What the Options Market Tells Us About General Motors

What the Options Market Tells Us About General Motors

Whales with a lot of money to spend have taken a noticeably bearish stance on General Motors.

有大量資金可以花的鯨魚對通用汽車採取了明顯的看跌立場。

Looking at options history for General Motors (NYSE:GM) we detected 11 trades.

查看通用汽車(紐約證券交易所代碼:GM)的期權歷史記錄,我們發現了11筆交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 45% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,36%的投資者以看漲的預期開盤,45%的投資者持看跌預期。

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.

在已發現的全部交易中,有5筆是看跌期權,總額爲210,940美元,6筆看漲期權,總額爲375,791美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $35.0 and $55.0 for General Motors, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在通用汽車過去三個月的35.0美元至55.0美元之間的價格區間上。

Volume & Open Interest Development

交易量和未平倉合約的發展

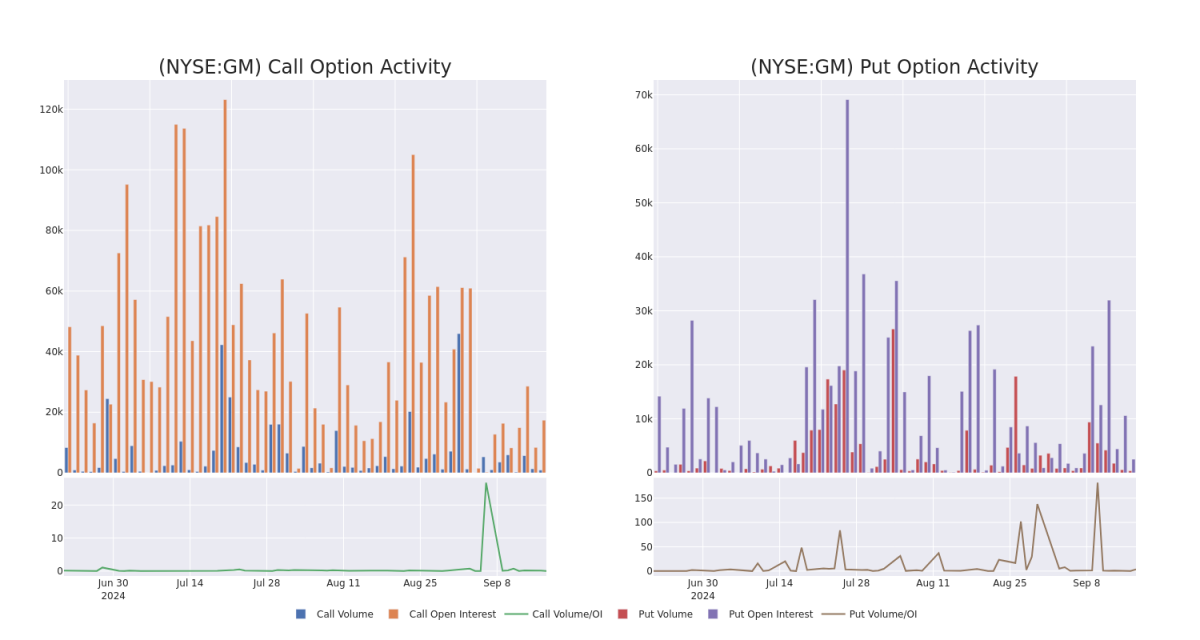

In terms of liquidity and interest, the mean open interest for General Motors options trades today is 2486.25 with a total volume of 1,284.00.

就流動性和利息而言,今天通用汽車期權交易的平均未平倉合約爲2486.25,總交易量爲1,284.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for General Motors's big money trades within a strike price range of $35.0 to $55.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天通用汽車在35.0美元至55.0美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

General Motors 30-Day Option Volume & Interest Snapshot

通用汽車30天期權交易量和利息快照

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | NEUTRAL | 06/20/25 | $14.85 | $14.55 | $14.7 | $35.00 | $147.0K | 4.1K | 100 |

| GM | CALL | TRADE | BEARISH | 10/18/24 | $3.5 | $3.45 | $3.45 | $45.00 | $69.0K | 3.2K | 200 |

| GM | PUT | SWEEP | BEARISH | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $59.1K | 109 | 82 |

| GM | CALL | SWEEP | BULLISH | 12/20/24 | $7.45 | $7.35 | $7.45 | $42.00 | $55.1K | 2.0K | 130 |

| GM | PUT | SWEEP | BEARISH | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $44.0K | 109 | 169 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | 打電話 | 貿易 | 中立 | 06/20/25 | 14.85 美元 | 14.55 美元 | 14.7 美元 | 35.00 美元 | 147.0K | 4.1K | 100 |

| GM | 打電話 | 貿易 | 粗魯的 | 10/18/24 | 3.5 美元 | 3.45 美元 | 3.45 美元 | 45.00 美元 | 69.0 萬美元 | 3.2K | 200 |

| GM | 放 | 掃 | 粗魯的 | 12/18/26 | 11.6 | 10.2 美元 | 11.6 | 55.00 美元 | 59.1 萬美元 | 109 | 82 |

| GM | 打電話 | 掃 | 看漲 | 12/20/24 | 7.45 美元 | 7.35 美元 | 7.45 美元 | 42.00 美元 | 55.1 萬美元 | 2.0K | 130 |

| GM | 放 | 掃 | 粗魯的 | 12/18/26 | 11.6 | 10.2 美元 | 11.6 | 55.00 美元 | 44.0 萬美元 | 109 | 169 |

About General Motors

關於通用汽車

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023's share was 16.5%. GM's Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company's captive finance arm in October 2010 via the purchase of AmeriCredit.

通用汽車公司於2009年7月從通用汽車公司(原通用汽車)的破產中脫穎而出。通用汽車擁有八個品牌,分爲四個細分市場:通用汽車北美、通用汽車國際、Cruise和Gm Financial。美國現在有四個品牌,而不是舊通用汽車旗下的八個品牌。該公司在2021年因芯片短缺而輸給豐田之後,在2022年奪回了美國市場份額的領先地位。2023年的份額爲16.5%。通用汽車的Cruise自動駕駛汽車部門此前曾在舊金山和其他城市提供無人駕駛的地理圍欄自動駕駛出租車服務,但在發生事故後於2023年底停止服務。它於2024年重啓服務,但未在加利福尼亞州重新啓動服務。通用汽車擁有克魯斯80%以上的股份。通用汽車金融於2010年10月通過收購Americredit成爲該公司的專屬融資部門。

Having examined the options trading patterns of General Motors, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了通用汽車的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Present Market Standing of General Motors

通用汽車目前的市場地位

- With a volume of 2,529,475, the price of GM is up 2.15% at $47.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 35 days.

- 通用汽車的交易量爲2529,475美元,上漲2.15%,至47.88美元。

- RSI指標暗示標的股票可能接近超買。

- 下一份業績預計將在35天后公佈。

What Analysts Are Saying About General Motors

分析師對通用汽車的看法

2 market experts have recently issued ratings for this stock, with a consensus target price of $43.0.

2位市場專家最近發佈了該股的評級,共識目標價爲43.0美元。

- An analyst from Wells Fargo has decided to maintain their Underweight rating on General Motors, which currently sits at a price target of $33.

- An analyst from Deutsche Bank downgraded its action to Hold with a price target of $53.

- 富國銀行的一位分析師已決定維持通用汽車的減持評級,目前的目標股價爲33美元。

- 德意志銀行的一位分析師將其評級下調至持有,目標股價爲53美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for General Motors with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解通用汽車的最新期權交易,以獲取實時警報。

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.