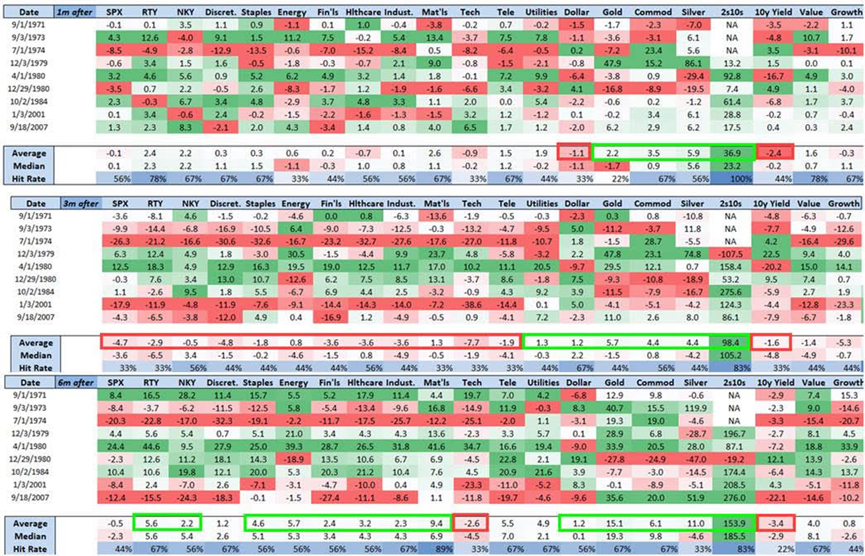

The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, marking the first easing of monetary policy since 2020. Nomura has looked at “all prior instances” of half-point cuts and found that three months after a 50bp cut, value stocks outperformed growth stocks.

Source: Nomura

Besides, exchange-traded funds focused on value stocks have raked in $6.9 billion so far in September, the cohort’s best month this year, according to data compiled by Bloomberg Intelligence. At the same time, growth-stock ETFs have shed about $13 million.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

Note: Data is through the end of the month, except in September

After the announcement of the rate cut, the large-cap value ETF sector reached an all-time high during trading sessions. Additionally, several value stock ETFs, including $Vanguard Value ETF (VTV.US)$, $EAFE Value Index MSCI Ishares (EFV.US)$, $Spdr Series Trust Spdr Portfolio S&P 500 Value Etf (SPYV.US)$, and $Ishares Russell Top 200 Value Etf (IWX.US)$, also hit new historical highs, according to moomoo.

The large-cap value stock ETF, Vanguard Value Index Fund ETF, with an AUM exceeding $183 billion, briefly reached an intraday all-time high of $174.349. Since the beginning of the year, it has risen by over 16%.

It's worth noting that within the holdings of VTV, $Home Depot (HD.US)$ reached a new intraday all-time high yesterday, touching $392.67, and has risen over 12% in the second half of the year. Additionally, other holdings such as $Walmart (WMT.US)$, $Procter & Gamble (PG.US)$, $Berkshire Hathaway-B (BRK.B.US)$, $Johnson & Johnson (JNJ.US)$, and $UnitedHealth (UNH.US)$ have all reached their all-time highs this month.

2. $EAFE Value Index MSCI Ishares (EFV.US)$

More than half of the September influx into value ETFs is coming from the iShares MSCI EAFE Value ETF, which has been a big beneficiary of BlackRock tweaking its model portfolios. The asset manager reduced its tilt to US equities and growth-oriented shares in favor of value stocks and fixed-income.

3. $Spdr Series Trust Spdr Portfolio S&P 500 Value Etf (SPYV.US)$

The SPDR Portfolio S&P 500 Value ETF, which has an AUM of $25 billion, saw its largest weekly inflow ever last week.

4. $Ishares Russell Top 200 Value Etf (IWX.US)$

The $3.2 billion iShares Russell Top 200 Value ETF has garnered more than $800 million so far in September.

“It’s where we’re seeing the best earnings potential,” Tushar Yadava, a strategist at BlackRock said. He added that while they’re still overweight growth stocks, they’re dialing some of that exposure back by adding value stocks to portfolios.

Source: Bloomberg, Financial Times