Market Whales and Their Recent Bets on MSTR Options

Market Whales and Their Recent Bets on MSTR Options

Financial giants have made a conspicuous bullish move on MicroStrategy. Our analysis of options history for MicroStrategy (NASDAQ:MSTR) revealed 145 unusual trades.

金融巨头们对MicroStrategy采取了引人注目的看好举措。我们对MicroStrategy(NASDAQ:MSTR)的期权历史进行分析后发现了145笔不寻常的交易。

Delving into the details, we found 44% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 35 were puts, with a value of $2,123,015, and 110 were calls, valued at $14,926,000.

深入研究后,我们发现44%的交易者看涨,而40%的交易者显示出看淡倾向。在我们发现的所有交易中,有35笔看跌期权,价值为2,123,015美元,还有110笔看涨期权,价值为14,926,000美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.5 to $380.0 for MicroStrategy over the last 3 months.

考虑到这些合约的成交量和持仓量,最近3个月来,大户们一直将MicroStrategy的价格区间定在$10.5到$380.0之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

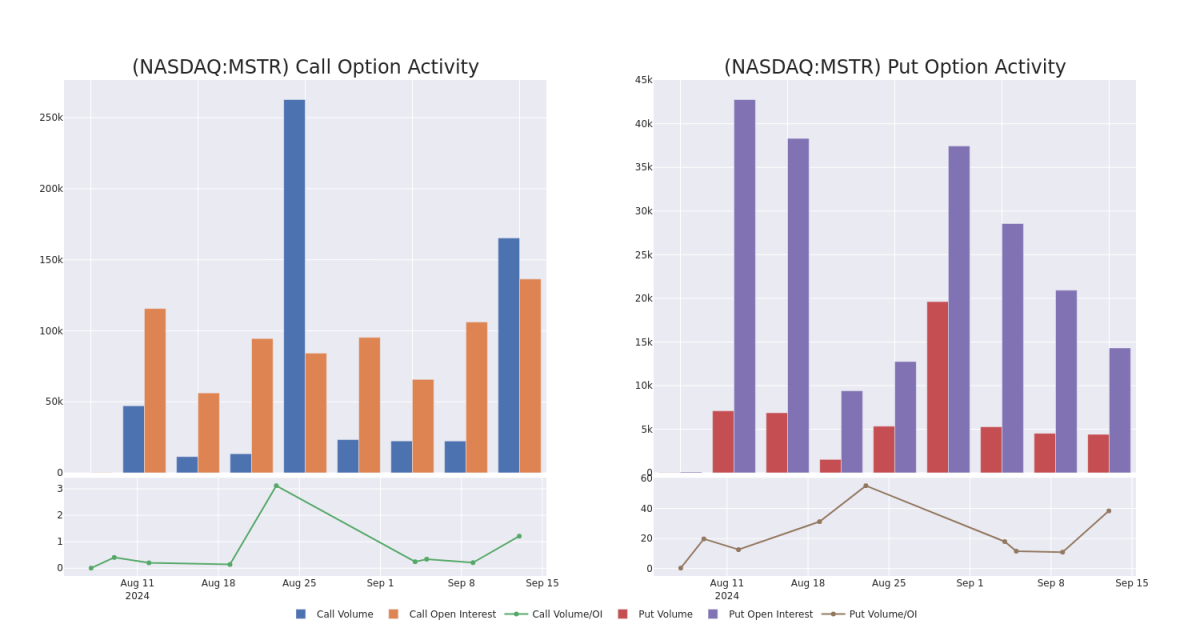

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for MicroStrategy's options for a given strike price.

这些数据可以帮助您跟踪给定行权价格的MicroStrategy期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy's whale activity within a strike price range from $10.5 to $380.0 in the last 30 days.

下面,我们可以观察MicroStrategy所有大户活动中近30天内$10.5到$380.0之间的行权价的成交量和持仓量的变化。

MicroStrategy Option Volume And Open Interest Over Last 30 Days

MicroStrategy在过去30天内的期权成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 01/17/25 | $34.55 | $34.1 | $34.41 | $123.00 | $1.7M | 43 | 501 |

| MSTR | CALL | SWEEP | BEARISH | 12/19/25 | $54.15 | $52.85 | $53.05 | $140.00 | $1.0M | 520 | 241 |

| MSTR | CALL | SWEEP | BEARISH | 12/19/25 | $53.65 | $52.65 | $52.73 | $140.00 | $358.3K | 520 | 632 |

| MSTR | CALL | SWEEP | BEARISH | 10/18/24 | $22.5 | $22.45 | $22.45 | $120.00 | $223.9K | 2.2K | 81 |

| MSTR | CALL | SWEEP | BEARISH | 12/19/25 | $54.15 | $52.85 | $53.04 | $140.00 | $196.2K | 520 | 294 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MicroStrategy | 看涨 | SWEEP | 看好 | 01/17/25 | $34.55 | $34.1 | 34.41美元 | $123.00 | $1.7M | 43 | 501 |

| MicroStrategy | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $54.15 | $52.85 | $53.05 | $140.00 | $1.0M | 520 | 241 |

| MicroStrategy | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $53.65 | $52.65 | $52.73 | $140.00 | 358.3千美元 | 520 | 632 |

| MicroStrategy | 看涨 | SWEEP | 看淡 | 10/18/24 | 22.5 | $22.45 | $22.45 | $120.00 | 223.9千美元 | 2.2K | 81 |

| MicroStrategy | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $54.15 | $52.85 | 53.04美元 | $140.00 | $196.2K | 520 | 294 |

About MicroStrategy

关于MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

MicroStrategy是一家企业分析和移动软件提供商。它提供MicroStrategy Analytics平台,通过移动设备或Web提供报告和仪表板,并使用户能够进行临时分析和分享见解;MicroStrategy Server提供分析处理和作业管理。该公司报告的经营部门从事通过许可安排和云订阅及相关服务的方式设计、开发、营销和销售其软件平台。

In light of the recent options history for MicroStrategy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于MicroStrategy的最近期权交易历史,现在适合关注公司本身。我们旨在探究其当前表现。

Present Market Standing of MicroStrategy

MicroStrategy的现在市场地位

- Trading volume stands at 7,277,458, with MSTR's price down by -4.28%, positioned at $135.41.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 44 days.

- 交易量为7,277,458,MSTR的价格下跌了-4.28%,位于$135.41。

- RSI指标显示该股票可能接近超买。

- 预计在44天后公布收益报告。

What The Experts Say On MicroStrategy

专家对MicroStrategy的评价

3 market experts have recently issued ratings for this stock, with a consensus target price of $171.0.

最近有3名市场专家对这只股票发表了评级意见,达成了171.0美元的一致目标价。

- Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for MicroStrategy, targeting a price of $173.

- An analyst from Barclays downgraded its action to Overweight with a price target of $146.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $194.

- 维持他们的立场,Canaccord Genuity的一位分析师继续持有对MicroStrategy的买入评级,目标价为173美元。

- 巴克莱银行的一位分析师将其评级下调至超配,目标价为146美元。

- Cantor Fitzgerald的一位分析师将其评级下调至超配,目标价为194美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的潜在利润。精明的交易者通过持续学习、策略性的交易调整、利用各种因子以及关注市场动态来减轻这些风险。通过Benzinga Pro,及时了解MicroStrategy的最新期权交易情况。