According to Gelonhui, on September 10, 2024, XCHG Limited, Asia Vets Charging Station Co., Ltd. (hereinafter referred to as Asia Vets Charging), successfully listed on NASDAQ in the USA, with the stock code XCH.

On the first day of listing, the opening price of Asia Vets Charging (XCH) was $7.25 per share, with the intra-day price peaking at $10.96 per share. The closing price on the first day was $7.36 per share, an increase of 18.71%, with a total market value of approximately $0.437 billion.

The company's IPO price per American depositary share (ADS) is $6.2, with a net proceeds of approximately $14.3 million after deducting various issuance expenses. If the underwriters exercise their full option to purchase additional ADSs, the net proceeds from fundraising will be $17.1 million.

The funds raised from the listing will mainly be used for investment in a new manufacturing facility in Texas, development of energy management and battery management technologies, global market expansion, and supplementary operational funds.

The funds raised from the listing will mainly be used for investment in a new manufacturing facility in Texas, development of energy management and battery management technologies, global market expansion, and supplementary operational funds.

Mr. Hou Yifei is the actual controller of the company. After this issuance and before the underwriters exercise their oversubscription rights, Hou Yifei actually holds 82.0% of the company's total voting rights of the issued share capital.

01

There is considerable pressure on the cash flow from operating activities.

Asia Vets Charging is registered in the Cayman Islands and does not have substantial business itself. All of the company's operations are conducted through its subsidiaries in Germany and China, with main operating addresses in Hamburg, Germany, and Peking.

The company's main business is to provide comprehensive electric vehicle charging solutions, mainly including the DC fast charging piles named C6 series and C7 series, advanced integrated battery DC fast charging piles, known as NZS, and related support services.

The NZS charging pile integrates DC fast charging piles with lithium-ion batteries and the company's proprietary energy management system, storing power when it's typically more available (e.g., at night) and releasing power when demand is higher (e.g., during the day).

The integrated solution of smart charging combines proprietary charging technology, energy storage technology, and support services, significantly improving the charging efficiency of electric vehicles, releasing the value of energy storage and management.

As of the date of the prospectus, the company has started commercial deployment of the company's NZS solution in Europe, the Americas, and Asia. Customers of the NZS solution include electric vehicle manufacturers, global energy companies, and charging station operators.

Company product images, source company's official website

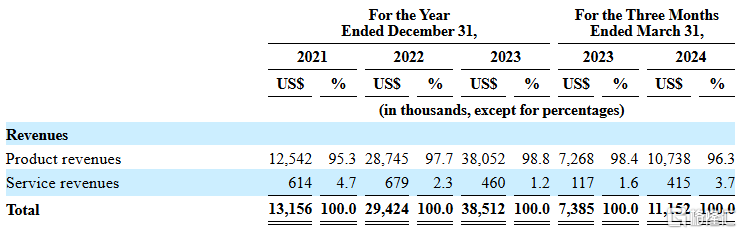

The company's revenue sources include initial sales of products and recurring revenue from support services, including software system upgrades and hardware maintenance. Product sales revenue accounts for over 95%, rising from 95.3% in 2021 to 98.8% in 2023, with a slight decrease in Q1-Q3 of 2024. However, the company anticipates that with the increase in the number of charging stations installed, recurring revenue from support services will account for an increasingly larger proportion.

The composition of the company's revenue comes from the prospectus.

The prospectus shows that in 2021, 2022, 2023, and the first quarter of 2024 (referred to as the 'reporting period'), the company recognized revenues from 807, 1934, 1688, and 351 DC fast charging piles and their ancillary services respectively.

In terms of financial data, during the reporting period, the company's revenue reached $13.16 million, $29.42 million, $38.51 million, and $11.5 million respectively, with gross margins of 35.2%, 36.4%, 45.6%, and 50.8%. The net income for the same period was -$2.07 million, $1.61 million, -$8.08 million, and $0.74 million.

In the latest reporting period, the company expects unaudited revenue for the second quarter of 2024 to be between $810 million and $990 million, a decrease of 19.2% to 33.9% compared to the same period in 2023.

Regarding intelligent charging in the prospectus, the reason for the revenue decline in the second quarter of 2024 is explained. Stimulated by preferential policies and the increasing adoption of electric vehicles in Europe, many of the company's customers ordered more advanced products in the second quarter of 2024, which will be delivered and recognized as revenue in the third quarter of 2024 or later. Therefore, the second quarter of 2024 is a transitional period where revenue turns negative compared to the same period in 2023.

The main financial indicators of the company come from the prospectus.

During the reporting period, the company's operating cash flow net amounts were -$6.49 million, $0.85 million, -$5.58 million, and -$4.04 million, showing significant differences from net income, with all except for 2022 being negative. This is mainly due to an increase in accounts receivable, indicating certain risks for the company in terms of operating cash flow.

The company mainly relies on external financing to support its operations, obtaining nearly $29.5 million in funds through bank loans, issuing preferred stocks, and other financing methods during the reporting period.

Key data of the cash flow statement, sourced from the prospectus

02

Industry technological changes are rapid.

The continuous expansion of the global new energy auto market has led to a significant increase in demand for electric vehicle charging stations. Direct current fast charging stations have become the preferred choice for charging point operators (CPOs) and electric vehicle owners. According to Sullivan's data, the global installation volume of direct current fast charging stations is expected to increase significantly from 2.7 million units in 2024 to approximately 10.7 million units in 2028, with a compound annual growth rate of 41.8%.

Frost & Sullivan stated that the European direct current fast charging station market is highly competitive and decentralized, with smart charging being one of the leading manufacturers in the 2023 European DC fast charging market in terms of sales volume.

In the wave of rapid development in the industry, in recent years, the revenue from intelligent charging has experienced rapid growth, bringing significant pressure to the company's management, administration, operation, financial resources, and infrastructure, requiring continuous improvement of operational, financial, and management control systems and procedures.

The growth of intelligent charging revenue highly depends on the adoption of electric vehicles by enterprises and consumers. Government regulations and industry standards in the electric vehicle market are constantly changing, as well as consumer preferences and behaviors. Despite the recent increase in demand for electric vehicles in the past few years, it cannot be guaranteed that future demand will continue.

Furthermore, the rapid development of electric vehicle charging station technology requires continuous development of new products and product innovations. If the rapid development of Direct Current (DC) fast charging falls short of expectations in the future, it will damage the company's business, operational performance, financial condition, and prospects.

A large part of the company's revenue depends on a limited number of key customers and may continue to do so. During the reporting period, revenue from the largest customers accounted for 32%, 63%, 42%, and 47% of the total company's revenue respectively, posing risks associated with dependency on major customers.

03

Epilogue

Against the backdrop of the rapid development of the electric vehicle industry, intelligent charging (XCH) has shown rapid performance growth in the past few years. However, influenced by product structure adjustments, performance declined in the second quarter of 2024. With the rapidly evolving technology of electric vehicle charging stations, the company needs to continuously develop new products and innovations to establish a foothold in intense competition.

上市募资资金主要用于在德克萨斯州的新制造设施的投资、能源管理和电池管理技术的开发、全球市场扩张以及补充营运资金等。

上市募资资金主要用于在德克萨斯州的新制造设施的投资、能源管理和电池管理技术的开发、全球市场扩张以及补充营运资金等。