Smart Money Is Betting Big In MSFT Options

Smart Money Is Betting Big In MSFT Options

Investors with a lot of money to spend have taken a bullish stance on Microsoft (NASDAQ:MSFT).

有大量资金可以花的投资者对微软(纳斯达克股票代码:MSFT)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MSFT, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当MSFT发生如此大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 52 uncommon options trades for Microsoft.

今天,Benzinga的期权扫描仪发现了微软的52笔不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 50% bullish and 42%, bearish.

这些大资金交易者的整体情绪介于50%的看涨和42%的看跌之间。

Out of all of the special options we uncovered, 8 are puts, for a total amount of $405,005, and 44 are calls, for a total amount of $4,789,268.

在我们发现的所有特殊期权中,有8个是看跌期权,总额为405,005美元,44个是看涨期权,总额为4,789,268美元。

Predicted Price Range

预测的价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $350.0 to $700.0 for Microsoft during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注微软在过去一个季度的价格范围从350.0美元到700.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

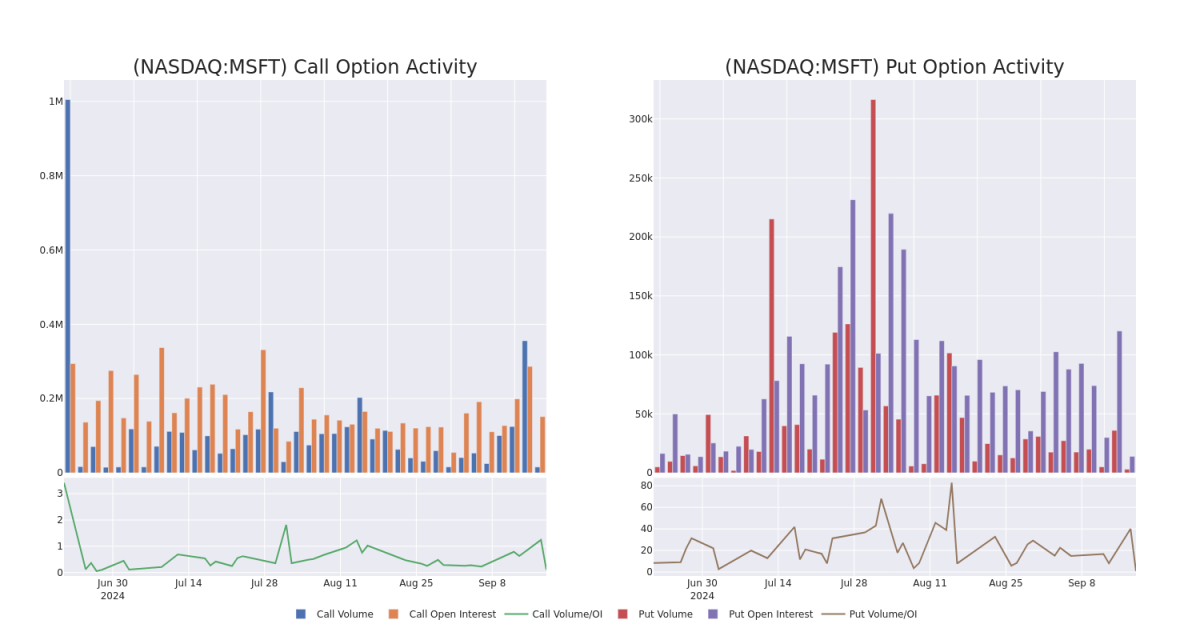

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Microsoft's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Microsoft's substantial trades, within a strike price spectrum from $350.0 to $700.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了特定行使价下微软期权的流动性和投资者对微软期权的兴趣。即将发布的数据可视化了与微软大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从350.0美元到700.0美元不等。

Microsoft Option Activity Analysis: Last 30 Days

微软期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | CALL | SWEEP | BULLISH | 08/15/25 | $44.55 | $43.75 | $44.47 | $440.00 | $888.7K | 1.0K | 320 |

| MSFT | CALL | SWEEP | BEARISH | 12/20/24 | $11.7 | $11.45 | $11.55 | $460.00 | $875.8K | 6.0K | 72 |

| MSFT | CALL | TRADE | BULLISH | 12/20/24 | $11.55 | $11.45 | $11.55 | $460.00 | $485.1K | 6.0K | 1.3K |

| MSFT | CALL | TRADE | BEARISH | 12/18/26 | $12.1 | $12.0 | $12.0 | $700.00 | $300.0K | 3.6K | 781 |

| MSFT | CALL | TRADE | BEARISH | 09/20/24 | $8.7 | $8.5 | $8.57 | $425.00 | $257.1K | 9.2K | 792 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | 打电话 | 扫 | 看涨 | 08/15/25 | 44.55 美元 | 43.75 美元 | 44.47 美元 | 440.00 美元 | 888.7 万美元 | 1.0K | 320 |

| MSFT | 打电话 | 扫 | 粗鲁的 | 12/20/24 | 11.7 美元 | 11.45 美元 | 11.55 美元 | 460.00 美元 | 875.8 万美元 | 6.0K | 72 |

| MSFT | 打电话 | 贸易 | 看涨 | 12/20/24 | 11.55 美元 | 11.45 美元 | 11.55 美元 | 460.00 美元 | 485.1 万美元 | 6.0K | 1.3K |

| MSFT | 打电话 | 贸易 | 粗鲁的 | 12/18/26 | 12.1 美元 | 12.0 美元 | 12.0 美元 | 700.00 美元 | 300.0 万美元 | 3.6K | 781 |

| MSFT | 打电话 | 贸易 | 粗鲁的 | 09/20/24 | 8.7 美元 | 8.5 美元 | 8.57 美元 | 425.00 美元 | 257.1 万美元 | 9.2K | 792 |

About Microsoft

关于微软

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

微软开发和许可消费者和企业软件。它以其Windows操作系统和办公生产力套件而闻名。该公司分为三个同样规模的细分市场:生产力和业务流程(传统的微软Office、基于云的Office 365、Exchange、SharePoint、Skype、LinkedIn、Dynamics)、情报云(基础设施和平台即服务产品Azure、Windows Server操作系统、SQL Server)以及更多个人计算(Windows Client、Xbox、必应搜索、展示广告以及Surface笔记本电脑、平板电脑和台式机)。

Having examined the options trading patterns of Microsoft, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了微软的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Where Is Microsoft Standing Right Now?

微软现在的立场在哪里?

- With a trading volume of 3,272,780, the price of MSFT is down by -0.04%, reaching $434.99.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 34 days from now.

- mSFT的交易量为3,272,780美元,下跌了-0.04%,至434.99美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于34天后发布。

What The Experts Say On Microsoft

专家对微软的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $506.0.

1位市场专家最近发布了该股的评级,共识目标价为506.0美元。

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Microsoft with a target price of $506.

- 摩根士丹利的一位分析师在评估中保持对微软的增持评级,目标价为506美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Microsoft with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro获取实时警报,了解微软的最新期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MSFT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MSFT, it often means somebody knows something is about to happen.