Altice USA, Inc. (NYSE:ATUS) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

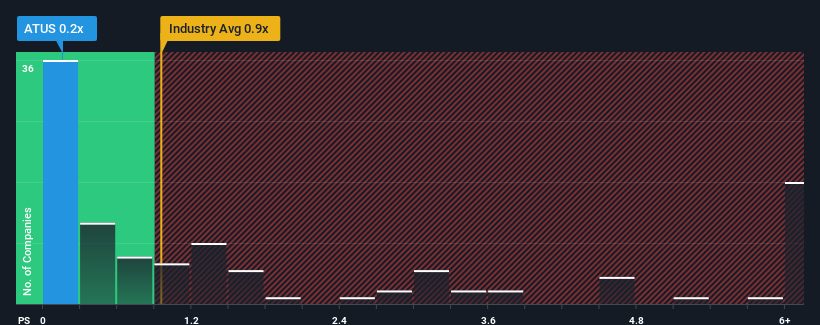

Even after such a large jump in price, Altice USA may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Media industry in the United States have P/S ratios greater than 0.9x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Altice USA Performed Recently?

While the industry has experienced revenue growth lately, Altice USA's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Altice USA will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Altice USA's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Altice USA's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 8.6% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.5% per year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 5.0% per annum, which paints a poor picture.

With this in consideration, we find it intriguing that Altice USA's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Altice USA's P/S

The latest share price surge wasn't enough to lift Altice USA's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Altice USA's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Altice USA (of which 2 are significant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.