Even if we ignore this 'incident', Kangji Medical's stock price has not shown any improvement since the release of the 2024 interim report on August 20, which is far from the performance of a nearly 15% increase in stock price after the release of the 2023 annual report in the first half of the year. This may be due to the changing views of investors on the market increment space in this field and the growth curve of enterprise valuation within the race track, faced with the continuous national low-value consumables group procurement.

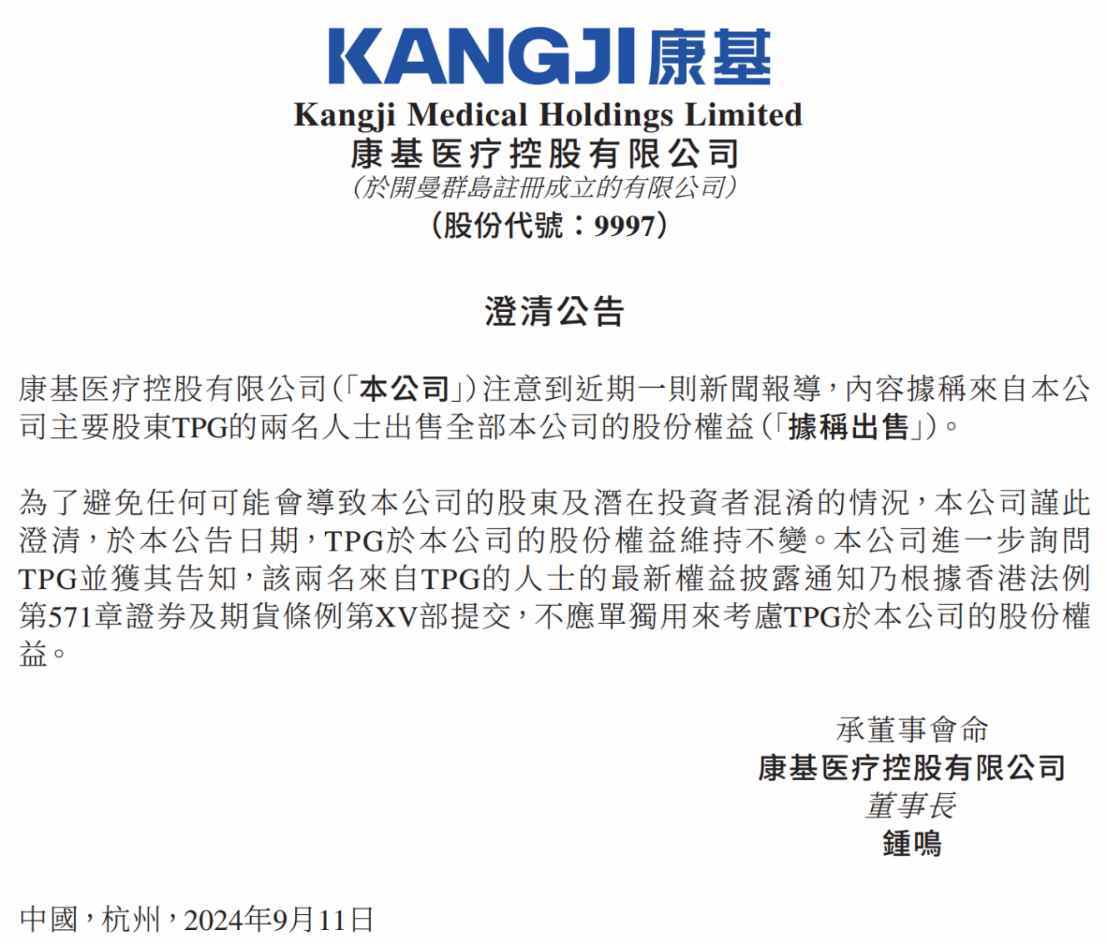

In September, Kangji Medical (09997) experienced a 'six consecutive decline' in the secondary market. The company's stock price, after 6 consecutive trading days of decline, hit a bottom of HKD 4.91 on September 11, from a closing price of HKD 5.79 on August 30, giving up all the gains since mid-February this year. On the same night, Kangji Medical urgently issued a clarification announcement stating, 'As of the date of this announcement, TPG's shareholding in the company remains unchanged.'

It was only after the company released the announcement that many investors realized the sudden plunge in the stock price.

The reason for the market sentiment fluctuation of Kangji Medical this time is that there are reports in the market that TPG, as a major shareholder of Kangji Medical, 'sold' all of its holdings in Kangji Medical (see the figure below) in the Hong Kong stock disclosure information inquiry on Yiguan website.

The reason for the market sentiment fluctuation of Kangji Medical this time is that there are reports in the market that TPG, as a major shareholder of Kangji Medical, 'sold' all of its holdings in Kangji Medical (see the figure below) in the Hong Kong stock disclosure information inquiry on Yiguan website.

According to the smart financial news app, TPG is currently Kangji Medical's largest institutional shareholder, with a stake of 17.86%. If TPG chooses to liquidate all of its holdings in the company, it will obviously have a serious negative impact on Kangji Medical's stock price and market cap. However, according to Kangji Medical's clarification announcement, this is an internally adjusted compliance disclosure by TPG and does not involve any share transactions of TPG in Kangji Medical.

After releasing a clarification announcement on September 11th, kangji medical's stock price has rebounded significantly on the following two trading days, with gains of 4.39% and 2.49% respectively, and the stock price has returned to around HKD 5.5.

However, even ignoring this "incident", kangji medical's stock price has been lackluster since the release of the 2024 interim report on August 20th, far from the performance of a nearly 15% increase in the stock price after the release of the 2023 annual report in the first half of the year. The reason behind this may lie in the changing views of investors on the market incremental space and the valuation growth curve of companies in this field, as a result of the continuous influx of national low-value consumables central procurement.

Accelerate the layout and investment in high-value consumables.

On August 20th, kangji medical disclosed its 2024 interim report. The financial report shows that kangji medical achieved an income of 458 million yuan for the period, a year-on-year increase of 13.6%; the gross margin was approximately 363 million yuan, a year-on-year increase of 12.9%; the net profit attributable to shareholders of the parent company was approximately 286 million yuan, a year-on-year increase of 11.9%.

If we take the company management's statement at the 2023 earnings conference that "the company's revenue growth expectation for the next three years is 20-25%" as the benchmark, the revenue growth rate of kangji medical in the first half of this year can only be described as lackluster. In addition, the difference between the revenue growth rate and the gross margin growth rate also indicates that the company has experienced some growth in costs.

According to the Zhitong Finance APP, as a leader in the domestic field of disposable consumables for minimally invasive surgery, kangji medical mainly provides one-stop solutions for minimally invasive surgery in clinical departments such as obstetrics and gynecology, general surgery, urology, and thoracic surgery by continuously delivering R&D pipelines and enriching product portfolios. Its product line covers a variety of minimally invasive surgical instruments, such as disposable trocar puncture, polymer ligating clips, disposable electrocoagulation forceps, other repetitive products, ultrasonic hemostatic knives, 4K endoscopic imaging systems, and other disposable products.

Among them, disposable trocar puncture and ligating clips are the core sources of the company's revenue, accounting for a combined proportion of 44.84% in the current period. In terms of revenue growth rate, the current growth rates of the two are only 12.9% and 4.5% respectively. The slowdown in the growth rate of ligating clips is likely due to the impact of the national joint procurement in July this year, and there is a heavy channel wait-and-see sentiment in the first half of the year. In contrast, the revenue growth rates of the company's ultrasonic knives and staplers have increased significantly by 90.2% and 1115.7% respectively, indicating that kangji medical has accelerated the market penetration of these two product categories in the current period.

Because it belongs to high-value consumables compared to disposable catheters and polymer ligation clips, such as the company's ultrasonic knife gross margin is only about 50%, the main reason is the increase in labor and production costs. The production difficulty determines the cost, which also makes the company's revenue cost increase by 16.44% year-on-year.

From the perspective of expenses, the company's current sales expenses and management expenses are 39.062 million yuan and 50.854 million yuan, respectively, with a year-on-year growth rate of 20.12% and 11.96%, while the R&D expenses, although decreased by 27.8% to 43.354 million yuan on the books, considering the company's financial disclosure situation due to the cancellation of the merger between Kangji Medical and Wei Jing Medical during the reporting period, the actual R&D expenses of Kangji Medical increased by 17.1% year-on-year.

Although most of the bearish pressure faced by the domestic MISIA market comes from the risk of price reduction in the large-scale segmented product market, it is not very significant for Kangji Medical.

From a deeper perspective, on the one hand, Kangji Medical mainly adopts a sales model with dealers as the main channel and centralized procurement as a supplement. In 2023, the revenue from the dealer channel accounted for more than 80%, and the current terminal price of minimally invasive surgical devices and consumables is about 4-5 times the ex-factory price, which provides enough space for the company to give benefits to dealers and stabilize the channel, thereby minimizing the impact of centralized procurement price reduction.

On the other hand, from the perspective of industry competition, in the Chinese MISIA market in 2019, Medtronic ranked first with a market share of 41.2%. Kangji Medical had only 2.7% at that time, and only 3.1% in 2021, showing a large gap. In this regard, the company predicts in the financial report that the price-for-volume strategy of centralized procurement is expected to accelerate domestic substitution and increase the company's market share.

However, what investors see in the financial report is not only the stable growth and market share in the low-value consumables field, but also the acceleration of Kangji Medical's development towards high-value consumables.

Moving towards high-end, moving towards overseas.

As mentioned earlier, as a leading domestic medical device manufacturer, Kangji Medical can fully rely on its own market channel construction and first-mover advantage to establish a moat. However, under the logic of centralized procurement, from the company's perspective, the continuing internal competition will only continue to squeeze profit margins, and the overall market's value-added space will also be greatly reduced. Therefore, while consolidating the low-value consumables base, Kangji Medical urgently needs to seek the next incremental market.

There are two directions facing Kangji Medical now, one is to accelerate the transformation of products from low-value consumables to high-value consumables with higher innovation power, and the other is to break the internal competition in the domestic market and export products to overseas markets. These two directions are not mutually exclusive, but require Kangji Medical to make efforts simultaneously.

Investors can clearly see from Kangji Medical's recent financial reports that the company is accelerating its development towards high-value consumables such as ultrasonic scalpels, staplers, and endoscopes. However, resistance also comes along. Firstly, its financial structure, based on low-value consumable products, with a 'low R&D, low capital expenditure' and high gross and net margin, is somewhat affected. Compared with domestic enterprises that mainly operate ligating clips and hemostatic clips, the gross margin is generally 70-85%, and the net margin is 25-40%. As one of the leaders in the industry, Kangji Medical's excellent financial data has always been the reason why it attracts investors' attention in the secondary market. However, entering the high-value consumables market undoubtedly means 'breaking the comfort zone'.

As mentioned above, products like ultrasonic scalpels and endoscopes are constrained by manual and production process costs, resulting in naturally lower gross margin. As the company accelerates its layout and promotion, it will continue to lower its overall gross margin level.

However, there are pros and cons to moving towards high value. For example, at the end of 2020, Kangji Medical obtained the domestic registration certificate for its stapler, which brought an incremental market of 12 million by 2023. According to the 2023 annual report, by the end of 2023, Kangji Medical had a total of 92 products registered with the National Medical Products Administration (NMPA) in China, and the company's technological barriers have also been steadily established.

Compared to the domestic market, the overseas market seems to be more appealing to Kangji Medical. According to the previously disclosed 2023 financial report, Kangji Medical's major investments in the overseas market are mainly in two areas: increasing overseas market registrations and increasing the output of its own brand.

In 2023, Kangji Medical had 22 products registered in overseas markets such as Central and South America and Southeast Asia; while increasing its registration investments, Kangji Medical is also gradually increasing the output of its own brand. In the past, the export of minimally invasive surgical products by domestic companies was mainly OEM-based, with few independent brands, and domestic brands did not establish brand recognition in the global market. Although Kangji Medical's previous layout for the overseas market was also mainly OEM-based, it is now gradually adjusting its layout. In 2023, its overseas dealer channel revenue increased by 67.3% year-on-year, far exceeding that of ODM customer channels.

According to the latest financial report, in the first half of this year, Kangji Medical has launched overseas customer structure optimization work, and the number of countries and regions covered by its products has increased to 69, an increase of 22 compared to the same period last year; the company has obtained a total of 141 overseas customers, with an increase of 43 compared to the same period last year. During the reporting period, the company added 11 overseas registrations, some of which were registered through OEM customers and dealers.

However, Kangji Medical's steps in going global seem to be somewhat conservative. Compared with its peer company Anges, its overseas revenue in 24H1 reached 0.138 billion RMB, a year-on-year increase of 35.3%, accounting for 52% of the total revenue. In contrast, Kangji Medical's target is for overseas revenue to account for 15% of total revenue in the next three years. Perhaps compared to going global, Kangji Medical is more focused on stabilizing its domestic market.

此次康基医疗出现市场舆情波动原因在于,市场有消息称在港股披露易官网查询到TPG作为康基医疗主要股东“出售”了其持有的康基医疗全部股份(见下图)。

此次康基医疗出现市场舆情波动原因在于,市场有消息称在港股披露易官网查询到TPG作为康基医疗主要股东“出售”了其持有的康基医疗全部股份(见下图)。