The latest US Federal Reserve interest rate resolution, which global investors are closely watching, was announced in the early morning of September 19.

The Federal Reserve announced that it will cut interest rates for the first time in four and a half years, lowering the benchmark interest rate by 50 basis points to 4.75% to 5.00%. The rate cut exceeds general market predictions. The move is expected to have a profound impact on the global financial market landscape. Furthermore, many market participants also predict that the Federal Reserve may cut interest rates more than once during this year to cope with the global economic slowdown and changes in domestic inflationary pressure.

As the interest rate cut cycle is officially kicking off, the author is going back to history and trying to find potential market response patterns from it in order to provide investors with more accurate insight into market trends.

1. Using history as a mirror to review the excess income opportunities of historical interest rate cut cycles

1. Using history as a mirror to review the excess income opportunities of historical interest rate cut cycles

Let's use history as a mirror to analyze the market performance of US stocks during the six interest rate cut cycles since the 90s.

Using a simple averaging method, CICC systematically reviewed the six cycles of the Federal Reserve's interest rate cuts since the 90s, and analyzed the return frequency and average annualized performance of various assets within 1 month, 3 months, and 6 months before and after the interest rate cut. Judging from the overall results, US debt, gold, and the Shanghai Composite Index performed better than after the interest rate cut, and the performance of industrial metals, crude oil, the Hang Seng Index, the NASDAQ, and the US dollar after cutting interest rates was better than before the interest rate cut. What is particularly prominent is that Hong Kong stocks have shown greater flexibility compared to A-shares.

Simply put, Hong Kong stocks are not only ahead of A-shares in terms of rising times, but their rebound also surpassed the A-share market.

Looking at sectors and topics, the Hang Seng Technology Index performed particularly well in the last round of interest rate cuts. Its elasticity far surpassed that of the Hang Seng State-owned Enterprises Index and the Hang Seng Index itself. In particular, before the first rate cut was implemented in 2019, Hong Kong stocks rebounded rapidly after bottoming out on June 4. The Hang Seng Index and the Technology Index achieved 7% and 6% increases respectively within a month. Despite subsequent social events and differences in the performance of various sectors of Hong Kong stocks, the Hang Seng Technology Index remained strong, achieving a significant increase of 74.8% during the period when the Federal Reserve cut interest rates.

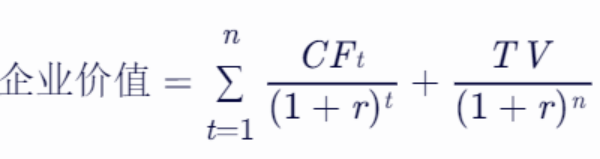

There are four reasons why the technology sector stands out in the interest rate cut cycle: first, interest rate cuts have raised market risk appetite and reduced discount rates. According to the DCF valuation model, technology growth stocks benefit particularly significantly due to future profit flows; second, interest rate cuts have reduced financing costs for enterprises and individuals, injecting strong impetus into the capital-intensive technology industry; third, they have broadened financing channels for technology companies to help them develop and innovate; fourth, Hong Kong technology stocks have a strong valuation advantage compared to high-enterprise US technology stocks. big.

However, we also need to rationally view the impact of interest rate cuts. We should not exaggerate their boosting effect on the “denominator side” (that is, the discount rate), and should also focus on the “molecular side” (that is, the company's fundamentals) support.

2. In the wave of interest rate cuts, the AI sector of Hong Kong stocks may become a hot spot

Artificial intelligence (AI) is currently a core hot topic in the field of technology. The AI sector of the Hong Kong stock market has a low valuation level and significant investment potential. However, in the Hong Kong stock market, although the commercialization process is relatively fast and there are relatively few AI big model companies that have a good “denominator side” effect, careful exploration can still uncover targets such as the fourth paradigm.

The fourth paradigm performed well in terms of revenue and profit. Its revenue grew from 0.944 billion yuan in 2020 to 4.207 billion yuan in 2023, with an average compound annual growth rate of about 46%, far exceeding the industry average. In terms of profit, the fourth paradigm is rapidly outlining the J curve, showing a clear path of profit. Following a sharp improvement in the company's losses in 2023, the company's adjusted net loss amount narrowed 4.0% year on year in the first half of 2024, and the adjusted net loss ratio narrowed to 9.0% year on year. Both CICC and Haitong Securities predict that the company will basically achieve break-even by 2025, which indicates that the company will usher in a critical growth turning point on the “J curve.”

As an iconic curve for the growth of technology companies, the “J curve” profoundly depicts the transformation process from initial investment to late return.

At the startup stage, enterprises face exploration and challenges in product and commercialization paths. Revenue is growing rapidly but the base is low. At the same time, they need to continuously increase investment in R&D to maintain technological leadership, and invest in sales and marketing to broaden the market landscape. In this process, a high proportion of reinvestment often puts pressure on net profit in the short term, and companies choose to sacrifice short-term profits in exchange for long-term competitive advantage and growth potential.

However, once the inflection point of growth was crossed, the company entered a stage of rapid commercialization and ushered in a moment of harvest. At this stage, the scale effect has effectively reduced unit costs, and net profit has grown by leaps and bounds, far exceeding the revenue growth rate. Therefore, the inflection point of growth is not only a “singularity” where corporate value explodes, but also a gold “hitting point” for investors to capture excess returns.

Judging from the business layout, the boundaries of the fourth paradigm big model ecosystem are expanding at an unprecedented rate, which is a strong proof that it has entered the rapid commercialization stage. At present, the company has successfully empowered 14 major industries including transportation, data centers, finance, energy and electricity, operators, information technology, intelligent manufacturing, and retail. The cumulative number of service users has reached 185, of which the number of benchmark users has reached 86, and the average income of benchmark users has reached 11.48 million yuan.

In addition to the “numerator side” and “denominator side” positive factors, the fourth paradigm also showed a series of “transactional” rebound characteristics. There is plenty of room for valuation improvement over the lower bid. In addition, the company is actively implementing a repurchase plan, further enhancing market confidence.

It is worth noting that after Alibaba was previously included in the Hong Kong Stock Connect, it attracted a large inflow of capital from the south, which fully proved that the Hong Kong stock market did not lack capital; what it really lacked was high-quality chips. Currently, with the improvement of global liquidity, the Hong Kong stock market is welcoming more overseas capital. The fourth paradigm has completed the full circulation of H shares and is about to enter the period of lifting the ban. Shares of high-quality companies were released at relatively low prices, providing more chips to the market.

Currently, the Hong Kong stock market is recovering, and the Hang Seng Technology Index has risen more than 2.5%. In addition to grasping the “denominator side” advantage, investors should also not ignore the “molecular side” boom logic in order to obtain sustainable excess profits.