Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like China XD Electric (SHSE:601179). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Quickly Is China XD Electric Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that China XD Electric's EPS has grown 35% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that China XD Electric's revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. The music to the ears of China XD Electric shareholders is that EBIT margins have grown from 2.4% to 4.5% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that China XD Electric's revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. The music to the ears of China XD Electric shareholders is that EBIT margins have grown from 2.4% to 4.5% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

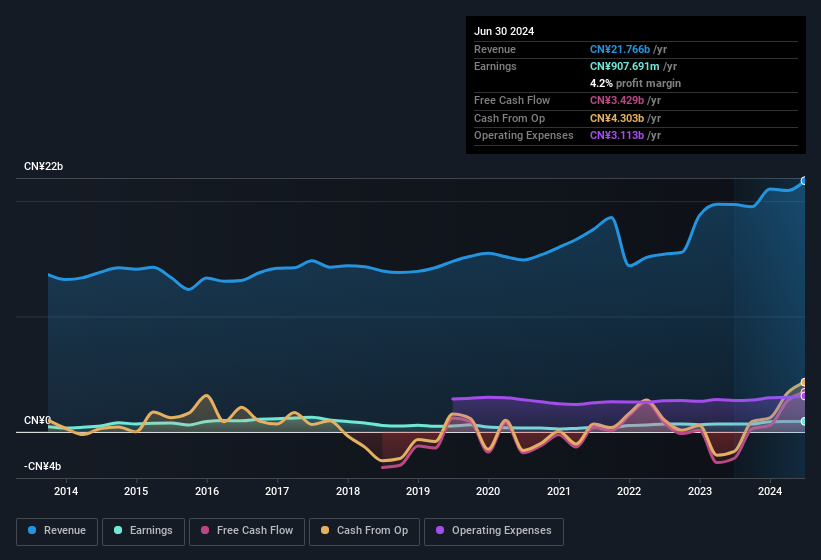

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for China XD Electric?

Are China XD Electric Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to China XD Electric, with market caps between CN¥28b and CN¥85b, is around CN¥2.2m.

China XD Electric's CEO took home a total compensation package of CN¥1.1m in the year prior to December 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does China XD Electric Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into China XD Electric's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. However, before you get too excited we've discovered 1 warning sign for China XD Electric that you should be aware of.

Although China XD Electric certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.