soochowのリサーチレポートによると、香港の株式市場指数は底を打ち、これはA株にとって先行きを示し、導く意味があるかもしれません。

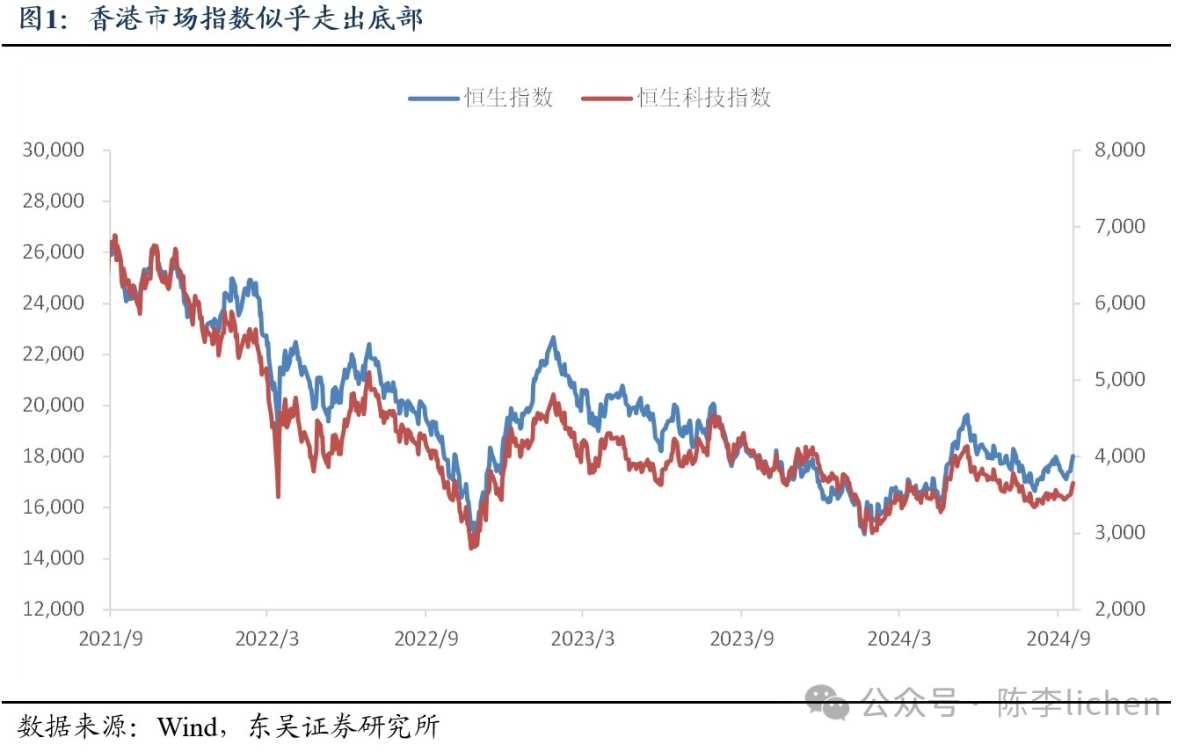

zhitong finance appによると、soochowのリサーチレポートによると、技術的な形状から見ると、香港市場の指数は3つまたは4つの底を打ったように見えます。取引高や利益(企業の収入と利益)の増加率を観察し、ドルが利下げサイクルに入ったことを考慮に入れると、多くの指標が示すように、香港の株式市場指数は底を打ち、これはA株にとって先行きを示し、導く意味があるかもしれません。

1. 取引の視点:香港株は出来高と価格の底を示しています。

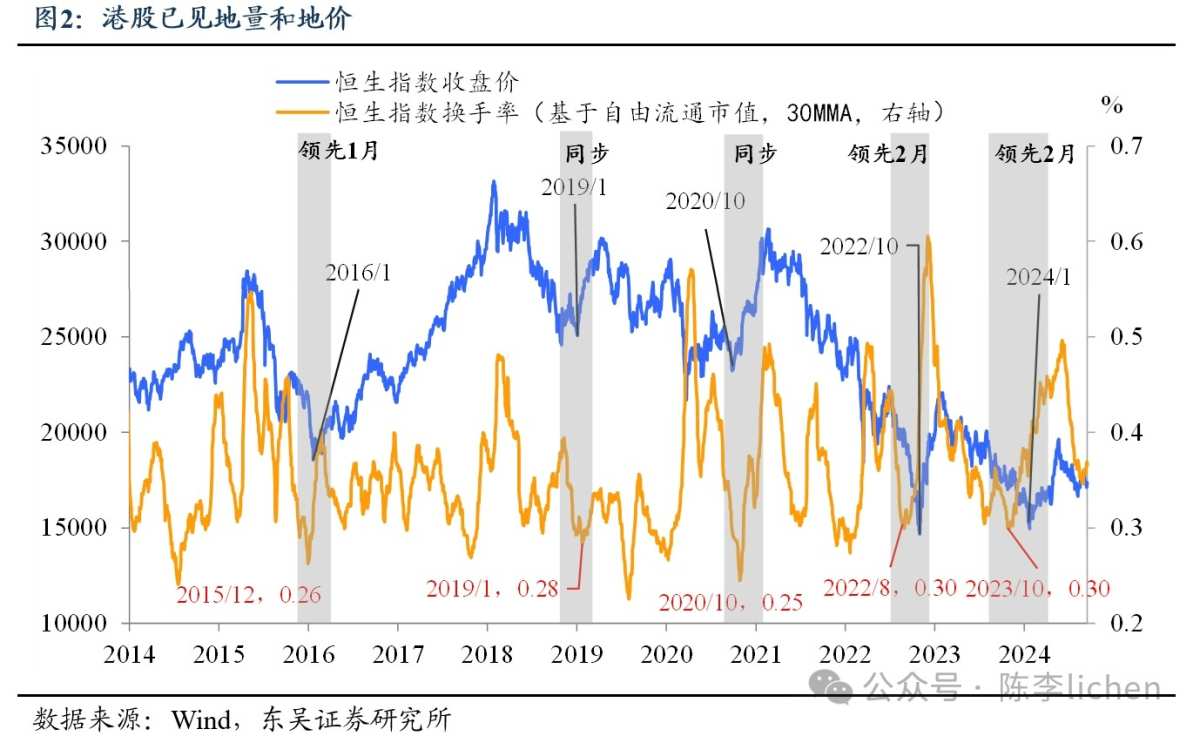

証券取引の観点から言えば、株式の取引の売買回転率の低点は、株価の低点と高度に重なることがよくあります。過去12ヶ月の範囲で香港株の取引の売買回転率を観察すると、短期の低点は過去になり、香港株の価格も低点を過ぎていることを示しています。

証券取引の観点から言えば、株式の取引の売買回転率の低点は、株価の低点と高度に重なることがよくあります。過去12ヶ月の範囲で香港株の取引の売買回転率を観察すると、短期の低点は過去になり、香港株の価格も低点を過ぎていることを示しています。

香港株の最後の「出来高と価格の底」の参考例は2022年です。その時、香港株の取引の売買回転率は2022年第3四半期に下がり、株価もそれに続いて反発しました。過去3カ月、ハンセン指数の日の出来高の低点は8月で、約300億元で、売買回転率は約0.25%(取引高/浮動株時価)で、2022年第3四半期の低点水準(0.21%)に近づきました。その後、売買回転率はゆっくりと上昇し、株価もそれに続いて反発しました。

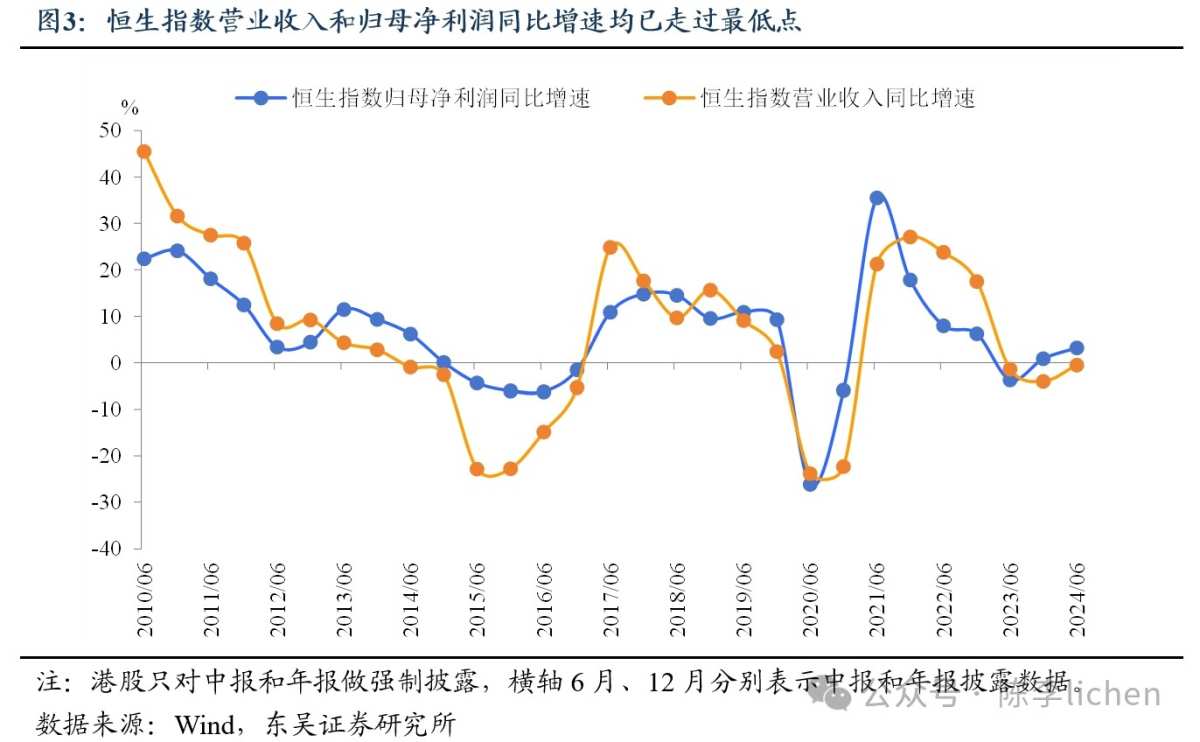

盈利観点:香港系企業はすでに底を打った可能性があります

景気は依然としてさまざまな挑戦に直面していますが、企業の利益は2024年に回復しています。A株企業と比較して、香港系企業は不動産産業のインダストリーグループが少なく、インターネットプラス関連が多いです。2024年上半期、ハンセン指数の売上高と当期純利益はそれぞれ前年比-0.5%、+3.1%となり、2023年の全体的な成長率(売上高比-4.0%、当期純利益比+0.8%)と比較して明らかに改善されています。

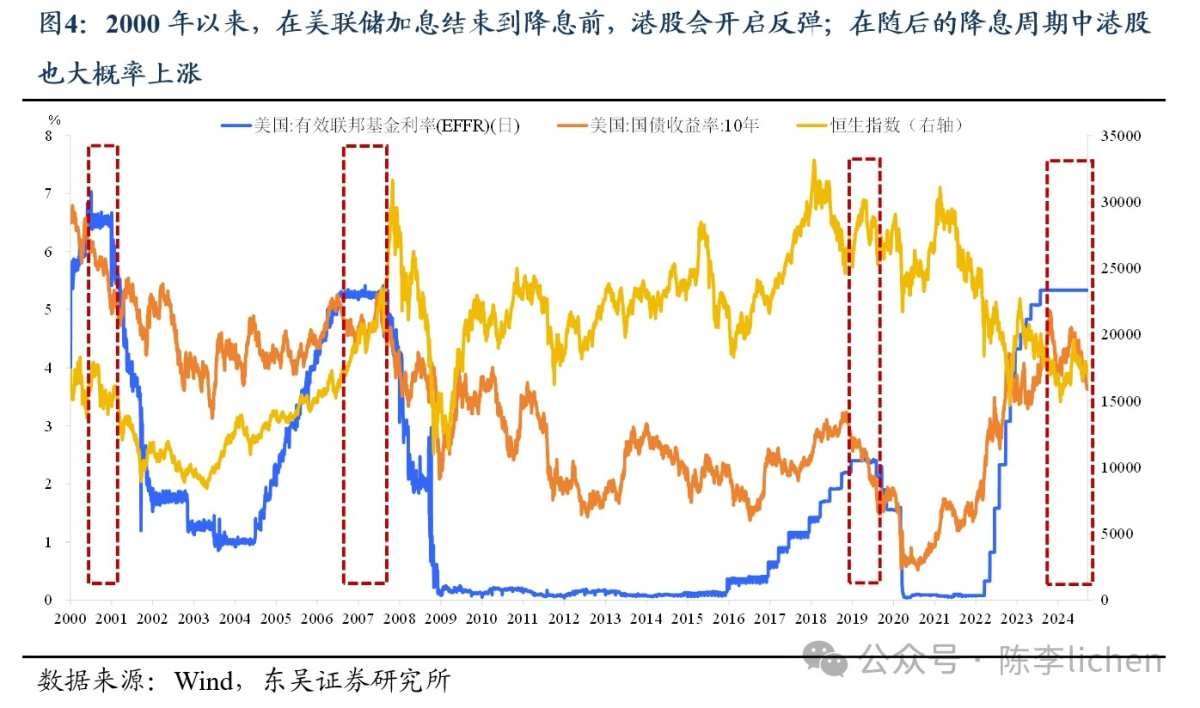

米ドル利率の視点:評価圧力が緩和される

2000年以降の米連邦準備制度の利下げサイクルを振り返ると、利上げ終了後から次回の利下げまでの期間に、ハンセン指数は反発します。その後の利下げ過程では、2008年の金融危機が基本面に大きな影響を与えた以外、香港系株は上昇傾向にありました。

1) 流動性環境は改善する可能性があります:米連邦準備制度が利下げを開始すると、米中金利差が傾向的に縮小し、人民元の上昇期待が高まり、人民元資産の魅力が高まります。

2) 香港株市場の評価は回復する:2021年9月17日現在、ハンセン指数のPE-TTMは8.67倍で、過去10年間で11.3%の歴史的なパーセンタイルレベルに位置しており、ハンセン指数のPBは1倍前後です。

3) 企業の利益も改善されます:米連邦準備制度理事会(FRB)による利下げは企業の資金調達コストを下げ、経済活動に刺激を与えます。一方、ドルの金利の低下により国内経済刺激策の余地が生まれ、基本的な経済状況の回復ペースが加速すると期待されます。

四、いくつかの香港系企業家の資金が香港に戻ってきているようです

東蘇證券は、長和(00001)、電能実業(00006)、長江基建集団(01038)、恒基不動産(00012)など、香港系列指数の底部形成において重要な役割を果たすいくつかの伝統的な香港系企業の株が価格と出来高の両面で明らかな上昇を見せていることに注目しています。これが一部の資金が香港に戻ってきた結果であると推測されています。もしこの推測が正しい場合、これらの資金は香港市場のさらなる活性化にも役立つでしょう。

五、香港株は一般的に中国株の底値回復と同期または先行する

ハンセン指数とCSI300指数の歴史的な動向を見ると、両者は基本的に一致しており、ハンセン指数の反転ポイントは通常、CSI300指数よりも早く発生しますが、2か月を超えることはありません。例えば、2024年1月末に香港株が底を打ち、2月に中国銀行が利下げのサインを出すと反転し、A株は2月初めに利下げが実施されてから底値回復が始まりました。同様に、2022年3月に香港株が先に底を打ち、A株は4月末に底を打ちます。その他にも、2016年2月と2020年3月は、両者が基本的に同時に底を打った期間です。

現在香港株は底値地域から抜け出し、A株もまもなく転機を迎えて反転すると予想されています。

リスク注意:過去の結果は将来を保証しません。第三者データの統計誤差があります。政策の刺激が予想を上回る可能性があります。