Top 3 Consumer Stocks Which Could Rescue Your Portfolio This Month

Top 3 Consumer Stocks Which Could Rescue Your Portfolio This Month

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

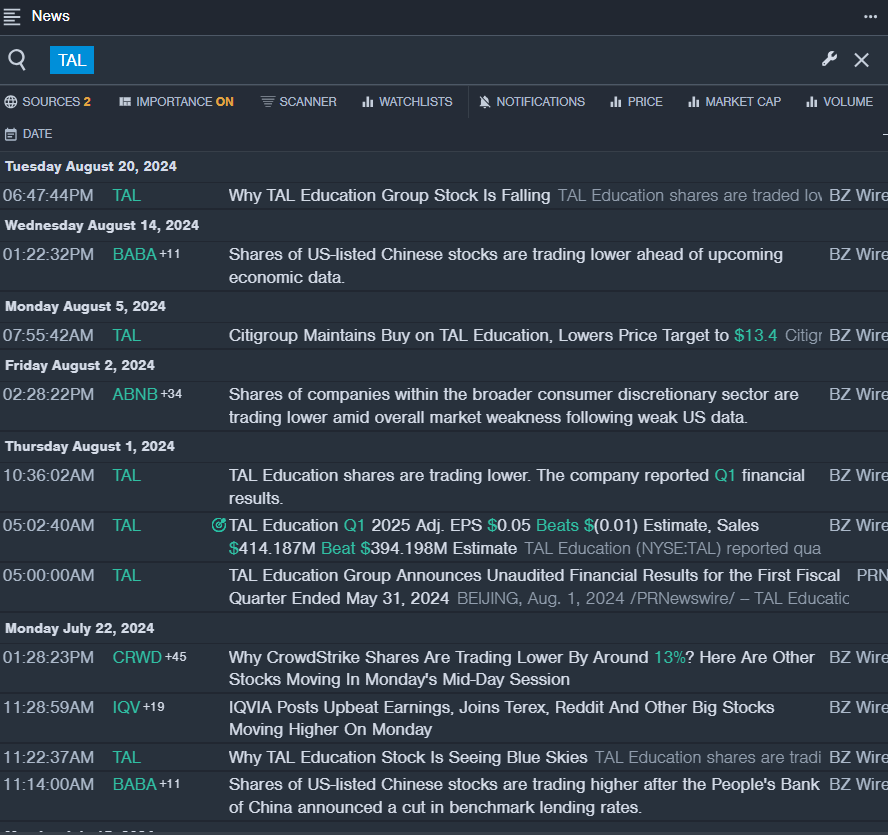

TAL Education Group (NYSE:TAL)

好未來集團 (NYSE:TAL)

- On Aug. 1, TAL Education posted upbeat quarterly results. "In this quarter, our core focus remains on delivering quality products and managing our online and offline operational efficiency to serve learners effectively," said Alex Peng, TAL's President and Chief Financial Officer. The company's stock fell around 18% over the past month and has a 52-week low of $6.81.

- RSI Value: 29.74

- TAL Price Action: Shares of TAL Education fell 0.1% to close at $7.42 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest TAL news.

- 8月1日,好未來發布了樂觀的季度業績。「在這個季度,我們的核心重點仍然是提供優質產品,並有效管理線上線下的運營效率,以有效地爲學習者提供服務,」好未來的總裁兼首席財務官Alex Peng表示。公司股價在過去一個月下跌了約18%,並且52周最低價爲6.81美元。

- RSI值:29.74

- 好未來股票價格走勢:上週一收盤價爲7.42美元,下跌了0.1%。

- Benzinga Pro的實時新聞提醒了最新的好未來消息。

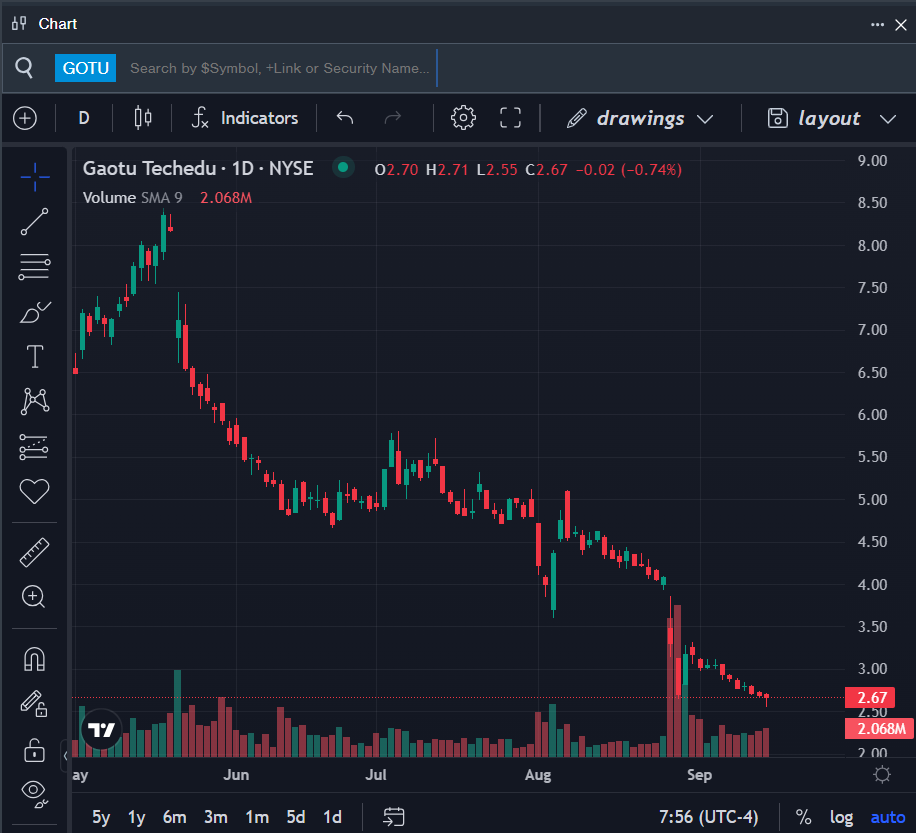

Gaotu Techedu Inc (NYSE:GOTU)

高途科技股份有限公司(紐交所:GOTU)

- On Aug. 27, Gaotu Techedu posted a wider-than-expected quarterly loss. Larry Xiangdong Chen, the Company's founder, Chairman and CEO, commented, "We achieved encouraging results in the second quarter, with net revenues increasing 43.6% year-over-year to RMB1.0 billion, reflecting strong accelerating growth momentum. As of June 30, 2024, our deferred revenue reached RMB1.6 billion, representing a 71.5% increase from the same point in time last year, ensuring robust support for our continued growth in the second half of the year." The company's stock fell around 39% over the past month. It has a 52-week low of $2.22.

- RSI Value: 27.21

- GOTU Price Action: Shares of Gaotu Techedu fell 0.7% to close at $2.67 on Monday.

- Benzinga Pro's charting tool helped identify the trend in GOTU stock.

- 8月27日,高途科技發佈了一份超出預期的季度虧損報告。公司創始人、董事長兼首席執行官陳祥東表示:「我們在第二季度取得了令人鼓舞的成績,淨營業收入同比增長了43.6%,達到了人民幣100億,反映出強勁的增長勢頭。截至2024年6月30日,我們的遞延營收達到了人民幣160億,較去年同期增長了71.5%,爲我們下半年持續增長提供了強有力的支持。」 過去一個月,該公司股價下跌了約39%,創下了$2.22的52周最低價。

- 相對強弱指數數值: 27.21

- GOTU股價走勢: 高途科技股票週一下跌0.7%,收於$2.67。

- 彭博專業版的圖表工具幫助識別了GOTU股票的趨勢。

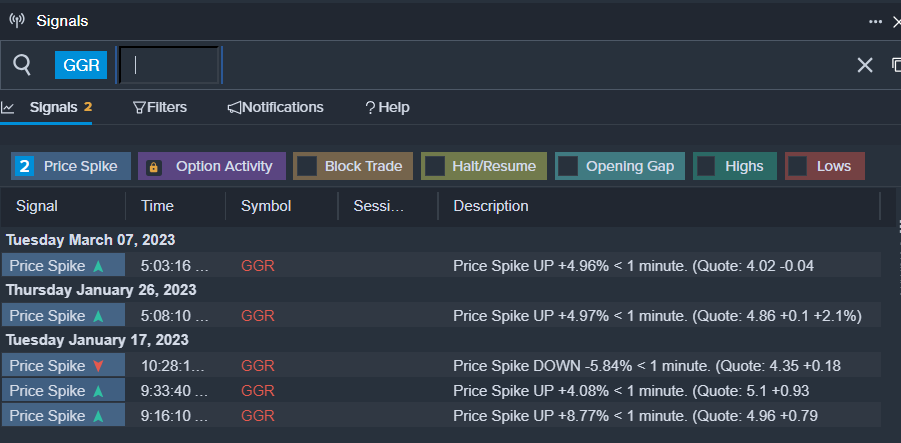

Gogoro Inc (NASDAQ:GGR)

Gogoro股份有限公司(納斯達克:GGR)

- On Aug. 27, Gogoro and Nebula Energy announced the commercial availability of its battery swapping and Smartscooters in the Kathmandu Valley. The company's shares fell around 36% over the past month and has a 52-week low of $0.84.

- RSI Value: 21.96

- GGR Price Action: Shares of Gogoro fell 14.1% to close at $0.86 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in GGR shares.

- 8月27日,Gogoro和Nebula Energy宣佈其換電和智能電動踏板車在加德滿都谷地的商用可用性。該公司股價在過去一個月下跌了約36%,52周最低價爲0.84美元。

- RSI值:21.96

- Gogoro股票價格走勢:週一Gogoro股票下跌14.1%,收盤價爲0.86美元。

- Benzinga Pro的信號功能提醒了Gogoro股票可能出現突破。

Read More:

閱讀更多:

- 'If You Want Steel, You Do Nucor,' Says Cramer When Asked About Gerdau

- 「如果你想要鋼鐵,就選擇紐柯鋼鐵,」當問及蓋爾道鋼鐵時,Cramer如此說道。