Key Insights

- Tat Hong Equipment Service to hold its Annual General Meeting on 26th of September

- Salary of CN¥2.00m is part of CEO Sean Yau's total remuneration

- The total compensation is 55% higher than the average for the industry

- Tat Hong Equipment Service's EPS declined by 118% over the past three years while total shareholder loss over the past three years was 8.2%

Shareholders will probably not be too impressed with the underwhelming results at Tat Hong Equipment Service Co., Ltd. (HKG:2153) recently. At the upcoming AGM on 26th of September, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

Comparing Tat Hong Equipment Service Co., Ltd.'s CEO Compensation With The Industry

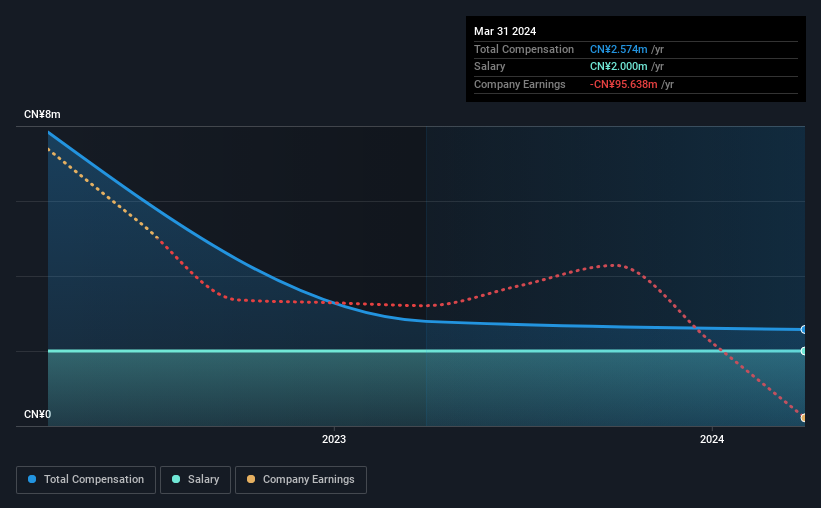

According to our data, Tat Hong Equipment Service Co., Ltd. has a market capitalization of HK$1.3b, and paid its CEO total annual compensation worth CN¥2.6m over the year to March 2024. We note that's a small decrease of 7.7% on last year. In particular, the salary of CN¥2.00m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the Hong Kong Construction industry with market caps ranging from HK$779m to HK$3.1b, we found that the median CEO total compensation was CN¥1.7m. Hence, we can conclude that Sean Yau is remunerated higher than the industry median. What's more, Sean Yau holds HK$5.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥2.0m | CN¥2.0m | 78% |

| Other | CN¥574k | CN¥790k | 22% |

| Total Compensation | CN¥2.6m | CN¥2.8m | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. Although there is a difference in how total compensation is set, Tat Hong Equipment Service more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. Although there is a difference in how total compensation is set, Tat Hong Equipment Service more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Tat Hong Equipment Service Co., Ltd.'s Growth Numbers

Over the last three years, Tat Hong Equipment Service Co., Ltd. has shrunk its earnings per share by 118% per year. In the last year, its revenue is down 11%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Tat Hong Equipment Service Co., Ltd. Been A Good Investment?

With a three year total loss of 8.2% for the shareholders, Tat Hong Equipment Service Co., Ltd. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Tat Hong Equipment Service that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.