Smart Money Is Betting Big In UBER Options

Smart Money Is Betting Big In UBER Options

Financial giants have made a conspicuous bullish move on Uber Technologies. Our analysis of options history for Uber Technologies (NYSE:UBER) revealed 10 unusual trades.

Financial giants have made a conspicuous bullish move on Uber Technologies. Our analysis of options history for Uber Technologies (NYSE:UBER) revealed 10 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $2,172,750, and 8 were calls, valued at $1,094,198.

Delving into the details, we found 50% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $2,172,750, and 8 were calls, valued at $1,094,198.

Expected Price Movements

预期价格波动

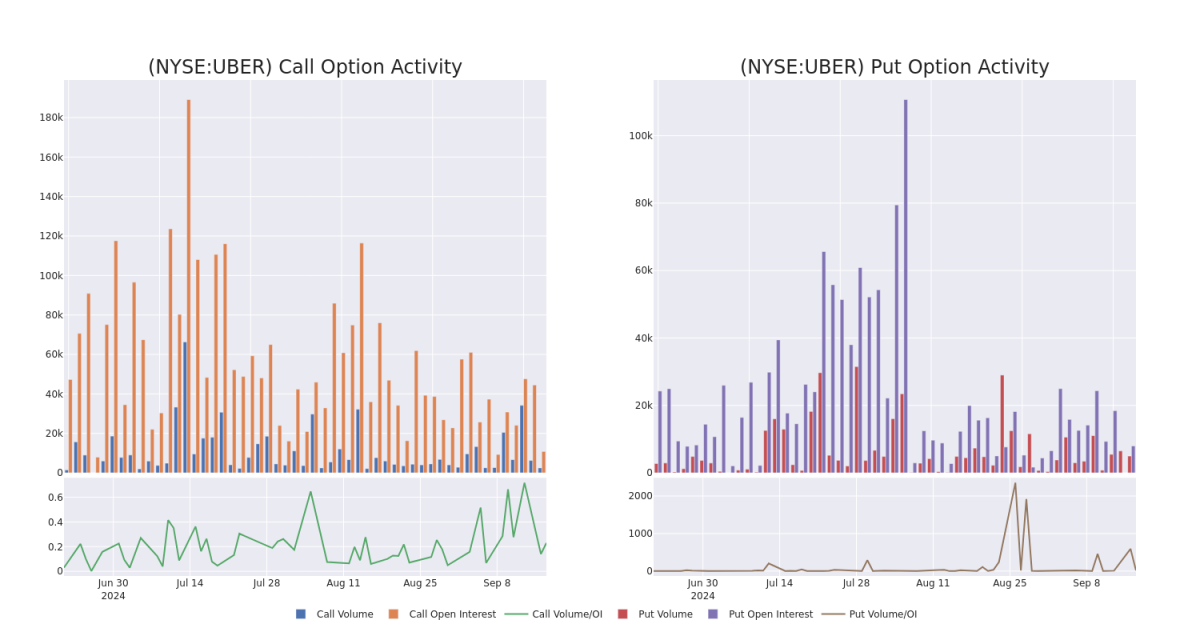

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $90.0 for Uber Technologies during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $90.0 for Uber Technologies during the past quarter.

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In today's trading context, the average open interest for options of Uber Technologies stands at 2086.56, with a total volume reaching 7,452.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Uber Technologies, situated within the strike price corridor from $50.0 to $90.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Uber Technologies stands at 2086.56, with a total volume reaching 7,452.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Uber Technologies, situated within the strike price corridor from $50.0 to $90.0, throughout the last 30 days.

Uber Technologies 30-Day Option Volume & Interest Snapshot

Uber Technologies 30天期权成交量和持仓量快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | PUT | TRADE | BULLISH | 12/19/25 | $8.55 | $7.0 | $7.15 | $65.00 | $2.1M | 176 | 3.0K |

| UBER | CALL | SWEEP | BULLISH | 03/21/25 | $5.8 | $5.7 | $5.79 | $80.00 | $577.8K | 7.4K | 24 |

| UBER | CALL | SWEEP | NEUTRAL | 10/18/24 | $9.1 | $9.05 | $9.07 | $65.00 | $135.9K | 1.3K | 153 |

| UBER | CALL | SWEEP | BEARISH | 03/21/25 | $6.0 | $5.8 | $5.9 | $80.00 | $100.3K | 7.4K | 1.1K |

| UBER | CALL | TRADE | BEARISH | 10/25/24 | $4.05 | $4.0 | $4.0 | $71.00 | $80.0K | 273 | 201 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | 看跌 | 交易 | 看好 | 2025年12月19日 | $8.55 | $7.0 | $7.15 | $65.00 | $2.1M | 176 | 3.0K |

| UBER | 看涨 | SWEEP | 看好 | 03/21/25 | $5.8 | $5.7 | 5.79美元 | $80.00 | 577.8千美元 | 7.4K | 24 |

| UBER | 看涨 | SWEEP | 中立 | 10/18/24 | $9.1 | $9.05 | 9.07美元 | $65.00 | 135.9千美元 | 1.3K | 153 |

| UBER | 看涨 | SWEEP | 看淡 | 03/21/25 | $6.0 | $5.8 | $5.9 | $80.00 | $100.3K | 7.4K | 1.1千 |

| UBER | 看涨 | 交易 | 看淡 | 10/25/24 | $4.05 | $4.0 | $4.0 | $71.00 | $80.0K | 273 | 201 |

About Uber Technologies

关于优步科技

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. The firm's on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, delivery via drones, and Uber Elevate, which, as the firm refers to it, provides "aerial ride-sharing." Uber Technologies is headquartered in San Francisco and operates in over 63 countries with over 150 million users who order rides or food at least once a month.

Uber Technologies是一家技术服务提供商,匹配乘客和车手、饥饿的人和餐厅和外卖服务提供商、装运货物的人和承运商。该公司的即时技术平台最终可以用于其他产品和服务,例如自动驾驶汽车、通过无人机进行送货以及Uber Elevate,即该公司提到的“空中共乘服务”。Uber Technologies总部位于旧金山,在63个国家/地区运营,拥有超过1.5亿用户,他们每月至少使用一次乘车或点外卖服务。

Following our analysis of the options activities associated with Uber Technologies, we pivot to a closer look at the company's own performance.

在对优步科技的期权活动进行分析后,我们转而更近距禮地观察公司自身的表现。

Where Is Uber Technologies Standing Right Now?

Uber Technologies现在处于什么位置?

- With a volume of 4,620,778, the price of UBER is up 3.02% at $73.68.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 49 days.

- 成交量为4,620,778,优步的价格上涨了3.02%,达到73.68美元。

- RSI指标暗示该股票可能要超买了。

- 下一次盈利预计在49天内发布。

What The Experts Say On Uber Technologies

专家对优步科技的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $89.4.

在过去的一个月中,有5位行业分析师分享了他们对该股票的见解,提出了一个平均目标价89.4美元。

- An analyst from Truist Securities persists with their Buy rating on Uber Technologies, maintaining a target price of $88.

- Consistent in their evaluation, an analyst from Loop Capital keeps a Buy rating on Uber Technologies with a target price of $84.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Uber Technologies with a target price of $88.

- An analyst from Wells Fargo persists with their Overweight rating on Uber Technologies, maintaining a target price of $97.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $90.

- 来自富信证券的分析师坚持给予优步科技的买入评级,并维持目标价为88美元。

- Loop Capital的分析师一贯评估认为,优步科技的买入评级值得保持,并设定目标价为84美元。

- b of A Securities的一位分析师坚持对优步保持买入评级,目标价为88美元。

- 来自富国银行的分析师坚持给予优步科技超配评级,并维持目标价为97美元。

- Cantor Fitzgerald的一位分析师调降了对优步的评级为超配,调整了目标价至90美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Uber Technologies with Benzinga Pro for real-time alerts.

期权交易涉及更高风险,但也提供了更高利润的潜力。熟练的交易者通过持续教育、策略性交易调整、利用各种因子并保持对市场动态的关注来缓解这些风险。借助Benzinga Pro的实时警报,及时了解Uber Technologies的最新期权交易。