Jinghua Micro's announcement states that it plans to acquire 60% to 70% of the equity of core technology's smart home appliance control chip business assets for no more than 1.4 billion yuan. Core Technology failed to list on the Science and Technology Innovation Board in 2023. Jinghua Micro indicated that this acquisition will help the company expand into the white appliance market.

On the evening of September 19, Jinghua Micro announced its intention to acquire core technology's smart home appliance control chip business.

The announcement shows that on September 19th of this year, Jinghua Micro signed an 'Intention Agreement' with the trading counterparty Core Technology, planning to use no more than 0.14 billion yuan in cash to purchase 60% to 70% of the shares of Shenzen Core Wisdom Microelectronics Co. Ltd., a wholly-owned subsidiary of Core Technology, which is about to hold the assets of the smart home appliance control chip business, and obtain controlling rights.

Who are the trading counterparty and the target company in this acquisition plan?

Who are the trading counterparty and the target company in this acquisition plan?

The ‘Science and Technology Innovation Board Daily’ reported that in June 2023, Core Technology had applied for listing on the Science and Technology Innovation Board, which was accepted. However, after the overall A-share IPO rhythm tightened, the company terminated its IPO application in October 2023.

Core Technology is a SoC chip design company. Its products with scale sales include mobile storage control chips and smart home control chips. From 2020 to 2022, Core Technology's revenue was 99.07 million yuan, 1.75 billion yuan, and 1.92 billion yuan, achieving net profits attributable to the parent company of 40.734 million yuan, 36.0822 million yuan, and 39.8369 million yuan respectively.

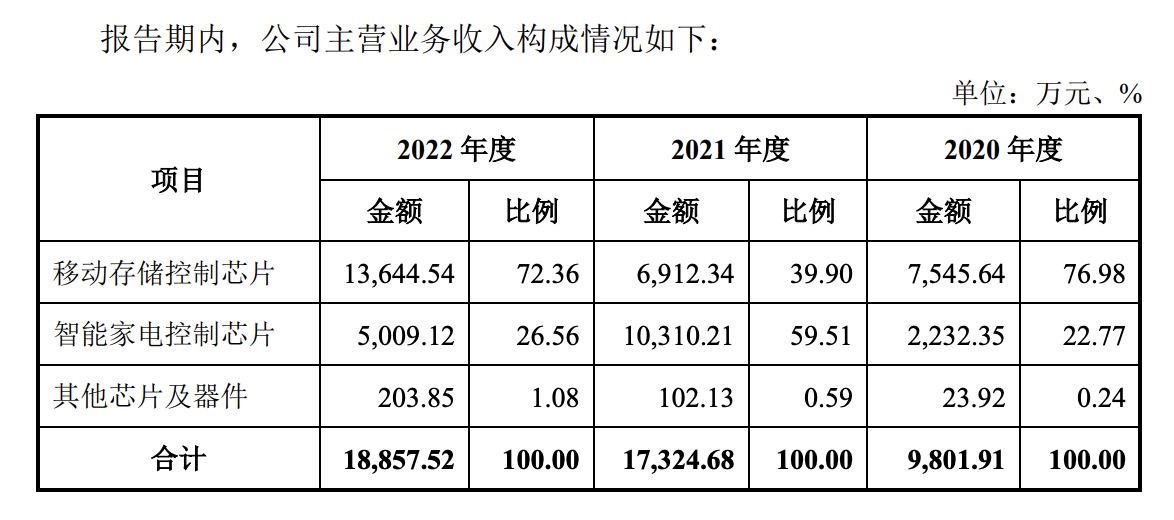

According to Core Technology's prospectus, in 2021, its smart home control chip revenue accounted for 59.51%, while the sales revenue in 2022 was 50.0912 million yuan, accounting for 26.56%. In 2023, Core Technology's revenue from smart home control chips was 52.9089 million yuan, and the gross margin decreased from 22.27% in 2022 to 19.64%. However, the profit situation of this business has not been disclosed.

Revenue composition during listing report of Chipbond Technology.

According to the prospectus submitted by Chipbond Technology, the company plans to raise approximately 0.605 billion yuan, of which about 0.2 billion yuan will be used for the upgrade and industrialization of its high-performance smart home appliance control chip.

According to the preliminary acquisition plan announced by Jinghua Micro, Chipbond Technology will inject its subsidiary's smart home appliance control chip business assets into the target company Chipbond Zhixin. Jinghua Micro will conduct formal audits and asset evaluations and disclose the specific financial data of the target company when signing the formal acquisition agreement.

Regarding the reason for Chipbond Technology to sell its core business assets, a Jinghua Micro spokesperson told a reporter from "Star Daily" that "the main purpose of this cooperation between the two parties is based on the strong synergy in technology, products, market customers, and supply chain. There will be opportunities to further enhance the market coverage and market share of related asset businesses in the future."

It is understood that the main business of Jinghua Micro is the research and development and sales of high-performance analog and mixed-signal integrated circuits. Its main products include medical health SoC chips, industrial control and instrument chips, intelligent sensing SoC chips, etc., which are widely used in medical health, pressure measurement, industrial control, instrumentation, and smart home and other fields.

Chipbond Technology's smart home appliance control chip products are applied to touch key interaction, and the product series have been adopted by well-known brands such as Midea, Zhejiang Supor, Changhong Meiling, Ecovacs Robotics, Vatti Corporation, Siemens, Royal Philips, Sunrise Electric Appliance, Skyworth Electric Appliance, Aucma Co., Ltd., Hangzhou Robam Appliances, etc. They are applied in home appliances such as refrigerators, washing machines, cooker hoods, floor scrubbers, ovens, microwaves, rice cookers, and other household appliances.

Jinghua Micro stated that in terms of technology, the company will utilize the core technology of the target assets in touch control, MCU, LED driver, and other smart home appliances' human-machine interaction fields to integrate the R&D resources of both parties. In terms of products, it will help the company expand MCU products, enrich the existing product portfolio, and improve its solutions in consumer electronics, smart home, and white appliances.

In terms of the market and customers, Jinhua Micro will fully leverage the respective market and customer advantages of the target company, promote market and customer synergy, enhance the company's coverage and market share in the consumer electronics and smart home markets, and also contribute to the company's expansion in the white appliances market.

In this plan, Jinhua Micro plans to acquire the target company in cash, with 60% to 70% equity corresponding to 0.14 billion RMB, which roughly means that the minimum valuation of the target is 0.2 billion RMB. After the acquisition is completed, Coretronic Technology will still hold at least 30% of the target.

As for why a full acquisition is not being carried out, and the intention of Coretronic Technology regarding the disposal of the remaining shares, a representative of Jinhua Micro told reporters from Star Daily that this is mainly based on comprehensive considerations of the company's operations and risk control. In addition, it is currently only an intention agreement, and the specific plan of this transaction still needs further negotiation, promotion, and implementation. If there are any relevant matters, they will fulfill their disclosure obligations in the subsequent signing of the formal acquisition agreement.

Furthermore, regarding the source of funds for the acquisition, Jinhua Micro stated that it will be implemented based on the specific negotiation and discussion in the future. Jinhua Micro announced that the specific payment progress, payment conditions, and delivery arrangements of this transaction will be negotiated by both parties based on the results of due diligence, and will be clearly stated in the formal acquisition agreement along with the final transaction price.

此次收购计划的交易对手及标的公司是谁?

此次收购计划的交易对手及标的公司是谁?