Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Vital Energy, Inc. (NYSE:VTLE) shareholders. Unfortunately, they have held through a 59% decline in the share price in that time. And over the last year the share price fell 44%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days.

On a more encouraging note the company has added US$87m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Vital Energy moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

During five years of share price growth, Vital Energy moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 10% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Vital Energy further; while we may be missing something on this analysis, there might also be an opportunity.

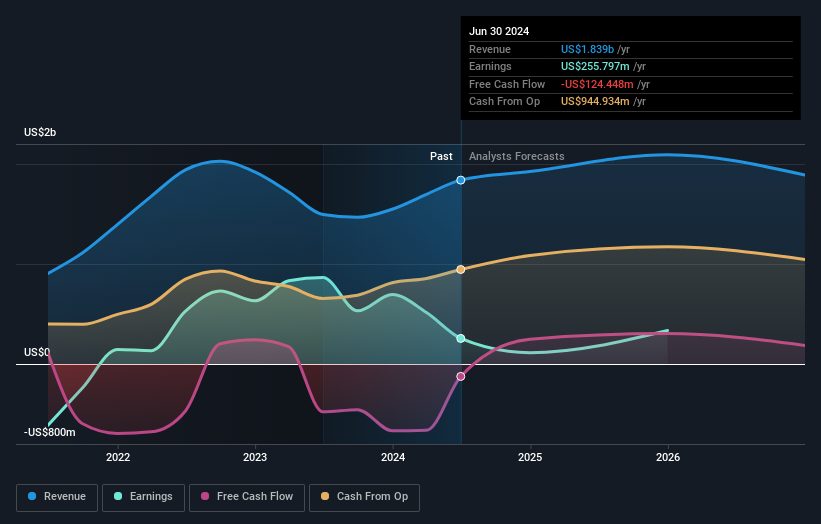

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Vital Energy

A Different Perspective

Investors in Vital Energy had a tough year, with a total loss of 44%, against a market gain of about 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Vital Energy is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Vital Energy is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.