As concerns about the decline of the US economy intensify, the attractiveness of gold as a safe haven asset increases.Its price has soared to a historic high, closely related to market expectations of interest rate cuts by the Federal Reserve.However, even if the Federal Reserve takes unexpected action, gold may prove to be a comprehensive tool for hedging risks.

According to the Economic Intelligence APP, as concerns about the decline of the US economy intensify, the attractiveness of gold as a safe haven asset increases, pushing its price to a historic high, which is closely related to market expectations of interest rate cuts by the Federal Reserve.

However, even if the Federal Reserve takes unexpected action, gold may prove to be a comprehensive tool for hedging risks. Brien Lundin, editor of the 'Gold Newsletter', pointed out that when the Federal Reserve actually cuts interest rates or approaches decision day, there may be a risk of 'buying the expectation, selling the fact' in the market. However, the allocation of gold in global investment portfolios is increasing, because whether the Federal Reserve gradually cuts interest rates or makes emergency cuts during an economic downturn, gold has the opportunity to perform well.

On Thursday, even as the stock market fell and the US dollar rose, gold continued to rise. Subsequently, as the stock market rebounded and the US dollar index declined, gold continued to rise. Lundin said that this indicates that gold has established itself as a hedge tool for 'whatever happens next'.

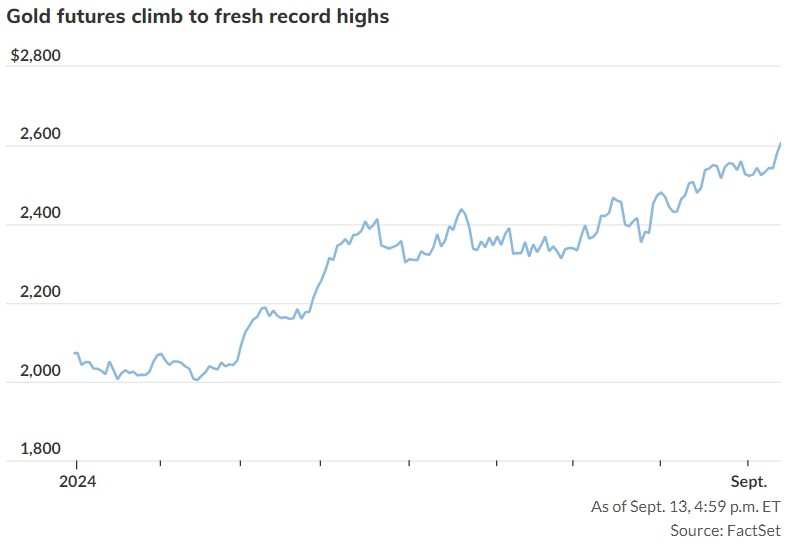

On Friday, the December delivery gold futures rose $30.10, or 1.2%, to close at $2,610.70 per ounce, reaching a historic high of $2,614.60 during trading. Last week, gold prices rose by 3.4%, marking the 34th historic high this year.

Currently, the short-term driving force of the gold price comes from the momentum in the Western market, especially under the expectation of an interest rate cut in the United States. Joe Cavatoni, Senior Market Strategist at the World Gold Council, stated in his comment on Thursday that the Federal Reserve will announce its monetary policy decision next Wednesday. As of Friday morning, the CME FedWatch tool shows a 57% probability of a 25 basis point rate cut at the Fed meeting next week, with a 43% probability of a 50 basis point rate cut. Lower interest rates typically help support gold, which has no interest income.

Cavatoni believes that although the market's expectation of an interest rate cut has already been reflected in the rise in gold prices, this impact has not yet been fully realized. He expects that an interest rate cut may drive gold prices further up in the coming weeks and lead to an increase in investor demand.

Diversity of gold demand

Cavatoni pointed out that as a global asset, the World Gold Council has always been concerned about "all forms of gold demand", especially when gold prices reach new highs, these demands may be changing.

He stated that the Council is closely monitoring the flow of jewelry demand in Asia to observe the performance of investment demand in the region. At the same time, it is also evaluating other demand factors from Western investors, including the potential increase in uncertainty from upcoming elections and gold as a tool to hedge "unexpected risk events".

Globally, central bank demand remains the main driving force behind gold demand, with purchases in 2022 and 2023 reaching the highest level in 14 years. This also reflects people's ongoing concerns about dollar-based assets and inflation.

In addition to central bank demand, traders seem to have a stronger preference for certain forms of gold investment. Adrian Ash, Research Director at BullionVault, pointed out that the activity in the gold market is currently mainly focused on speculative trading of derivative contracts rather than physical gold. Users of the platform have recently chosen to take profits when the gold price reached a historical high, while coin dealers have been inundated with second-hand products.

According to Ash, trading volume of gold futures contracts on the CME derivatives exchange surged by over 26% on Thursday, while trading volume of gold options contracts skyrocketed by 80%. Meanwhile, the world's largest gold-backed ETF - SPDR Gold Trust fund - grew by 0.9% in September.

Despite a 14% increase in demand for gold on the BullionVault platform in the last 24 hours, the selling volume surged by 298%, leading to a net clearing close to 0.1 metric tons. Ash believes that investors chose to take profits in gold against the US dollar, euro, and British pound reaching historic highs, primarily due to lack of leverage trading and market fear, with gold rising more on the expectation of a Fed rate cut rather than geopolitical tensions.

However, Ash also acknowledges that 'geopolitical conflicts and tensions are supporting the upward trend of gold'. This is mainly due to continued demand for gold from emerging market central banks, but what currently drives gold to record highs is speculative behavior regarding the expected Fed rate cut.

Ash warns that if the Fed disappoints the market at next Wednesday's policy meeting, whether in the decision itself or the new dot plot forecasts, it may provide an opportunity for long-term investors expecting a pullback, potentially leading to a correction.