Financial giants have made a conspicuous bearish move on Plug Power. Our analysis of options history for Plug Power (NASDAQ:PLUG) revealed 15 unusual trades.

Delving into the details, we found 0% of traders were bullish, while 100% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $980,019, and 2 were calls, valued at $90,000.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $4.0 to $5.0 for Plug Power over the recent three months.

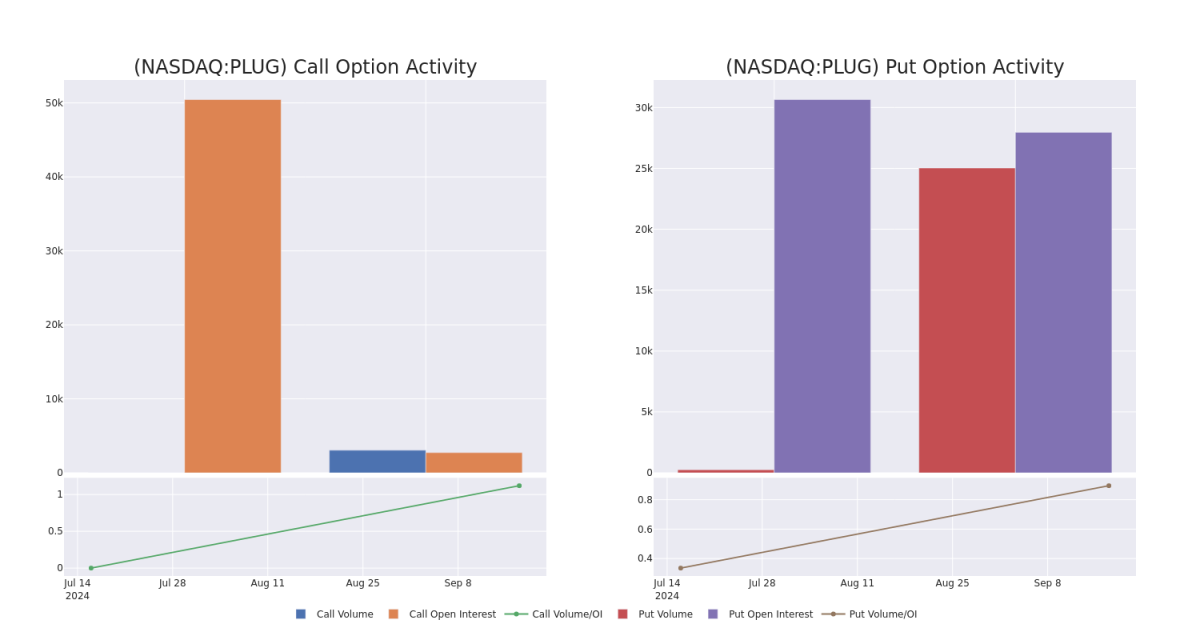

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Plug Power's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Plug Power's whale activity within a strike price range from $4.0 to $5.0 in the last 30 days.

Plug Power Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLUG | PUT | SWEEP | BEARISH | 01/17/25 | $2.89 | $2.85 | $2.89 | $5.00 | $295.9K | 27.9K | 121 |

| PLUG | PUT | SWEEP | BEARISH | 01/17/25 | $2.92 | $2.87 | $2.92 | $5.00 | $88.1K | 27.9K | 3.5K |

| PLUG | PUT | SWEEP | BEARISH | 01/17/25 | $2.91 | $2.87 | $2.91 | $5.00 | $85.2K | 27.9K | 1.5K |

| PLUG | PUT | SWEEP | BEARISH | 01/17/25 | $2.92 | $2.87 | $2.92 | $5.00 | $75.9K | 27.9K | 2.5K |

| PLUG | PUT | SWEEP | BEARISH | 01/17/25 | $2.92 | $2.88 | $2.91 | $5.00 | $73.3K | 27.9K | 2.5K |

About Plug Power

Plug Power is building an end-to-end green hydrogen ecosystem—from production, storage, and delivery to energy generation. The company plans to build and operate green hydrogen highways across North America and Europe. Plug will deliver its green hydrogen solutions directly to its customers and through joint venture partners into multiple end markets, including material handling, e-mobility, power generation, and industrial applications.

Following our analysis of the options activities associated with Plug Power, we pivot to a closer look at the company's own performance.

Present Market Standing of Plug Power

- With a volume of 33,213,916, the price of PLUG is up 7.62% at $2.12.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 51 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Plug Power options trades with real-time alerts from Benzinga Pro.