① CME is a channel company for the sale of medical device products located in Europe, and has a sales advantage in endoscopes and other products. ② In recent years, in order to hedge against domestic influence, Nanwei Medical's overseas revenue has gradually increased. By the first half of 2024, it had reached 0.624 billion yuan, accounting for 46.78% of the total revenue.

“Science and Technology Innovation Board Daily”, September 19 (Reporter Zheng Bingxun) “Our strategy is to go hand in hand with innovation and internationalization, expand more overseas while stabilizing the domestic market, maintain profit margins, and promote healthy enterprise development.” In response to the acquisition of CME, a European medical device sales company, Nanwei Medical (688029.SH) management personnel told the “Science and Technology Innovation Board Daily” reporter today.

On the evening of the 18th, Nanwei Medical announced that it plans to acquire a total of 51% of Creo's wholly-owned subsidiary CME through its subsidiary “Nanwei Holland” with its own capital of no more than 36.72 million euros (equivalent to about RMB 0.289 billion). After the transaction is completed, CME will become a subsidiary of Nanwei Medical Holdings and will be included in the scope of the company's consolidated statements.

According to data, CME is a channel company that sells medical device products based in Europe. Its distribution products include self-developed products from parent company Creo, as well as related products from other medical device companies, including medical device products in the fields of digestion, urination, and disposable endoscopy.

According to data, CME is a channel company that sells medical device products based in Europe. Its distribution products include self-developed products from parent company Creo, as well as related products from other medical device companies, including medical device products in the fields of digestion, urination, and disposable endoscopy.

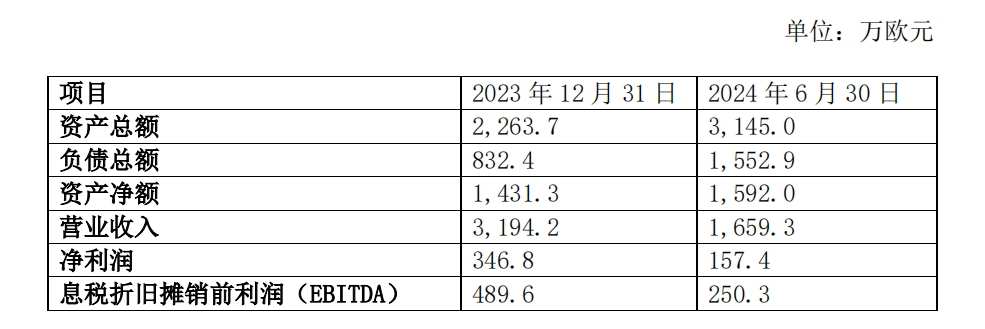

In the first half of 2024, CME achieved revenue of 16.593 million euros and net profit of 1.574 million euros. Net assets at the end of the reporting period were EUR 15.92 million. In the same period, the balance of cash and cash equivalents on Nanwei Medical's account was $1.223 billion.

Nanwei Medical said that CME's existing sales channels and products are highly complementary to Nanwei Medicine, and the two sides have a good foundation of cooperation, which is conducive to the common development of both parties.

The Nanwei Medical management staff mentioned above further told the “Science and Technology Innovation Board Daily” reporter, “CME was originally an independent company and was later acquired by Creo, but when it became independent, it used to be our dealer. After that, we wanted to develop our own brand after going public, so we set up our own subsidiaries in the UK and France to do direct sales. Slowly, our cooperation with CME was interrupted, but we had a very happy cooperation in history.”

As a minimally invasive medical device R&D, manufacturing and sales company, Nanwei Medical's main products include three series of endoscopic diagnosis and treatment devices used with endoscopes, microwave ablation equipment and consumables, and disposable endoscopes. In 2023, nearly 70% of CME's corporate revenue came from products such as endoscopic consumables and disposable endoscopes.

According to information, in the Beijing-Tianjin-Hebei “3+N” Alliance centralized procurement of medical consumables led by Hebei Province in 2023, Nanwei Medical's two types of hemostatic clips, biliary stents, and various products such as tracheal stents were selected. In May and June of this year, the Hebei Pharmaceutical Equipment Centralized Procurement Center and the Guangxi Health Insurance Administration successively issued notices on the implementation of this collection, with a procurement cycle of 2 years each.

The “Science and Technology Innovation Board Daily” reporter discovered that in recent years, in order to hedge against the effects of domestic medical insurance fee control and procurement, Nanwei Medicine has been speeding up the pace of “going overseas.”

Nanwei Medical's overseas sales revenue has increased from 0.742 billion yuan in 2021 to 1.042 billion yuan in 2023, and its share of overall revenue also increased from 38.11% to 43.22%. In the first half of 2024, Nanwei Medical's overseas revenue was 0.624 billion yuan, which further increased to 46.78% of overall revenue.

At an investor conference not long ago, Nanwei Medical revealed that currently the company uses direct sales methods in places such as the US and Europe, and uses a distribution model in Japan, Australia, Latin America, etc. In the first half of 2024, of overseas revenue of 0.624 billion yuan, the American region contributed about 0.28 billion yuan, an increase of 38.6% over the previous year, while the EMEA region (Europe, Africa, Middle East) contributed about 0.22 billion yuan, an increase of about 54% over the previous year.

The CME company acquired this time mainly focuses its business in Western Europe, covering countries such as the United Kingdom, Spain, France, Germany, Belgium, and Luxembourg. In 2023, revenue generated in France accounted for about 30% of CME revenue, and the combined revenue of the four regions of the United Kingdom, Belgium, Spain, and Germany accounted for about 60%.

Nanwei Medical said that after acquiring CME, it will introduce more of the company's product categories and new products not yet sold by CME to help enhance the company's product sales capacity and market share in Europe and accelerate overseas expansion.

The person mentioned above from Nanwei Medical told the “Science and Technology Innovation Board Daily” reporter, “Although foreign development will also encounter some obstacles and constraints, and foreign countries are not easy to do, overseas markets are the focus of future development, and it is impossible not to do it. You can only find a way to deal with difficulties if you do it first.”

Also, according to Nanwei Medical's estimates, the current expected growth target for the European and American markets in the next year is 20% +.

资料显示,CME是一家位于欧洲的医疗器械产品销售的渠道公司,其经销产品包括母公司Creo的自研产品,以及其他医疗器械公司的相关产品,包括消化、泌尿、呼吸、一次性内镜等领域的医疗器械产品。

资料显示,CME是一家位于欧洲的医疗器械产品销售的渠道公司,其经销产品包括母公司Creo的自研产品,以及其他医疗器械公司的相关产品,包括消化、泌尿、呼吸、一次性内镜等领域的医疗器械产品。