On September 12, 2024, Future Vision II Acquisition Corp. (referred to as "Future Vision II") successfully listed on the NASDAQ in the United States, with the stock code FVNNU.

Future Vision II issued 5 million shares of stock at a price of $10 per share, and has provided underwriters with up to 0.75 million shares of over-allotment option. The common stock and rights offering of Future Vision II have the stock codes "FVN" and "FVNNR" respectively on NASDAQ.

On the first day of listing, FVNNU opened at $10.01 per share and closed at $10 per share, with a total market value of approximately $65.84 million.

Stock price trend on the first day of listing, source: East Money Information

Stock price trend on the first day of listing, source: East Money Information

Future Vision II was established on January 30, 2024, registered in the Cayman Islands as a tax-exempt company, and the business addresses of its major shareholders are all in Shanghai. The company is a special-purpose acquisition company (SPAC), also known as a blank check company, whose business purpose is to merge, exchange shares, acquire assets, purchase shares, restructure, or similar business combinations with one or more companies or entities.

The company's management team is led by Xiaodong Wang as CEO and Chairman, and Caihong Chen as CFO and Director.

Xiaodong Wang resides in Beijing, China. He holds a bachelor's and master's degree in chemistry from Tsinghua University, as well as an EMBA from Peking University Guanghua School of Management. He has over 25 years of experience in asset management and has served as an executive in Tsinghua Holdings Co., Ltd., an investment platform under Tsinghua University, and other companies. The total assets managed during his career exceed $2 billion.

Caihong Chen has nearly 25 years of investment and banking experience. She is currently the General Manager of Increase Family Office and has previously served as an executive at CITIC Trust Co., Ltd. and China Construction Bank.

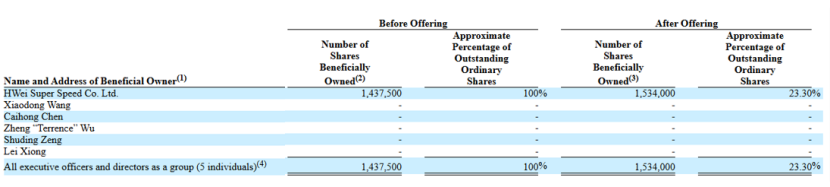

Before this issue, the founding team held 100% of the shares; after the issue is completed, the founding team's stake will be diluted to 23%.

Shareholder situation of the company, source: prospectus

Future Vision II is a newly established company that has not conducted any business or generated any revenue. As of June 30, 2024, the company's total assets are $51.2153 million, total liabilities are $0.75 million, the face value of convertible/redeemable common stock is $45.7506 million, and shareholder equity is $4.7147 million.

Major financial data of the company, source: prospectus

Special Purpose Acquisition Company (SPAC) is essentially a form of private equity investment product. It is typically initiated by an experienced financial management team and professional investors, and exists in the form of a 'cash shell company'. After the establishment of the SPAC company, it will conduct an initial round of financing and listing on the U.S. stock market through an initial public offering (IPO), and use the raised funds to acquire eligible target companies with potential for listing, and merge with them to help the target companies achieve listing on exchanges such as NYSE and NASDAQ, and realize exit profits through the capital appreciation of the acquired companies.

The goal of Future Vision II is to invest in companies in the TMT industry and related technology fields that have or will have a large target market, including but not limited to companies that provide advanced and highly differentiated solutions for the TMT industry, such as smart chips, 5G, integrated circuits, and other digital transformation technologies.

TMT companies have had a significant and growing impact on the world, and many companies have achieved great success in the past decade. The landscape of the TMT industry has undergone major changes, with transaction-driven factors pointing to trends such as the AI boom, hybrid cloud computing, and cybersecurity.

In 2023, generative AI suddenly emerged, and the ability of AI to create images, videos, code, and text has led TMT companies to upgrade their software and services to adopt generative AI. A research report released by Deloitte in 2024 predicts that almost all enterprise software companies will embed generative AI in their products this year, resulting in a revenue growth of $10 billion for enterprise software companies.

Meanwhile, the semiconductor industry, which has powered every generation of microchips for the past 50 years, is preparing for the next evolution of TMT. With the widespread adoption of 5G and Internet of Things (IoT) devices in the market, the demand for high-performance and reliable semiconductor chips is also increasing.

Due to the company's future investment focus on the TMT industry, a recent domestic regulation requires companies listed overseas to undergo cybersecurity reviews before collecting or holding a large amount of data. This will significantly strengthen the regulation of Chinese internet giants.

According to relevant regulations, companies that hold more than 1 million user data must apply for cybersecurity approval when applying for listing in other countries due to concerns that such data and personal information may be "influenced, controlled, and maliciously exploited" by foreign governments. Therefore, the company may face certain policy risks in the future.

For example, if a potential target for the company's initial business merger is a company operating in China and the Chinese government requires a cybersecurity review and other specific actions for the potential target company, such as a company operating in China with at least 1 million users' personal data, the company may not be able to determine whether it can obtain such approval in a timely manner, resulting in investment obstacles.

上市首日股价走势,来源:东方财富

上市首日股价走势,来源:东方财富