Dazhong Transportation (Group) Co., Ltd. (SHSE:600611) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 116% in the last twelve months.

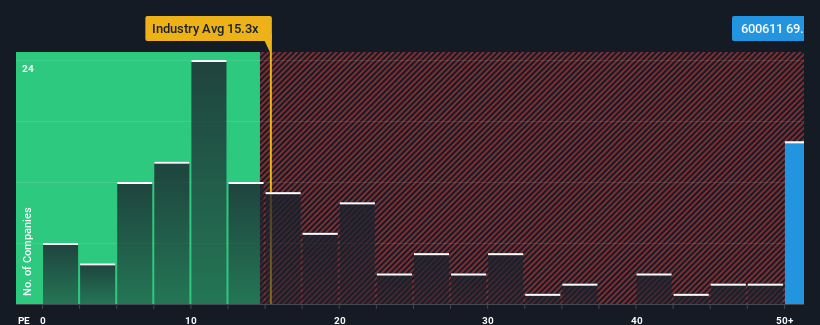

Even after such a large drop in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 26x, you may still consider Dazhong Transportation (Group) as a stock to avoid entirely with its 69.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Dazhong Transportation (Group) has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For Dazhong Transportation (Group)?

In order to justify its P/E ratio, Dazhong Transportation (Group) would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Dazhong Transportation (Group) would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 72%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 65% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Dazhong Transportation (Group)'s P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Dazhong Transportation (Group)'s P/E?

Dazhong Transportation (Group)'s shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Dazhong Transportation (Group) revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Dazhong Transportation (Group) (2 don't sit too well with us) you should be aware of.

You might be able to find a better investment than Dazhong Transportation (Group). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.