The InnoCare Pharma Limited (HKG:9969) share price has done very well over the last month, posting an excellent gain of 31%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.3% in the last twelve months.

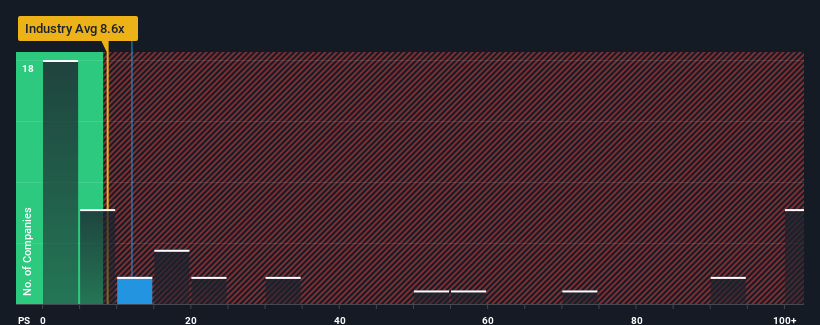

Since its price has surged higher, InnoCare Pharma may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 11.9x, since almost half of all companies in the Biotechs in Hong Kong have P/S ratios under 8.6x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does InnoCare Pharma's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, InnoCare Pharma has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think InnoCare Pharma's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, InnoCare Pharma would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, InnoCare Pharma would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 3.1% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 40% per year during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 52% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it concerning that InnoCare Pharma is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From InnoCare Pharma's P/S?

The large bounce in InnoCare Pharma's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see InnoCare Pharma trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 1 warning sign for InnoCare Pharma you should be aware of.

If these risks are making you reconsider your opinion on InnoCare Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.