The US monetary policy is about to reach a watershed moment. The expected interest rate cut by the Fed will help the world's largest economy to break free from the long-standing shackles of borrowing costs. In addition, the decision-makers may also signal that they are prepared to further loosen in the coming months.

Here are some key points to watch after the Federal Open Market Committee's interest rate decision announcement at 2 p.m. Eastern Time on Wednesday afternoon.

Magnitude

Currently, the market's divergence is focused on whether the first rate cut will be 25 or 50 basis points.

Currently, the market's divergence is focused on whether the first rate cut will be 25 or 50 basis points.

After the retail sales data was released on Tuesday, the market-implied probability of a 50 basis point rate cut reached around 55%.

The market's expectation is that there will be a reduction of approximately 77 basis points by November, implying a 50 basis point cut.

As one of the most influential and prestigious economists on Wall Street, Evercore ISI founder and chairman Ed Hyman also believes that the Fed will cut rates by 50 basis points on Wednesday.

JPMorgan economists, and even former New York Fed President William Dudley, also believe that the Fed should take a bigger step: a direct rate cut of 50 basis points.

Blackrock believes that the market's bet on a significant interest rate cut is unlikely to materialize.

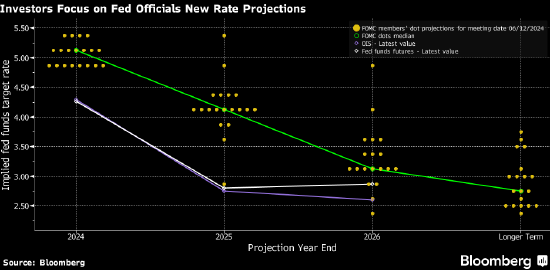

Dot plot

The latest quarterly forecasts of the Federal Reserve officials on the interest rate path (the so-called "dot plot") will provide each decision maker's year-end estimate for each year until 2027.

The dot plot does not disclose the officials' identities, but the public can catch a glimpse of their outlook from now until the end of 2024, a very short period of time.

The dot plot will show how many Federal Open Market Committee members are inclined to further interest rate cuts in November and December (a survey of economists indicates that it is likely a majority), and how many expect a 50 basis point cut in one of those instances.

If the latter figure represents a significant minority, it means that the FOMC is not far from leaning towards more aggressive action.

It is worth paying attention to the changes in Wednesday's dot plot compared to the June forecast, when no decision makers expected more than two interest rate cuts this year.

Statement

30 minutes before Chairman Jerome Powell's press conference, the Fed's interest rate statement is the best way to understand the decision-making of the leadership. Pay particular attention to the following points:

Whether there are any dissents in the vote;

The description and outlook of the leadership on inflation;

Views and outlook on the labor market;

Implications for future interest rate paths;

Press conference

The highlight is Powell's statement.

If the interest rate is cut by 25 basis points from the beginning, those who believe that labor market risks are accumulating will hope that the chairman will imply that the decision-making body is ready to act more decisively when necessary in the future.

David Wilcox, who has provided advice to three Federal Reserve chairmen, said that no matter how much the first cut is, Powell himself may want to keep his options open at future meetings.

At the Federal Reserve's annual symposium held in Jackson Hole, Wyoming in August, several policymakers spoke about the reasoning behind the gradual reduction of interest rates. However, it is worth noting that Powell did not endorse this chorus of voices at the time.

Markets

Like about 30 years ago, both bonds and stocks are rising ahead of the crucial Federal Reserve policy meeting.

After analyzing the market performance of the six Fed easing cycles since 1989, media found that the S&P 500 index, US Treasury bonds, and gold usually rise when the Fed starts cutting rates.

In the six months following the start of a Fed rate cut, the S&P 500 index has averaged a 13% increase, excluding the recession periods in 2001 and 2007.

Short-term US Treasury bonds have typically outperformed longer-term bonds, leading to a steepening yield curve.

After the first interest rate cut in six months, the average spread between the 10-year and 2-year government bond yields has expanded by 44 basis points.

In the past six cycles, gold has brought returns to investors four times.

The US dollar and oil have both risen and fallen.

Given that market implied probabilities suggest a slightly higher than 50% chance of a 0.5 percentage point interest rate cut by the Federal Reserve on Wednesday, Subadra Rajappa, head of US rate strategy at Industrial Bank of France, says market reaction would be much stronger if the rate cut was 25 basis points instead of 50.

Political factors

The November presidential election also poses a disturbing and serious challenge to the Fed's decision-making.

Republican candidate and former President Donald Trump has said that the central bank should not cut interest rates so close to the election, while Democratic Senator Elizabeth Warren and others are pushing for a 75 basis point rate cut.

Trump has also said that he will not reappoint Powell as the chairman of the Federal Reserve.

目前市场的分歧集中在首次降息是下调25个还是50个基点。

目前市场的分歧集中在首次降息是下调25个还是50个基点。