Should we focus on sales volume or profit? Li Xiang, the ideal, is torn.

By Zhang Jun, Sina Technology

From the high-speed growth of 2023 to the braking this year, MEGA has become a watershed for the development of Li Auto Inc.

The second quarter financial report recently released by Li Auto Inc. showed further slowdown in revenue growth and a significant decline in net income. The aftershocks of the MEGA crisis are still ongoing. Overall, Li Auto Inc. mitigated the impact of the MEGA setback on sales volume through the Li Xiang L6. However, the relatively low-priced Li Xiang L6 also had some side effects, with the vehicle gross margin of Li Auto Inc. falling to 18.7% in the second quarter of this year, below the 20% red line set by Li Xiang.

The second quarter financial report recently released by Li Auto Inc. showed further slowdown in revenue growth and a significant decline in net income. The aftershocks of the MEGA crisis are still ongoing. Overall, Li Auto Inc. mitigated the impact of the MEGA setback on sales volume through the Li Xiang L6. However, the relatively low-priced Li Xiang L6 also had some side effects, with the vehicle gross margin of Li Auto Inc. falling to 18.7% in the second quarter of this year, below the 20% red line set by Li Xiang.

This year, Li Auto Inc. has lowered its annual sales target from the initial 0.8 million vehicles to the current 0.5 million vehicles. In the future, Li Auto Inc. will face two major variables: whether the pure electric vehicle models, delayed until next year, will be accepted by consumers; and the competition with the strongest competitor, Huawei Hongmong Intelligent Drive.

After the setback of MEGA, the L6 came to the rescue.

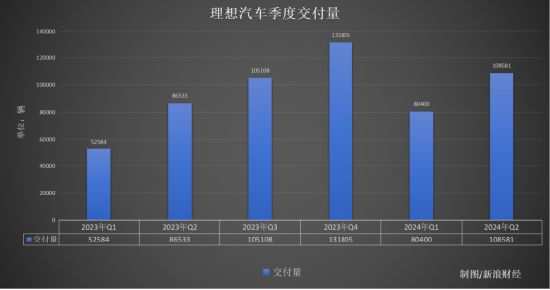

In the second quarter of 2024, li auto inc delivered a total of 108,581 vehicles, a year-on-year increase of 25.5%. Although still achieving year-on-year growth, the growth rate has declined compared to before. For example, in the first quarter of 2024, li auto inc delivered a total of 80,400 vehicles, a year-on-year increase of 52.9%.

Behind the slowdown in sales growth is the "aftermath" of the previous failure of ideal MEGA.

In March of this year, li auto inc launched its first pure electric MPV model, ideal MEGA. Although Li Xiang had high expectations for it, the car sparked public opinion controversies about its appearance as soon as it was launched, which also affected the sales of this model.

In fact, ideal MEGA was originally the first pure electric product launched by li auto inc this year. Ideal initially planned to launch 8 products in 2014, 4 of which were extended-range models and 4 were pure electric models. Li Xiang even set the goal of "challenging to deliver 0.8 million vehicles in the challenge year and achieve the goal of being the top-selling luxury car brand in the Chinese market."

But the public opinion controversies surrounding ideal MEGA completely disrupted the layout rhythm of ideal's pure electric products, forcing a reconsideration and readjustment of this year's strategic rhythm.

In late March, Li Xiang sent an internal memo to all employees, admitting a misjudgment in grasping the market pace, "We mistakenly treated the phase from 0 to 1 of MEGA as if it were the phase from 1 to 10 in operation". This led to a significant reduction in the sales team's focus on the L series, affecting the service and sales of the main model ideal L8.

Subsequently, ideal initiated several major measures. First, it postponed the launch of pure electric products; secondly, in April of this year, it launched ideal L6, with a starting price of 2.498 million yuan, also the first model under li auto inc priced below 3 million yuan; then, in April, ideal officially reduced prices for all its models by 180,000 to 300,000 yuan, compensating owners who purchased the new models before the price reduction by making up the difference.

In February-April this year, li auto inc's monthly delivery volume ended its previous high-speed growth and dropped below 0.03 million vehicles. Among them, in April this year, the monthly delivery volume almost did not increase. However, after the launch of li auto inc's L6 and the overall price reduction, starting from May this year, the monthly delivery volume of li auto inc began to return to a high-speed growth track.

However, the delay in the delivery of pure electric vehicle models has greatly affected li auto inc's expectations for overall delivery volume this year. At first, in March of this year, li auto inc lowered its annual sales volume guidance from 0.8 million vehicles to 0.56 million-0.64 million vehicles. In the financial report conference call for the second quarter of this year, li auto inc CFO Li Tie stated that if the passenger vehicle market develops healthily in the second half of this year, he is confident of achieving the delivery of 0.5 million vehicles for the whole year.

It is difficult to balance sales volume with profit.

However, although the launch of li auto inc L6 has boosted li auto inc's sales volume, it has also affected its profit level.

In the second quarter of this year, li auto inc's total revenue was 31.7 billion yuan, an increase of 10.6% year-on-year; but the net profit was 1.1 billion yuan, a decrease of 52.3% year-on-year. Without considering the US GAAP, the net profit was 1.5 billion yuan, a decrease of 44.9% year-on-year.

In comparison, in the first quarter of this year, li auto inc's total revenue was 25.6 billion yuan, a year-on-year increase of 36.4%; the net profit was 0.5911 billion yuan, a year-on-year decrease of 36.7%. Without considering the US GAAP, the net profit was 1.3 billion yuan, a year-on-year decrease of 9.7%.

This means that in the second quarter of this year, li auto inc's revenue growth rate has dropped significantly, and the decline in net profit has further expanded.

It is worth noting that in the first half of this year, the operating profit of Li Auto also changed from a profit of 2.031 billion yuan in the first half of 2023 to a loss of 1.168 billion yuan in the first half of this year. Fortunately, Li Auto's interest income and investment income increased significantly to 1.439 billion yuan in the first half of this year, which to some extent saved its net income.

Previously, Li Xiang stated that as a smart electric vehicle company, a gross margin of 20% is the threshold for the healthy development of the company. However, in the first quarter and second quarter of this year, Li Auto's vehicle gross margin has been below this threshold set by Li Xiang for two consecutive quarters.

Li Auto CFO Li Tie stated that under the product portfolio, it is expected that the vehicle gross margin in the third quarter will continue to rise to about 19%, and the company's total gross margin will be around 20%.

Uncertainty of pure electric vehicle models

Several pure electric vehicle models that were originally planned to be launched this year have been postponed to next year by Li Auto.

Earlier, the exterior spy photos of Li Auto's pure electric vehicle models were exposed, and it seems that there has not been a significant change in appearance, still maintaining the style of Li ONE. However, there is still uncertainty as to whether this will be accepted by consumers.

Li Xiang said that for pure electric SUVs, Li Auto needs to solve two problems next: one is the design of the product's appearance, and the other is to provide users with more than 2000 super charging stations when delivering pure electric products. "So, we are very confident in the competitiveness of pure electric SUVs. We hope that after about two years, Li Auto can enter the first echelon of high-end pure electric products."

Li Auto Inc. President Ma Donghui revealed that the overall research and development progress of pure electric vehicles is normal, with multiple small-scale sample production completed. In terms of test validation, including high-temperature and high-humidity, quality durability, and other related tests and performance evaluations, have been completed according to the calibration and test verification plan. In terms of capacity preparation in the industry chain, overall progress is also normal. The capacity plan of pure electric vehicles can meet the sales demand, and the production plant for manufacturing whole vehicles has been completed. The installation and commissioning of the four major production lines are underway.

Li Auto is also steadily advancing the layout of the charging network, which is also an important factor for the success of pure electric vehicles. According to the financial report, as of June 30, 2024, Li Auto has 614 super charging stations in operation in China, equipped with 2,726 charging piles.

In addition, there is another variable, which is Huawei Hongmong Zhixing. AskJie is currently the main sales support for Hongmong Zhixing, and AskJie's product line and price range are direct competitors to Li Auto.

Data shows that in the first half of 2024, Hongmong Zhixing delivered a cumulative total of 194,027 vehicles, while Li Auto delivered 188,981 vehicles. Hongmong Zhixing has surpassed Li Auto to become the best-selling new energy vehicle brand in China for the first half of the year.

Li Xiang admitted, "I think Hongmong Zhixing is our strongest competitor in the market." He also expressed that Li Auto's core attitude is to learn from Huawei's technology research and development system and operational management system for the long term and continuously.

Smart driving is one of the distinctive labels of Hongmong Zhixing. Huawei's Qiankun smart driving has been upgraded to version 3.0 and has launched Qiankun smart driving basic version to cover relatively low-priced models.

Li Auto is also expanding its layout in smart driving. At the previous Chengdu Auto Show, Li Auto focused on the latest progress and future planning of intelligent driving. Lang Xianpeng, Vice President of Intelligent Driving Research and Development of Li Auto, expressed in an interview that in terms of smart driving technology architecture, Li Auto is not much different from Tesla, and even more advanced. In terms of China's training computing power and training data, at least for now, Li Auto is ahead of Tesla, as Tesla is constrained in terms of data compliance.

However, from the user's perspective, Li Auto still needs to further strengthen the brand image in terms of smart driving.

理想汽车日前公布的第二季度财报显示,其营收增速进一步放缓,净利润也大幅下滑,理想MEGA风波的余震仍在持续。整体来看,理想汽车通过理想L6,弥补了理想MEGA失利对销量的影响。不过,相对低价的理想L6也带来了一定的副作用,今年第二季度理想汽车的车辆毛利率下降至18.7%,低于李想此前设定的20%的红线。

理想汽车日前公布的第二季度财报显示,其营收增速进一步放缓,净利润也大幅下滑,理想MEGA风波的余震仍在持续。整体来看,理想汽车通过理想L6,弥补了理想MEGA失利对销量的影响。不过,相对低价的理想L6也带来了一定的副作用,今年第二季度理想汽车的车辆毛利率下降至18.7%,低于李想此前设定的20%的红线。