Traders are looking back at the situation in 1995 to help them deal with the first interest rate cut in four years. In 1995, then-chairman Alan Greenspan led the Fed to achieve a rare economic soft landing.

Just like about 30 years ago, both bonds and stocks are rising ahead of the key Fed policy meeting. But for current Fed Chairman Jerome Powell, the core issue this time is whether a 25 basis point or 50 basis point rate cut is most beneficial to the U.S. economy.

Kristina Hooper, Chief Global Market Strategist at Invesco, said that as the Fed starts to ease policy on the eve of the U.S. elections, the U.S. economy seems poised to avoid a recession.

"Once the Fed starts cutting rates, it will have a psychological effect," she said. "This will be supportive."

"Once the Fed starts cutting rates, it will have a psychological effect," she said. "This will be supportive."

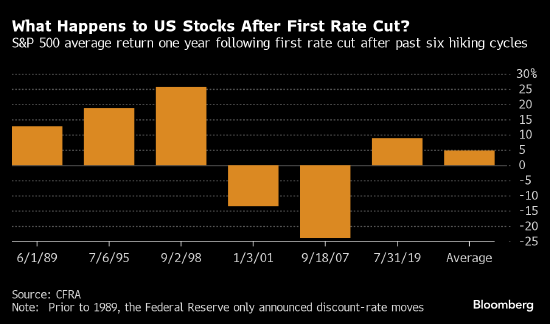

Analyzing the market performance during the six Fed easing cycles since 1989, it was found that the S&P 500 Index, U.S. Treasuries, and gold usually rise when the Fed starts cutting rates.

Data shows that in the six months after the Fed starts cutting rates, the S&P 500 Index typically rises by an average of 13%, except during the economic recessions in 2001 and 2007.

Meanwhile, during the Fed's easing cycles, short-term U.S. Treasury performance typically outperforms longer-term bonds, leading to a steepening yield curve. Six months after the first interest rate cut, the yield spread between 10-year and 2-year Treasury bonds on average widens by 44 basis points.

In the past six cycles, four of them have brought returns to investors, while the price of gold, the US dollar, and oil has fluctuated.

Of course, traders have little confidence in the situation in the coming months. Shortly after the Federal Reserve embarked on a path of interest rate cuts, former President Donald Trump will compete against current Vice President Kamala Harris in the November election.

The two candidates present completely different economic agendas, but depending on the results of the congressional elections, both have the ability to have a significant impact on global markets.

Salman Ahmed, Head of Global Macro and Strategic Asset Allocation at Invesco, believes that a soft landing is the most likely scenario. Partly due to election-related risks, he downgraded his rating on the US market from overweight to neutral. 'The election will be important. This could be a unique cycle.'

Republican presidential candidate Trump has promised to raise taxes significantly and extend tax cuts, which is seen as bullish for the US dollar and bearish for bonds. Goldman Sachs economists say that Trump's import tariff measures, once implemented, could push up inflation.

Trump has pledged to lower the federal corporate tax rate from 21% to 15%, which would benefit corporate profits. In contrast, his Democratic opponent Harris has proposed raising the tax rate to 28%, which Goldman Sachs economists say would reduce corporate profits by about 5%.

Going back to 1995,

In the six easing cycles since 1989, the Federal Reserve has successfully avoided an immediate economic downturn only twice - in 1995 and 1998. This time, the US stock and bond markets expect the Fed to achieve a soft landing similar to 1995.

At that time, Greenspan and his colleagues at the Federal Reserve lowered interest rates from 6% to 5.25% in just six months. The yield on U.S. Treasury bonds rose in the 12 months after the first rate cut, and the total return on bonds lagged behind cash.

This time, Federal Reserve officials have maintained the target range for the benchmark interest rate at 5.25% to 5.5% for 14 months, but policymakers have not committed to taking aggressive action.

Bond traders expect the Federal Reserve to cut interest rates by more than 2 percentage points in the next 12 months, while the S&P 500 index is just one step away from its all-time high and credit spreads are close to historical lows.

What gives investors hope for a soft landing is that both household and corporate balance sheets are strong. Record profits and household wealth make them less susceptible to economic shocks.

"The big problem facing the economy and the markets is no longer inflation, but high interest rates," said Yung-Yu Ma, Chief Investment Officer at BMO Wealth Management. "Now, by cutting interest rates, the Federal Reserve may solve this problem and prevent an economic downturn."

This prepares traders for a situation where borrowing costs decrease while the economy remains relatively resilient.

The latest stock flow data from Bank of America and EPFR Global shows that funds are flowing into utilities and real estate, two important sectors closely tied to the economy. Historically, these two sectors benefit from rate cuts whenever there is strong economic growth.

“一旦美联储开始降息,就将会带来心理作用,”她说。“这将起到支持作用。”

“一旦美联储开始降息,就将会带来心理作用,”她说。“这将起到支持作用。”