Unpacking the Latest Options Trading Trends in Eli Lilly

Unpacking the Latest Options Trading Trends in Eli Lilly

Whales with a lot of money to spend have taken a noticeably bearish stance on Eli Lilly.

Looking at options history for Eli Lilly (NYSE:LLY) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 43% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $423,567 and 26, calls, for a total amount of $4,363,478.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $700.0 to $1100.0 for Eli Lilly during the past quarter.

Insights into Volume & Open Interest

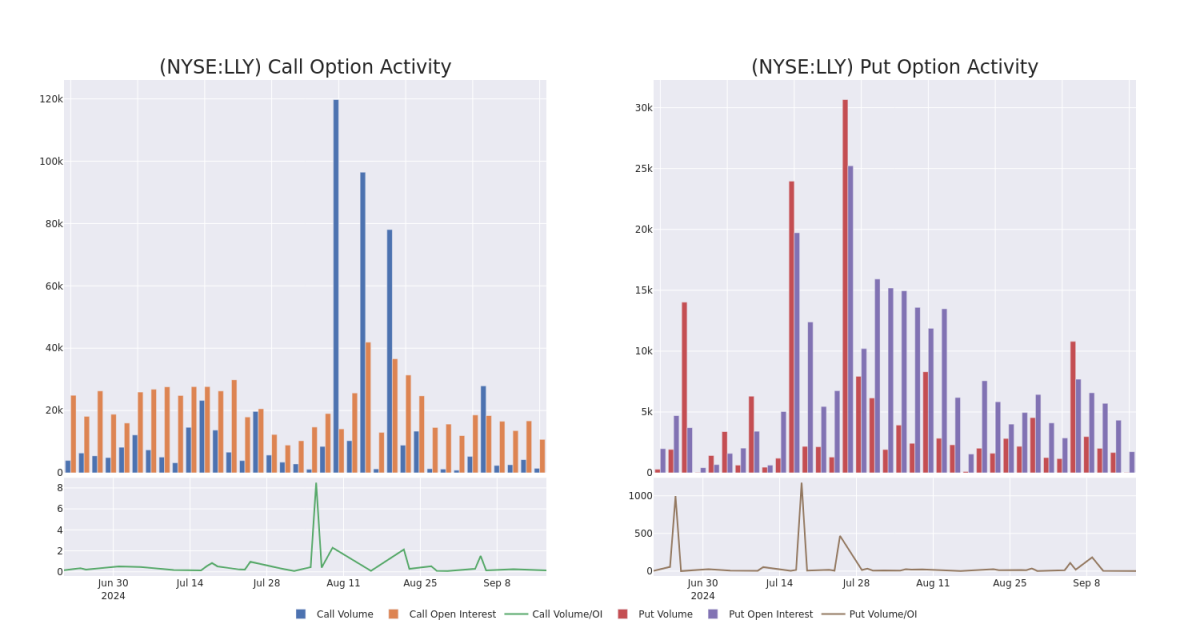

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 498.6 with a total volume of 1,460.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $700.0 to $1100.0 over the last 30 days.

Eli Lilly Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BEARISH | 11/15/24 | $223.4 | $217.55 | $220.0 | $700.00 | $2.2M | 836 | 300 |

| LLY | CALL | SWEEP | NEUTRAL | 01/17/25 | $81.9 | $80.95 | $81.9 | $900.00 | $311.3K | 1.8K | 46 |

| LLY | PUT | SWEEP | BULLISH | 10/18/24 | $28.3 | $25.0 | $25.0 | $900.00 | $300.4K | 883 | 2 |

| LLY | CALL | SWEEP | NEUTRAL | 01/17/25 | $119.15 | $115.4 | $119.15 | $840.00 | $273.9K | 459 | 7 |

| LLY | CALL | TRADE | BEARISH | 11/15/24 | $51.65 | $48.8 | $48.8 | $930.00 | $239.1K | 535 | 100 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Following our analysis of the options activities associated with Eli Lilly, we pivot to a closer look at the company's own performance.

Present Market Standing of Eli Lilly

- Currently trading with a volume of 365,615, the LLY's price is down by -1.32%, now at $911.36.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 44 days.

Professional Analyst Ratings for Eli Lilly

5 market experts have recently issued ratings for this stock, with a consensus target price of $1007.2.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $885.

- Reflecting concerns, an analyst from Citigroup lowers its rating to Buy with a new price target of $1060.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Eli Lilly with a target price of $1100.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $885.

- An analyst from Morgan Stanley has revised its rating downward to Overweight, adjusting the price target to $1106.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.