Wens Foodstuff Group announced tonight that it intends to repurchase shares with a value of 0.9 billion-1.8 billion yuan. The company's performance has been consistently good since June, and the average selling price has been increasing month by month. Since June, the performance of related pork stocks in the secondary market has been sluggish, with Wens Foodstuff Group falling by 28.67%.

According to Caixin, since June, pork prices have continued to rise, and the profitability of the hog farming industry has been increasing month by month. However, related pork industry stocks have been relatively weak in the secondary market. Wens Foodstuff Group (300498.SZ) is no exception. The company's stock price has fallen by 28.67% since June. It may be affected by this, the company announced tonight that it plans to launch a stock repurchase plan.

Specifically, the announcement stated that the company plans to repurchase the company's common A shares with its own funds of 0.9 billion-1.8 billion yuan through centralized bidding trading, in order to implement employee shareholding plans or stock-based incentives. The repurchase price shall not exceed RMB 27.01 per share (including par value). Based on the upper limit of the repurchase price and the upper and lower limits of the repurchase amount, it is expected that the number of repurchased shares will be between 33.321 million shares and 66.642 million shares. The repurchase period shall not exceed 12 months from the date of approval of this repurchase proposal by the board of directors.

In fact, this is the second large-scale repurchase plan disclosed by Wens Foodstuff Group since December 2022. Wens Foodstuff Group stated, "The launch of this stock repurchase plan is mainly based on confidence in the company's future development prospects and a high degree of recognition of the company's intrinsic value. Through this repurchase plan, the company sends a signal to the capital market about the steady development of the company, which is beneficial to safeguard the interests of a wide range of investors, especially small and medium-sized investors, and enhance their confidence."

In fact, this is the second large-scale repurchase plan disclosed by Wens Foodstuff Group since December 2022. Wens Foodstuff Group stated, "The launch of this stock repurchase plan is mainly based on confidence in the company's future development prospects and a high degree of recognition of the company's intrinsic value. Through this repurchase plan, the company sends a signal to the capital market about the steady development of the company, which is beneficial to safeguard the interests of a wide range of investors, especially small and medium-sized investors, and enhance their confidence."

Why did the company initiate a large-scale stock repurchase plan? Caixin reporters noted that this may be related to the company's low stock price in the secondary market in recent months. Since June, Wens Foodstuff Group's stock price has fallen by 28.67%, with a closing price of 15.20 yuan today. In fact, other related pork industry stocks have faced similar situations in the past few months. Among them, Leshan Giantstar Farming&Husbandry Corporation (603477.SH), DongFang Electric Corporation Ltd. (001201.SZ), Muyuan Foods Co., Ltd. (002714.SZ), Beijing Dabeinong Technology Group Co., Ltd. (002385.SZ), and New Hope Liuhe Co., Ltd. (000876.SZ) have fallen by 52.04%, 43.81%, 23.31%, 18.24%, and 17.47% respectively since June.

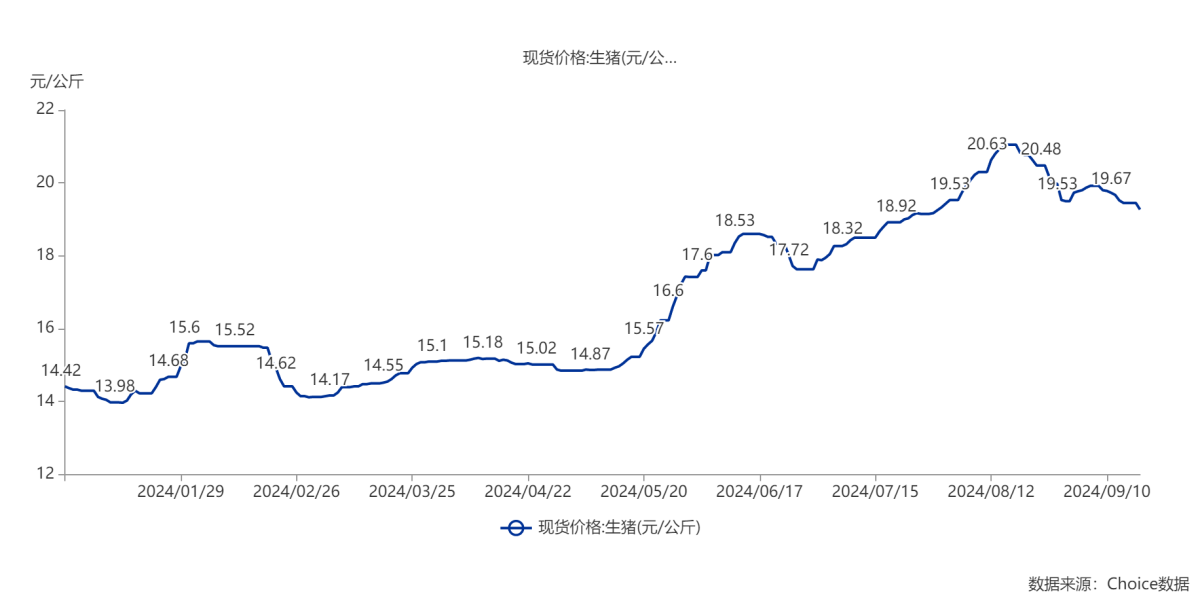

However, since June, the price of live hogs has been rising month by month, and the entire pork industry has entered a profitable period. Wens Foodstuff Group sold 2.354 million pigs in August, with sales revenue of 5.863 billion yuan and an average selling price of 20.45 yuan/kg. Without considering other factors, based on the company's latest announced comprehensive breeding cost of 13.8 yuan/kg, and estimating the weight of 120 kg for each pig, the hog farming business alone recorded a profit of more than 1.8 billion yuan in August.

Looking ahead, although pig prices have experienced a slight decline recently, they are still at a high level overall. According to the information from the Price Monitoring Center of the National Development and Reform Commission, as of the week of September 11th, the national pig-to-feed ratio was 6.37, a decrease of 1.09% compared to the previous week. Based on the current prices and costs, the average profit per hog for the weaner-to-finisher pig farming model is 554.40 yuan.

Analysts recently interviewed by Caixin reporters said, "The third and fourth quarters are usually the peak season for meat consumption, especially with the temperature dropping and more holidays, the demand for pork may increase. The increase in demand may further push up pork prices. Coupled with the decrease in breeding costs, this will create better profit conditions for pig companies."

(Hog spot price Image source: Choice)

事实上,这也是温氏股份继2022年12月以来披露的第二次大额回购计划。温氏股份方面表示,“本次启动回购股票计划,主要是基于对公司未来发展前景的信心以及对公司内在价值的高度认可。公司通过本次回购计划,向资本市场传递公司稳健发展的信号,有利于维护广大投资者特别是中小投资者的利益,增强投资者的信心。”

事实上,这也是温氏股份继2022年12月以来披露的第二次大额回购计划。温氏股份方面表示,“本次启动回购股票计划,主要是基于对公司未来发展前景的信心以及对公司内在价值的高度认可。公司通过本次回购计划,向资本市场传递公司稳健发展的信号,有利于维护广大投资者特别是中小投资者的利益,增强投资者的信心。”