What the Options Market Tells Us About Advanced Micro Devices

What the Options Market Tells Us About Advanced Micro Devices

Financial giants have made a conspicuous bearish move on Advanced Micro Devices. Our analysis of options history for Advanced Micro Devices (NASDAQ:AMD) revealed 16 unusual trades.

金融巨头对先进微设备采取了明显的看跌举动。我们对先进微设备(纳斯达克股票代码:AMD)期权历史的分析显示了16笔不寻常的交易。

Delving into the details, we found 31% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $434,230, and 10 were calls, valued at $473,774.

深入研究细节,我们发现31%的交易者看涨,而62%的交易者表现出看跌倾向。在我们发现的所有交易中,有6笔是看跌期权,价值434,230美元,10笔是看涨期权,价值473,774美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $380.0 for Advanced Micro Devices over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Advanced Micro Devices的价格定在120.0美元至380.0美元之间。

Volume & Open Interest Development

交易量和未平仓合约的发展

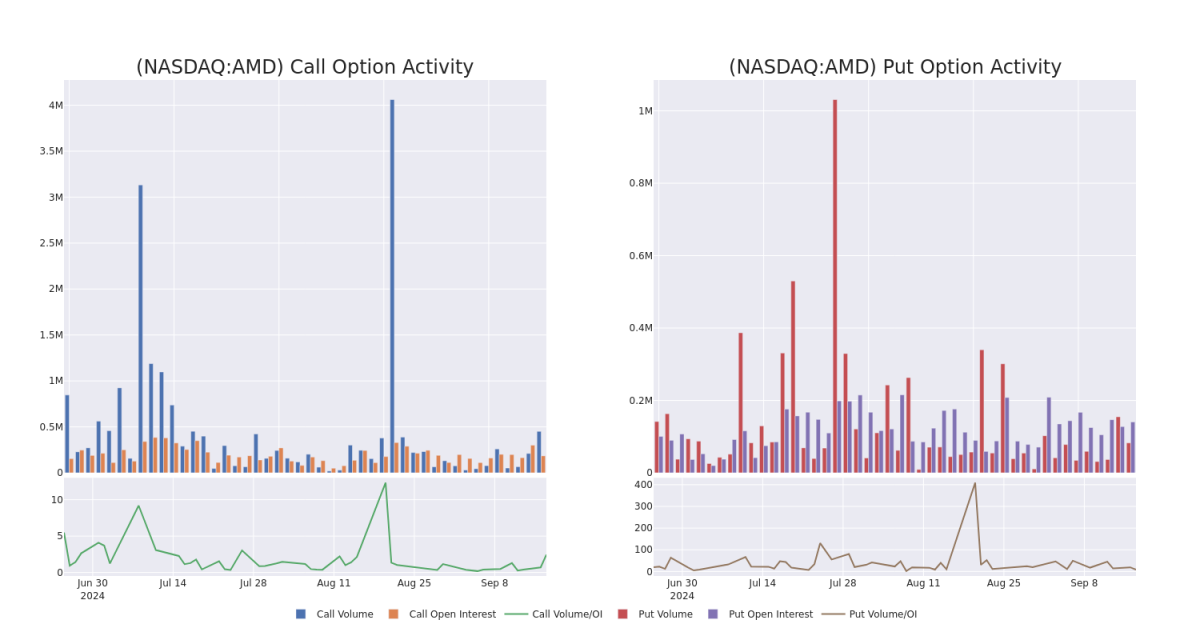

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Advanced Micro Devices's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下的Advanced Micro Devices期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Advanced Micro Devices's whale activity within a strike price range from $120.0 to $380.0 in the last 30 days.

下面,我们可以分别观察过去30天内,Advanced Micro Devices所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化,其行使价在120.0美元至380.0美元之间。

Advanced Micro Devices 30-Day Option Volume & Interest Snapshot

高级微设备30天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | SWEEP | BULLISH | 09/20/24 | $0.4 | $0.38 | $0.4 | $160.00 | $136.0K | 38.2K | 30 |

| AMD | PUT | SWEEP | BULLISH | 11/15/24 | $2.17 | $2.16 | $2.17 | $120.00 | $114.8K | 11.6K | 549 |

| AMD | PUT | TRADE | BULLISH | 06/18/26 | $232.9 | $228.05 | $228.15 | $380.00 | $114.0K | 0 | 5 |

| AMD | PUT | TRADE | BEARISH | 12/20/24 | $13.85 | $13.75 | $13.85 | $150.00 | $63.7K | 5.8K | 115 |

| AMD | PUT | SWEEP | BULLISH | 06/20/25 | $30.85 | $30.7 | $30.7 | $165.00 | $61.4K | 3.9K | 20 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | 打电话 | 扫 | 看涨 | 09/20/24 | 0.4 美元 | 0.38 美元 | 0.4 美元 | 160.00 美元 | 136.0 万美元 | 38.2K | 30 |

| AMD | 放 | 扫 | 看涨 | 11/15/24 | 2.17 美元 | 2.16 美元 | 2.17 美元 | 120.00 美元 | 114.8 万美元 | 11.6K | 549 |

| AMD | 放 | 贸易 | 看涨 | 06/18/26 | 232.9 美元 | 228.05 美元 | 228.15 美元 | 380.00 美元 | 114.0 万美元 | 0 | 5 |

| AMD | 放 | 贸易 | 粗鲁的 | 12/20/24 | 13.85 美元 | 13.75 美元 | 13.85 美元 | 150.00 美元 | 63.7 万美元 | 5.8K | 115 |

| AMD | 放 | 扫 | 看涨 | 06/20/25 | 30.85 美元 | 30.7 美元 | 30.7 美元 | 165.00 美元 | 61.4 万美元 | 3.9K | 20 |

About Advanced Micro Devices

关于高级微设备

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Advanced Micro Devices 为个人电脑、游戏机、数据中心、工业和汽车应用等市场设计各种数字半导体。AMD 的传统优势在于个人电脑和数据中心使用的中央处理器、CPU 和图形处理单元(GPU)。此外,该公司还提供索尼PlayStation和微软Xbox等知名游戏机中的芯片。2022年,该公司收购了领先的赛灵思现场可编程门阵列(FPGA),以实现业务多元化并扩大其在数据中心和汽车等关键终端市场的机会。

In light of the recent options history for Advanced Micro Devices, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Advanced Micro Devices最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Present Market Standing of Advanced Micro Devices

先进微设备目前的市场地位

- Currently trading with a volume of 4,744,009, the AMD's price is down by -0.78%, now at $149.65.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 41 days.

- AMD目前的交易量为4,744,009美元,价格下跌了-0.78%,目前为149.65美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计财报将在41天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.