席美国经济学家斯科特·安德森表示,他预计美联储将降息,并可能在即将召开的会议上暗示一系列进一步的降息措施,以减少货币政策的紧缩效应。